PKR registers modest gains, up by 1.3 rupees in a week

By MG News | June 24, 2022 at 03:58 PM GMT+05:00

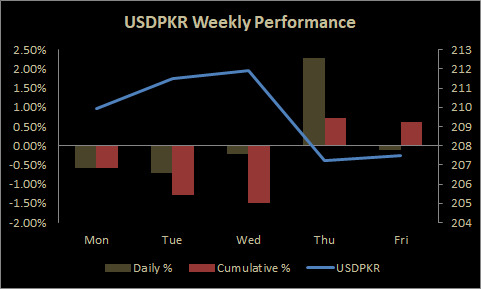

June 24, 2022 (MLN): As Pakistan is stepping closer to the IMF tranche along with upcoming inflows of $2.3 billion from China, the interbank market started wearing off the uncertainty which led the Pakistani rupee (PKR) toward a modest gain of 1.1 rupees in five consecutive sessions to settle the week at PKR 207.48 per USD.

However, in today’s session, the domestic unit lost 25 paisa after being traded in a band of one rupee, showing an intraday high bid of 208.50 and an intraday low offer of 207.50. While, in the open market, PKR was traded at 206.50/208.50 per USD.

The economic downturn has forced the Pakistani rupee (PKR) towards a bottomless pit as the currency lost over three rupees collectively during the four sessions. As per experts, the dismal macros coupled with delay in IMF tranche and FATF result have created an aura of panic across the interbank market.

In addition, the foreign banks are deeply concerned about the depleting foreign exchange reserves of Pakistan and its ability to pay the outstanding bills in the future.

Owing to the fast-depleting foreign exchange has also pushed importers to demand more dollars to pay the import bills in months to come.

It is pertinent to mention that the total liquid foreign exchange reserves held by the country dropped by $733 million or 4.9% WoW to stand at the lowest level of $14.2 billion since Jan 18, 2019, during the week ended on June 17, 2022, that is barely enough to finance the import bill of 1.21 months.

In order to improve the liquidity in the interbank market, the State Bank of Pakistan (SBP) is up to reverse around $590 million to scheduled banks against Cash Reserve Requirement (CRR).

However, on Wednesday, Positive news on the IMF front came under the limelight wherein Pakistan side and IMF reached an understanding on the federal budget for FY23. It had brought back the certainty among market participants during intraday trade which made PKR able to gain its lost ground by over three rupees.

Anyhow, the local unit could not sustain the gains on the back of upcoming taxes and petroleum levy which are the key requirements to unlock the IMF tranche, Zafar Paracha, President of Exchange Companies Association of Pakistan told Mettis Global.

Furthermore, the news of an incoming inflow of $2.3bn from China had led PKR to gain 4.7 rupees on Thursday.

If Pakistan receives the expected inflows timely, it will give PKR a temporary respite, he added.

To note, the government has to repay the loans in the coming months which will also keep PKR under pressure.

In an attempt to reduce the fiscal deficit upon IMF’s requirement, the government decided on Friday to impose an extra one-time 10% tax on the large-scale industry for one year to raise over Rs400 billion.

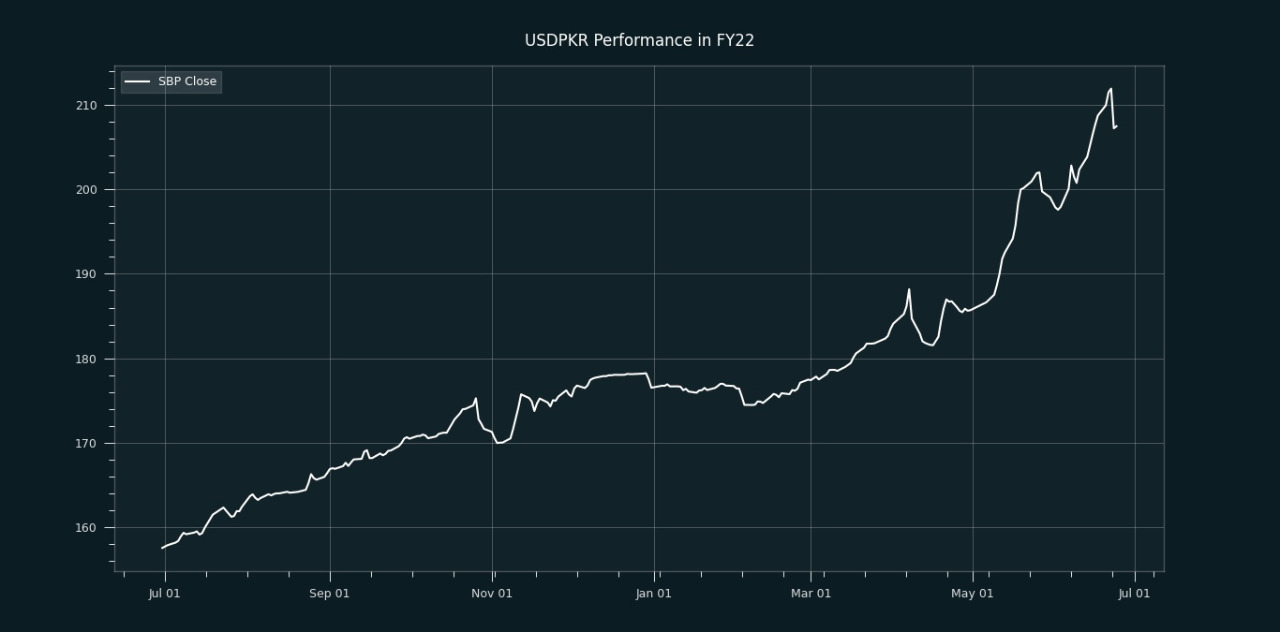

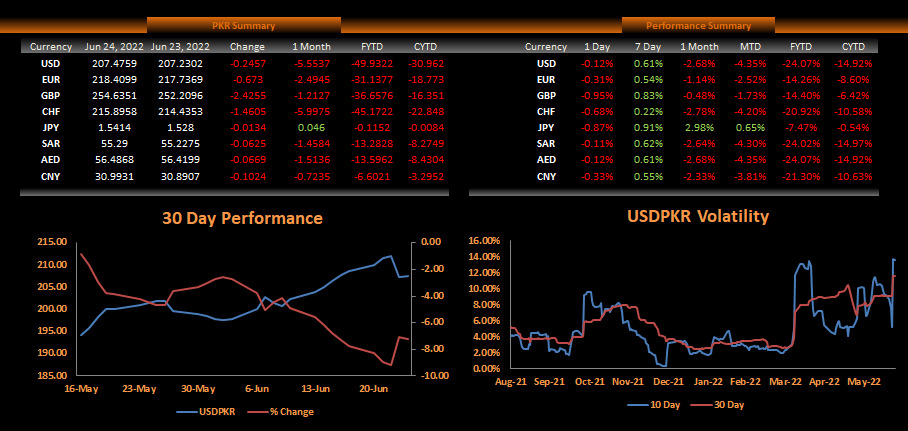

From July’21 to date, the local unit has lost Rs49.93 against the USD. Similarly, the rupee fell by Rs30.96 in CY21, with the month-to-date (MTD) position showing a decline of 4.35%, as per data compiled by Mettis Global.

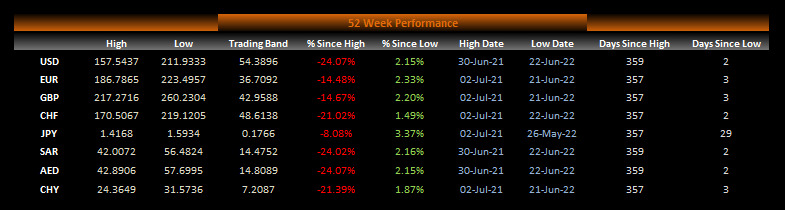

During the last 52 weeks, PKR lost 24.07% against the greenback while reaching its lowest at 211.93 on June 22, 2022, and the highest of 157.54 on June 30, 2021.

Furthermore, the local unit has weakened by 14.48% since its high on July 02, 2021, against EUR while, it has dropped by 14.67% against GBP since its high on July 02, 2021.

The performance of the local unit remained firm against other major currencies in the previous seven sessions as the currency lost its value by 0.91%, 0.83%, 0.62%, 0.61%, 0.55%, 0.54%, and 0.22% against JPY, GBP, SAR, AED, CNY, EUR, and CHF respectively.

.jpeg)

Meanwhile, the currency lost 2.4 rupees to the Pound Sterling as the day's closing quote stood at PKR 254.64 per GBP, while the previous session closed at PKR 252.21 per GBP.

Similarly, PKR's value weakened by 67 paise against EUR which closed at PKR 218.41 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) in which it injected Rs.402.2 billion for 77 days at 13.84 percent.

Overall, SBP injected Rs591.7 billion into the money market through reverse repo purchase and Shariah-compliant mudarabah-based open market operation.

The overnight repo rate towards the close of the session was 12.80/13.00 percent, whereas the 1-week rate was 13.45/13.55 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,919.86 155.28M |

1.34% 1720.44 |

| ALLSHR | 80,861.23 427.13M |

1.35% 1073.61 |

| KSE30 | 39,763.34 63.86M |

1.68% 658.35 |

| KMI30 | 189,306.78 54.32M |

1.28% 2391.17 |

| KMIALLSHR | 54,732.03 195.68M |

0.98% 530.15 |

| BKTi | 34,692.22 30.67M |

3.63% 1215.54 |

| OGTi | 28,336.54 4.85M |

1.34% 373.95 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,030.00 | 107,055.00 105,440.00 |

1280.00 1.21% |

| BRENT CRUDE | 67.28 | 67.29 67.05 |

0.17 0.25% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.57 | 65.65 65.34 |

0.12 0.18% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI