PKR registers a loss of 71 paisa on gloomy macros in a week

Nilam Bano | December 23, 2022 at 05:30 PM GMT+05:00

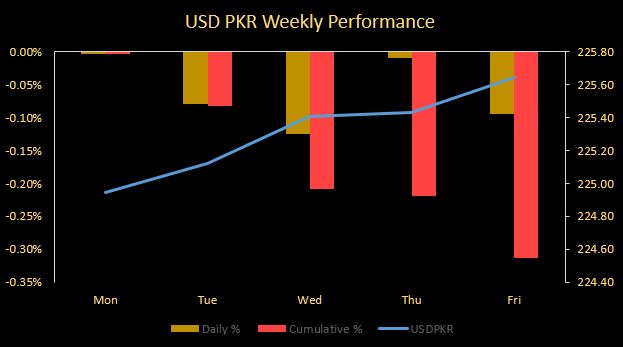

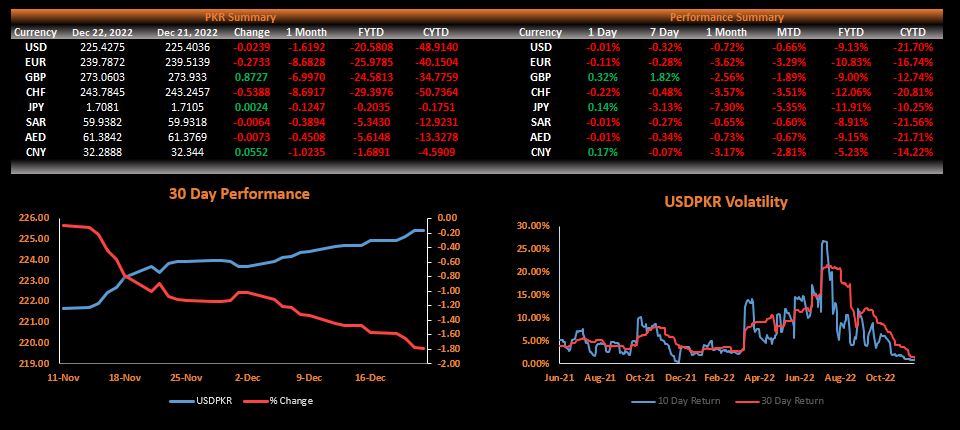

December 23, 2022 (MLN): Amidst dwindling macros, plummeting foreign exchange reserves, and political upheaval, the Pakistani rupee (PKR) has weakened by 71 paisa against the US dollar in the interbank market to PKR 225.64 per USD during the week-ended today, compared to the previous week’s closing of PKR 224.94 per USD.

Within today’s session, the local unit registered a fall of 21 paisa while trading in a band of 35 paisa per USD.

Meanwhile, in the open market, PKR was traded at 232.44/234.77 per USD.

Throughout the week, the domestic unit remained under pressure on the back of prevailing uncertainty in the market.

On the economic front, the foreign exchange reserves held by the State Bank of Pakistan (SBP) decreased by $ 583.8 million to $6.12 billion during the week ended on December 22, 2022, the lowest since April 2014.

Adding more fuel to the fire, global rating agency S&P Global has downgraded Pakistan’s long-term sovereign credit rating to “CCC+” from “B” due to high external risk.

In addition to it, the Real Effective Exchange Rate (REER) index, a measure of the value of a currency against a weighted average of several foreign currencies, was recorded at 98.84 in November 2022, showing a drop of 1.34% MoM compared to 100.18 in October 2022.

A decrease in REER implies that exports have become cheaper while imports become more expensive therefore, this fall indicates an increase in trade competitiveness.

In FYTD, PKR lost 20.58 rupees or 9.13%, while it plummeted by 48.91 rupees or 21.70% against the USD in CYTD, as per data compiled by Mettis Global.

Alternatively, the currency gained 79 paisa against the Pound Sterling as the day's closing quote stood at PKR 272.27 per GBP, while the previous session closed at PKR 273.06 per GBP.

Similarly, PKR's value strengthened by 7 paisa against EUR which closed at PKR 239.72 at the interbank today.

On another note, within the money market, the central bank conducted an Open Market Operation (OMO) and Shariah-compliant Mudarabah OMO today, in which it cumulatively injected a total of Rs858.7 billion into the market, from which Rs170.7bn injected into the market for 7 days at 16.27% and Rs600bn for 70 days at 0%.

The overnight repo rate towards the close of the session was 16.00/16.25%, whereas the 1-week rate was 15.86/15.96%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,075.00 | 119,740.00 116,460.00 | -1220.00 -1.03% |

| BRENT CRUDE | 73.37 | 73.63 71.75 | 0.86 1.19% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.20 | 70.51 68.45 | 0.99 1.43% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|