PKR: Hawks & Doves

MG News | January 31, 2022 at 05:26 PM GMT+05:00

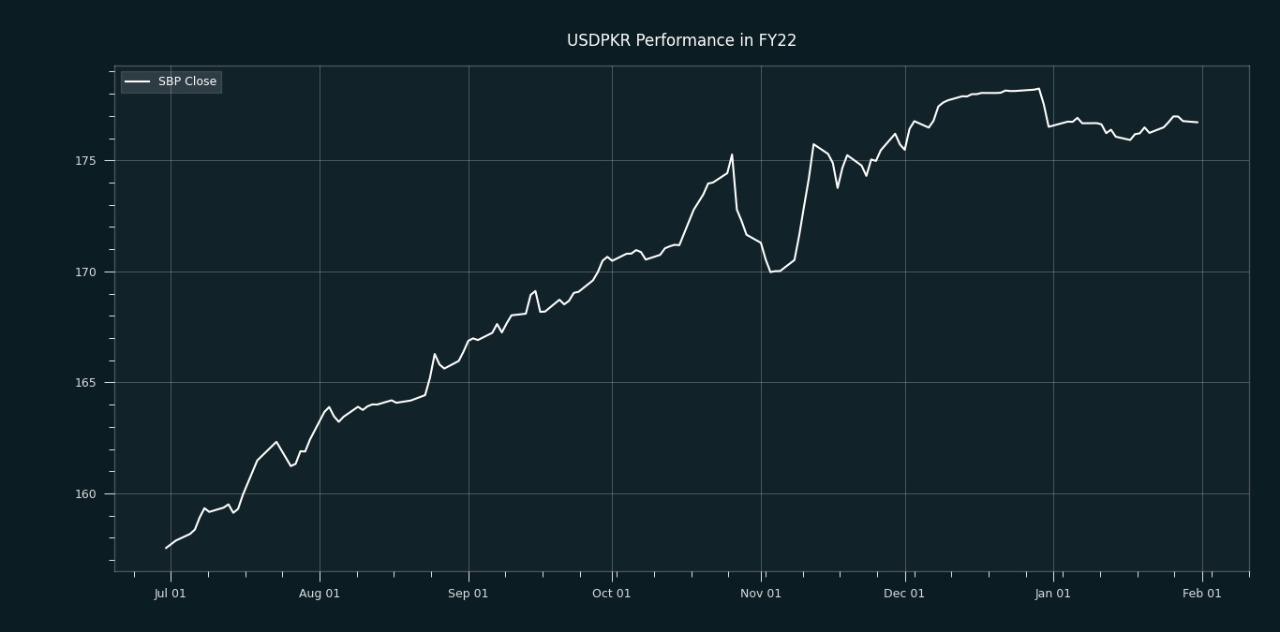

January 31, 2022 (MLN): After witnessing a year in a free fall, the Pakistani Rupee (PKR) showed strong resistance against the US dollar during January 2022. While managing to offset some of its previous losses, the currency remained resilient as it only lost 20 paisa or 0.12% in the interbank market to close the month’s trade at PKR 176.72 per USD, compared to the depreciation of 0.17% in January’21.

During the last trading session of the month, the local unit gained 5 paisa. Throughout the session, the currency traded in a range of 15 paisa per USD showing an intraday high bid of 176.75 and an intraday low offer of 176.60.

Not hard as nails but still the currency’s performance was comparatively better than previous months. To recall, In the month of December’21 alone, PKR dropped by 1.03 rupees or 0.45% against USD while the highest close was recorded on December 29 at 178.23 per USD. Meanwhile, the local unit has lost Rs19.17 in the fiscal year 2022 to date.

As per the prediction of Zafar Paracha, President Exchange Companies of Pakistan (ECAP), PKR has been hovering around 177 per USD throughout the month on the back of IMF’s upcoming tranche and the policy measures taken by the State Bank of Pakistan (SBP) despite the drop in foreign exchange reserves.

Resultantly, the 30-days rupee-dollar parity is less volatile as the rupee has been less responsive to economic events. Apart from the US dollar, the currency made remarkable progress against other major currencies as it gained 2.26 rupees, 3.38 rupees, and 81 paisa against EUR, CHF and GBP.

Sharing his views with Mettis Global on SBP’s Act amendment bill, he said, “it will have a positive impact on PKR going forward if IMF will not put any condition pertaining to currency devaluation.”

Given the present status of the macroeconomic condition, PKR will remain stable in the medium term as PKR is currently undervalued and the dollar is overvalued. The price per dollar in terms of PKR should be below 170 rupees, he added.

On SBP’s matter Asad Rizvi, the former Treasury Head at Chase Manhattan said, “The central bank is facing a tough situation as it needs another IMF tranche for its external financing needs. It’s tightening approach spells trouble because, in the last quarter of 2021, the market demanded sharply higher yields for government T-Bills/bonds and the SBP was forced to take several measures to cool down the sentiment.

While in the present scenario it is worrisome for independent SBP to stay behind the curve. It is a bit of a challenge, he noted.

Speaking to Mettis Global, Ahsan Mehanti, Director Arif Habib Group gave the credit of PKR’s stability to SBP. He particularly mentioned that measures taken to improve the transparency of exchange companies have resulted in stabilization.

However, the accumulating debt and soaring import bill will keep pushing PKR towards the depreciation of 5%-10% in a year.

No matter how PKR performed during the outgoing month rising commodity prices in the international markets are all set to further hit the current account balance of Pakistan which will pose a serious threat to the resistance of PKR.

According to the ECAP, PKR gained 50 paisa for buying and selling over the day closed at 177 and 178 respectively in the open market.

Alternatively, the currency lost 1.1 rupees to the Pound Sterling as the day's closing quote stood at PKR 237.47 per GBP, while the previous session closed at PKR 236.36 per GBP.

Similarly, PKR's value weakened by 55 paisa against EUR which closed at PKR 197.41 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 10.00/10.30 percent, whereas the 1-week rate was 9.80/9.90 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,910.00 | 118,935.00 117,905.00 | 1290.00 1.10% |

| BRENT CRUDE | 72.70 | 72.82 72.70 | -0.54 -0.74% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.29 | 70.41 70.18 | 0.29 0.41% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|