PKR gains ground by 67 paisa per USD in a week

MG News | May 26, 2023 at 05:19 PM GMT+05:00

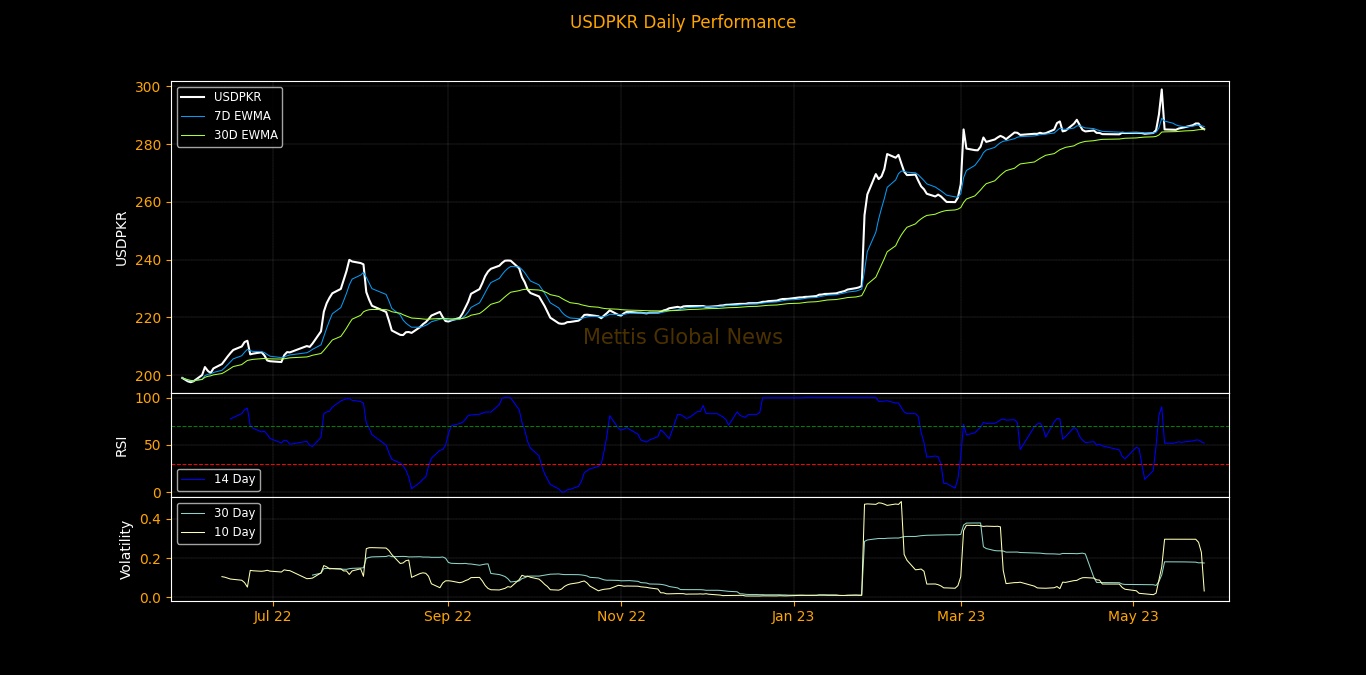

May 26, 2023 (MLN): Riding a choppy trail, the Pakistani rupee (PKR) clawed back the mighty dollar by 67 paisa during the outgoing week as the local unit settled the week at PKR 285.15 per USD compared to the previous week's close at PKR 285.82 per USD.

In today's session, the local managed to gain by 1.05 rupees per USD compared to yesterday's close of PKR 285.74 per USD.

Throughout today’s session, the local unit traded in a band of 1.51 rupee, showing an intraday high bid of 285.8 and a low offer of 284.85.

However, the dollar in the open market was being traded at 309/313 per USD, indicating the shortage of dollars.

Market talks suggest that the widening difference between interbank and open market rates is due to the prevailing uncertainty wherein market participants are on the verge of losing hope.

Especially, the longer-than-expected delay in the IMF tranche has further deteriorated the market sentiments.

On the other hand, the stability in the interbank market is attributed to the latest promises of Finance Minister Ishaq Dar to the business community of Pakistan that the business community will be offered tax relief measures in the upcoming budget.

With regards to default noise, he assured that Pakistan is not going to default.

Meanwhile, the currency gained 1.6 rupees against the Pound Sterling as the day's closing quote stood at PKR 352.08 per GBP, while the previous session closed at PKR 353.66 per GBP.

Similarly, PKR's value strengthened by 53 paisa against EUR which closed at PKR 306.11 at the interbank today.

In FYTD, PKR lost 80.30 rupees or 28.16%, while it plummeted by 58.72 rupees or 20.59% against the USD in CYTD. Within the last seven sessions, the local unit moved up by 0.23%, as per data compiled by Mettis Global.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO), and Shariah-compliant Mudarabah OMO today, in which it cumulatively injected a total of Rs1.77 trillion into the market, from which Rs1.73tr injected into the market under reverse repo.

While the remaining Rs37bn was injected through Shariah-compliant Mudarabah OMO.

The overnight repo rate towards the close of the session was 20.9%/21.25%, whereas the 1-week rate was 21.15%/21.25%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 176,355.49 799.09M | 1.32% 2301.17 |

| ALLSHR | 106,095.08 1,399.85M | 1.42% 1480.57 |

| KSE30 | 54,010.33 172.85M | 1.33% 707.40 |

| KMI30 | 250,685.98 166.33M | 0.86% 2146.75 |

| KMIALLSHR | 68,659.48 915.21M | 1.16% 786.70 |

| BKTi | 49,612.52 72.87M | 2.53% 1222.09 |

| OGTi | 35,256.55 17.79M | 1.06% 368.14 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 88,120.00 | 89,705.00 87,470.00 | -140.00 -0.16% |

| BRENT CRUDE | 60.91 | 61.92 60.63 | -0.42 -0.68% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.65 0.75% |

| ROTTERDAM COAL MONTHLY | 96.75 | 0.00 0.00 | 0.20 0.21% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.41 | 58.55 57.20 | -0.54 -0.93% |

| SUGAR #11 WORLD | 14.95 | 15.22 14.80 | 0.11 0.74% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI