PKR gains 52 paisa against USD during intraday trade

.png)

MG News | November 29, 2023 at 10:21 AM GMT+05:00

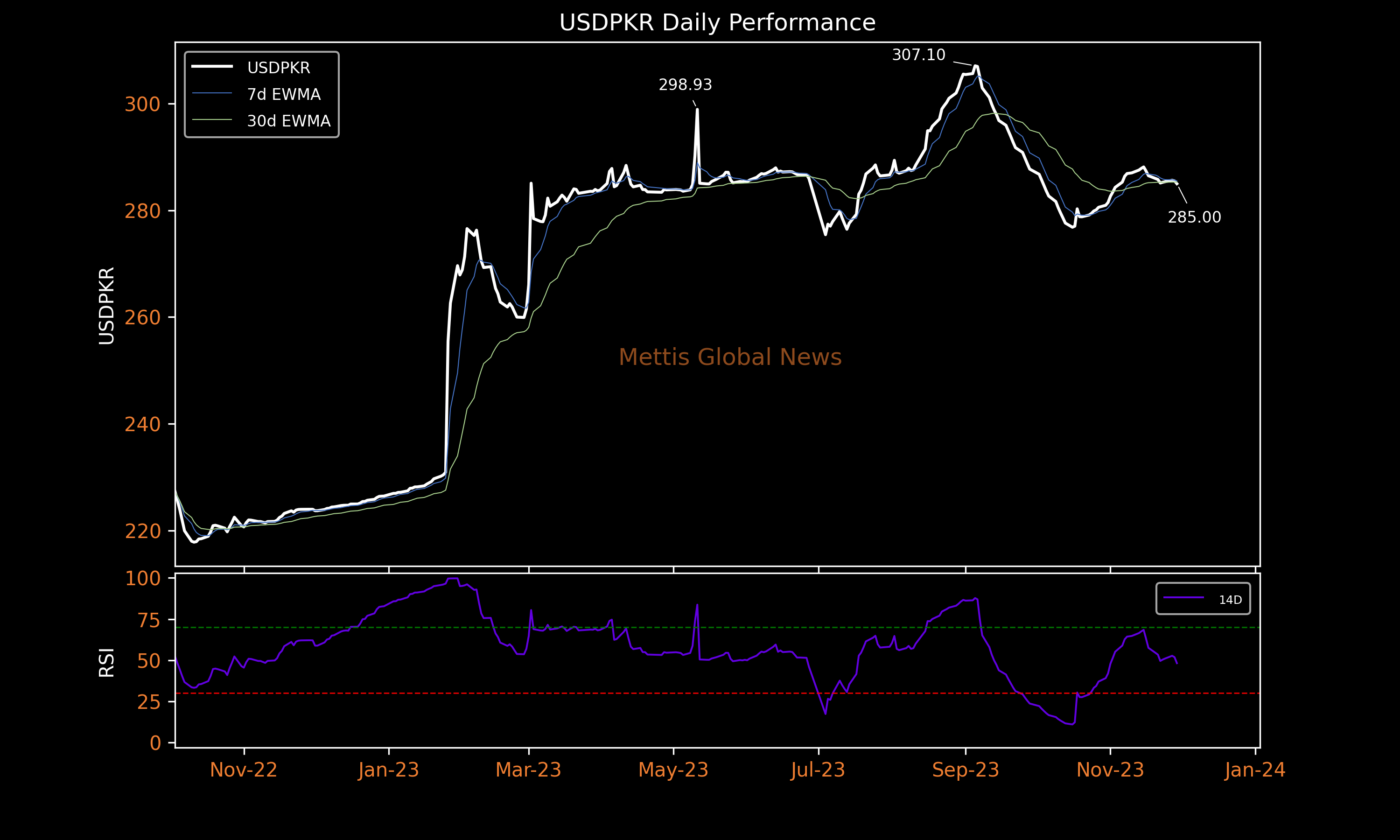

November 29, 2023 (MLN): The Pakistani Rupee (PKR) started today's trading session on a strong note against the U.S. Dollar, extending gains from the previous session by appreciating by 52 paisa against the US dollar in intraday trading.

This increase was observed in comparison to the previous closing rate of PKR 285.52 per USD.

The local unit was quoted at PKR 285/285.5 [10:30 am PST] with the trades being reported at 285 per USD.

It is important to mention that the local unit appreciated by 12 paisa in yesterday's session, reversing a trend of three consecutive daily losses against the greenback.

This upswing is attributed to the successful staff-level agreement (SLA) between the International Monetary Fund (IMF) and Pakistani authorities during the first review under the Stand-By Arrangement (SBA).

Pending approval by the IMF's Executive Board, the agreement will grant Pakistan access to SDR 528 million, around $700m.

While inflows following increased regulatory and law enforcement helped normalize import and FX payments and rebuild reserves, the authorities recognize that the rupee must remain market-determined to alleviate external pressures and rebuild reserves sustainably.

To support this, they plan to strengthen the transparency and efficiency of the FX market and refrain from administrative actions to influence the rupee.

Moreover, in a recent development, Pakistan is likely to receive funds worth $1.5 billion from global lenders upon the IMF's approval of the loan tranche under the $3bn SBA, the caretaker finance minister, Dr Shamshad Akhtar stated during an interview with a local news channel.

To recall, the pressure resulting from the gap between the demand and supply of dollars prevailed over the market for days and the PKR suffered losses for four consecutive weeks.

According to Bloomberg's latest post, the local unit is set to end the year as Asia’s worst-performing currency and the losses are expected to persist in 2024.

The U.S. Dollar Index (DXY), which tracks the value of the greenback against six other top currencies is also under pressure as it is on track to mark its fifth consecutive decline.

The market's expectations that the Federal Reserve has reached the end of its tightening cycle continue to enforce pressure on the dollar and U.S. bond yields, resulting in benefits for international prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves