PKR gains 21 paisa against USD

MG News | September 21, 2021 at 04:50 PM GMT+05:00

September 21, 2021 (MLN): Pakistani rupee (PKR) managed to gain 21 paisa against US Dollar in today's interbank session as the currency closed the day's trade at PKR 168.52 per USD, against yesterday's closing of PKR 168.72 per USD.

While expressing his views on the recent meeting of MPC and the impact of a rate hike on PKR, Asad Rizvi, former Treasury Head at Chase Manhattan stated that there was no urgency of a rate hike. The act could be a hint of worse economic news in the pipeline. Rupee & Stock Market too could come under pressure.

Taking to his official Twitter Handle, Mattias Martinsson, Founder and Chief Investment Officer at Tundra Fonder said, “A weak FX is not by default a problem. If there is the logic behind it and a pattern to see, good cos one can plan accordingly & great cos one can even profit.”

The problem is always when central banks decide to "provide stability" (burn reserves while CAD is incr.). Always ends in tears, he added.

The rupee traded within a very narrow range of 35 paisa per USD showing an intraday high bid of 168.70 and an intraday Low offer of 168.35.

Within the Open Market, PKR was traded at 168.50/170.20 per USD.

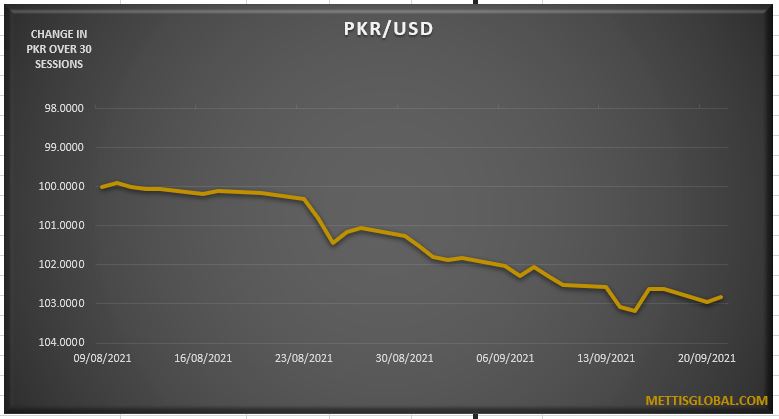

The home unit has depreciated by 6.51% or PKR 10.97 in the fiscal year-to-date against the USD. Similarly, the rupee has weakened by 5.15% or PKR 8.68 in CY21, with the month-to-date (MTD) position showing a decline of 2.57%, as per data compiled by Mettis Global.

Meanwhile, the currency gained 2 paisa against the Pound Sterling as the day's closing quote stood at PKR 230.69 per GBP, while the previous session closed at PKR 230.71 per GBP.

On the other hand, PKR's value weakened by 22 paisa against EUR which closed at PKR 197.79 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 7.35/7.50 percent, whereas the 1 week rate was 7.35/7.45 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|