PKR edges lower by 5 paisa

Nilam Bano | December 07, 2022 at 04:56 PM GMT+05:00

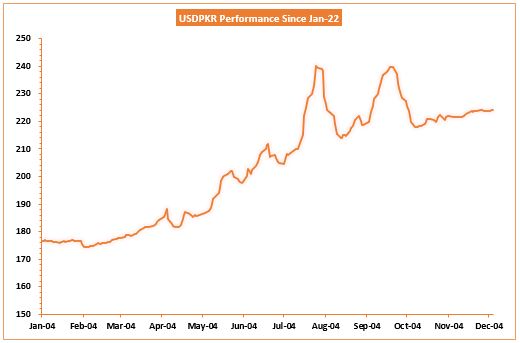

December 07, 2022 (MLN): Amid rising uncertainty over the economic outlook of the country, the Pakistani rupee (PKR) registered a loss of 5 paisa on Wednesday against the US dollar in the interbank session as the currency settled the trade at PKR 224.16 per USD, compared to the previous closing of PKR 224.11 per USD.

During the session, the rupee traded in a band of 10 paisa per USD showing an intraday high bid of 224 and low offer of 224.50 while in the open market, PKR was traded at 228.75/231 per USD.

It was the third consecutive session of the week wherein the local unit remained under pressure mainly due to depressing macros, and melting foreign exchange reserves. The government’s total debt surged to Rs50.15 trillion in September 2022, compared to Rs47.8tr in June 2022, witnessing an increase of Rs2.36tr or 4.95% in 4MFY23. Meanwhile, the cumulative outflows from the National Savings Schemes (NSS) in 4MFY23 were recorded at Rs207.57 billion, as compared to Rs78.88bn recorded in 4MFY22.

In addition to it, the rumors regarding economic emergency proposals have also fueled the chaos. However, the Finance Division on Tuesday rebutted reports of economic emergency proposals are being circulated on social media and categorically denied it saying that there is no plan to impose an economic emergency.

The message is unfortunately aimed at creating uncertainty about the economic situation in the country and can only be spread by those who do not want to see Pakistan prosper.

In FYTD, PKR lost 19.31 rupees or 8.62%, while it plummeted by 47.64 rupees or 21.25% against the USD in CYTD, as per data compiled by Mettis Global.

Alternatively, the currency gained 1.5 rupees against the Pound Sterling as the day's closing quote stood at PKR 272.04 per GBP, while the previous session closed at PKR 273.52 per GBP.

Similarly, PKR's value strengthened by 61 paisa against EUR which closed at PKR 234.53 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 16.25/16.50%, whereas the 1-week rate was 15.85/15.95%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,620.00 | 119,740.00 116,460.00 | -675.00 -0.57% |

| BRENT CRUDE | 73.51 | 73.63 71.75 | 1.00 1.38% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.31 | 70.51 68.45 | 1.10 1.59% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|