PKR depreciates by 2.8 rupees over the week

By MG News | October 22, 2021 at 05:10 PM GMT+05:00

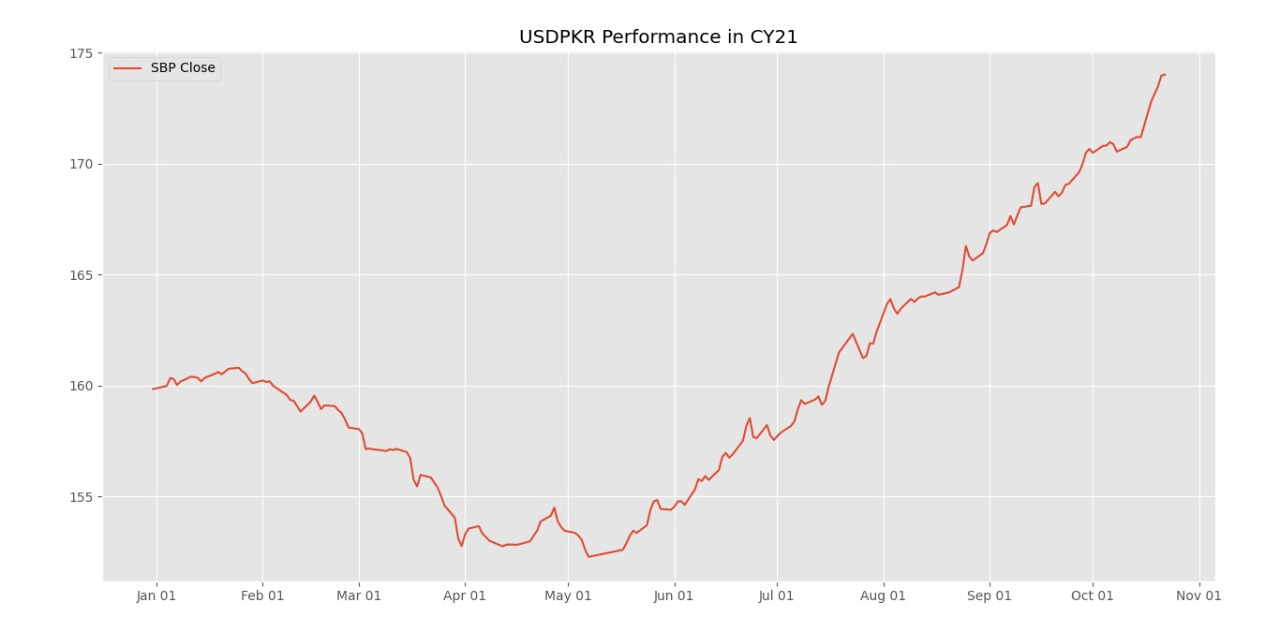

October 22, 2021 (MLN): With making new lows against the US dollar (USD), the Pakistani Rupee has stumbled around 9.5 percent this fiscal year to date. The free fall of the rupee has triggered hand-wringing in the media, where currency experts blame soaring imports and oil prices that lead to the current account deficit.

In today’s trade, the rupee shed 4 paisa against the greenback in the interbank market on the last trading day of the week to close at another lifetime low of Rs174 per USD, most likely due to a decrease in the central bank’s reserves by USD1.64 billion.

On Thursday, the home unit has closed at 173.96.

Further, the talks between IMF and government for resumption of Extended Fund Facility (EFF) has not been finalized yet that also kept the rupee under pressure.

“Net reserves with SBP plunged by USD1.64bn. Nothing firm yet on Pakistan/IMF talks. And with the M/E market close due to the weekend, PKR lacks support,” said Asad Rizvi, the Former Treasury Head at Chase Manhattan on his Twitter handle.

While talking to the media, Dr Reza Baqir, Governor State Bank of Pakistan said,” The dollar’s march against Pakistani rupee is helping expatriates as 10% depreciation so far has raised USD3billion. It is expected that remittances inflows will cross USD30bn this fiscal year. However, this weakening rupee is bad for some.

Talking about the governor’s comment, Mattias Martinsson, Founder and Chief Investment Officer at Tundra Fonder said, “Few things make Pakistanis more emotional than their currency.

Dr. Baqir's comment, although a bit insensitive, reveals that still many educated people still don't understand that their currency reflects 30 years of isolation and underinvestment.

The rupee traded within a very narrow range of 25 paisa per USD showing an intraday high bid of 174.30 and an intraday Low offer of 174.05.

During the week, the currency has lost 2.8 rupees against the greenback, as the previous week was concluded at PKR 171.18 per USD.

Within the Open Market, PKR was traded at 174/175.50 per USD.

Meanwhile, the currency lost 2 paisa to the Pound Sterling as the day's closing quote stood at PKR 240.2 per GBP, while the previous session closed at PKR 240.18 per GBP.

On the other hand, PKR's value strengthened by 3 paisa against EUR which closed at PKR 202.46 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation in which it injected Rs.1.84 trillion for 7 days at 7.34 percent.

The overnight repo rate towards close of the session was 7.25/7.40 percent, whereas the 1 week rate was 7.35/7.40 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,550.00 | 108,105.00 107,505.00 |

-685.00 -0.63% |

| BRENT CRUDE | 66.42 | 66.63 66.34 |

-0.32 -0.48% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.76 | 65.02 64.67 |

-0.35 -0.54% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)