PKR comes under pressure, closes at 206.94 per USD

By MG News | July 05, 2022 at 04:44 PM GMT+05:00

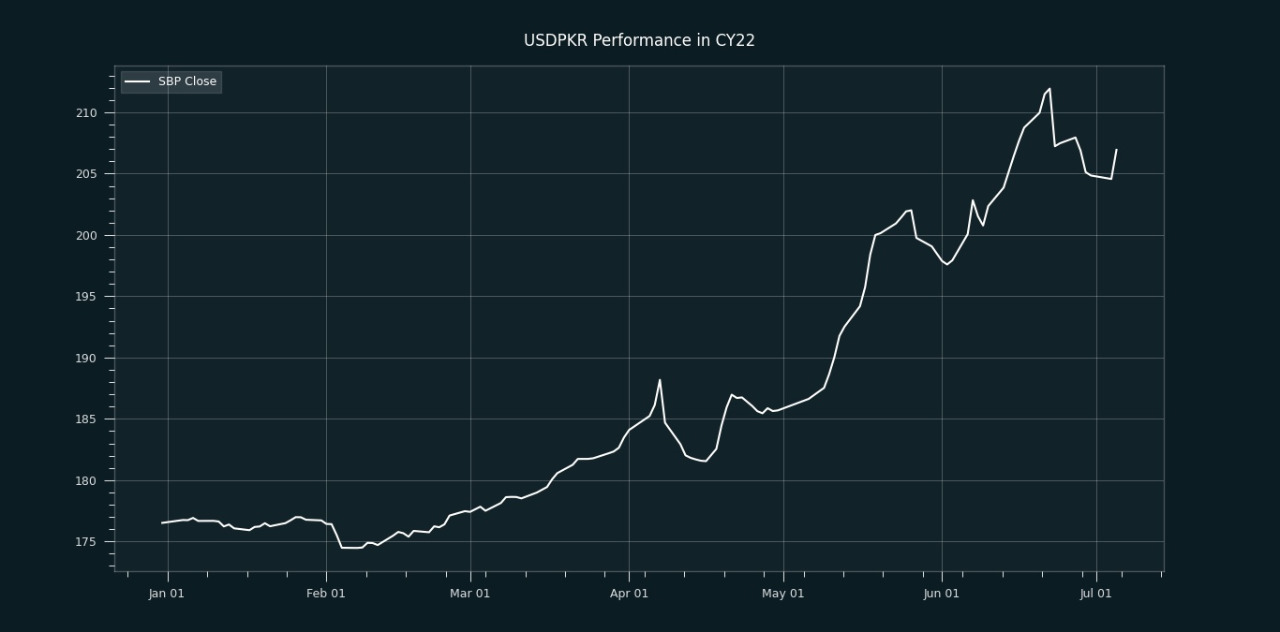

July 05, 2022 (MLN): After a long winning streak, the Pakistani Rupee on Tuesday came under pressure once again on the back of a delayed tranche of a $3 billion IMF loan program and speculative activity. The currency depreciated by 2.4 rupees against US Dollar (USD) in today's interbank session to close the day's trade at PKR 206.94 per USD.

In the last trading session, the local unit closed at PKR 204.56 per USD.

The rupee endured a highly volatile trading session with quotes being recorded in a range of 2.64 rupees per USD showing an intraday high bid of 206.8 and an intraday low offer of 205.24.

It seemed that the forex market reacted to news reports circulating on social media that the IMF program was postponed or delayed due to some anti-corruption laws.

However, on such rumors and news reports, Federal Minister for Finance and Revenue, Miftah Ismail took to his Twitter handle and clarified that Extended Fund Facility (EFF) program with the International Monetary Fund (IMF) is on track.

The minister said that there had been some tweets and stories about the IMF program being postponed or delayed due to some anti-corruption laws.

There was no truth in this and the program was on track, he added.

While speaking to Mettis Global, Zafar Paracha, President of Exchange Companies of Pakistan told Mettis Global, “The delayed of IMF program and speculative transaction by banks hammered the rupee.”

The longer the delay in the release of IMF funds, the weaker the sentiment will get and as a result, the rupee will fall.

Last three and 4 years, the SBP was quite vigilant and had good controls under the previous governor Dr. Reza Baqir. The rupee had the same trend either upward or downward. The present trend seems like a see-saw due to inconsistent policies.

“Government should control banks to avoid this volatility in PKR-USD Parity.”

On the other hand, Malik Bostan, President Forex Association of Pakistan said that the tough conditionalities of IMF have been incorporated in the fiscal year budget.

“We must wait for the yellow signal to turn to green. The green light from IMF and exclusion of Pakistan from FATF will attribute to gradual economic growth while bringing a healthy foreign investment into the country.”

In CYTD, the local unit plummeted by Rs14.7 or 30.42% against the USD while in the month of June 2022 while it registered a decline of 1.01% against the greenback in MTD, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 23.5% against the greenback while reaching its lowest at 211.93 on June 22, 2022, and the highest of 158.37 on July 06, 2021.

Furthermore, the local unit has weakened by 12.66% since its high on July 06, 2021 against EUR, while it has depreciated by 12.31% against GBP since its high on July 07, 2021.

.jpeg)

The performance of the local unit remained bleak against other major currencies in today's session as the currency lost its value by 0.70%,0.84%, 0.98%, 0.57%,1.15%, 1.15%, and 1.15% against EUR, GBP, CHF, JPY, SAR, AED, and CNY.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation in which it injected Rs.1.19 trillion for 73 days at 13.97 percent.

The overnight repo rate towards the close of the session was 13.00/13.25 percent, whereas the 1-week rate was 13.45/13.55 percent.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI