PKR collapses by 7.6 rupees in a week against greenback

By MG News | May 20, 2022 at 08:29 PM GMT+05:00

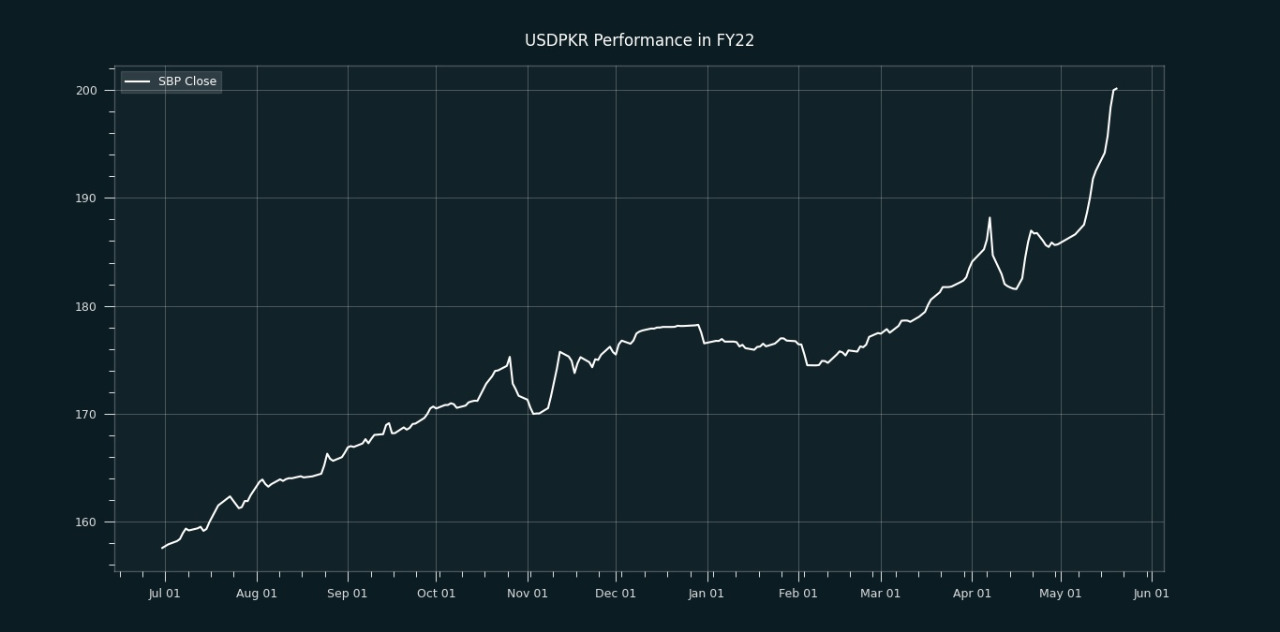

May 20, 2022 (MLN): Ongoing storm of economic crisis- where the country is left with only 1.54 months cover for the import bill, economic managers being clueless and hesitant regarding unpopular decision making, has provided the maximum ground to the US dollar to beat the Pakistani rupee (PKR) by 7.6 rupees in the departed week as the currency settled week’s trade at PKR 200.14, compared to the previous week’s close of 192.53 per USD.

In today's session, the local unit was traded in a range of 1.4 rupees per USD showing an intraday high bid of 200.50 and an intraday low offer of 200, depreciating by 14 paisa by the end of the session.

The elevated demand for the dollar amid panic created by uncertain market conditions and delay in the IMF tranche has finally crossed the psychological mark of PKR 200 in yesterday’s session, which was termed by experts as “Black Day” in history.

In addition, the dollar hoarding, speculative elements and SBP’s silence have added more fuel to the fire.

Regarding IMF, Zafar Paracha, President of Exchange Companies Association of Pakistan said, “IMF has raised concerns over the subsidy on petroleum products given by Pakistani government and Pakistan side had agreed to roll back the subsidies, however, the relief package is still being provided.”

He also added, “It seems that financial assistance from Saudi Arabia and China is now conditional to the IMF’s allocation of $1bn to Pakistan.”

However, the talks with IMF have started during the outgoing week and if the talks remain in favour of Pakistan, the pressure from the exchange rate will be eased off.

Meanwhile, the government on Thursday decided to impose a blanket ban on the import of non-essential luxury items to redress current economic woes under the Comprehensive Economic Plan.

This plan has been formulated under which a fiscal management policy would be introduced to steer the country out of the current economic crisis. The plan would help reduce the country’s reliance on foreign debts

According to Minister for Information and Broadcasting Marriyum Aurangzeb, “The economic initiatives of the current government would have a swift impact on the foreign exchange reserves for the next two months and there would be an annual impact of around $6 billion.”

Analyst fraternity on the other hand is of the view that the government’s move will likely have an estimated saving of $100mn per month.

This development has potential benefits for local auto assemblers where prime beneficiaries would be INDU, PSMC, HCAR and LUCK. The ban on imported cars will likely increase localization and accelerate investments.

While the temporary ban on CBU mobile phones would save $27.5mn in a month which will surely curtail the current account deficit. Market experts believe that Airlink and Luck (Samsung) might gain from this ban.

From July’21 to date, the local unit has lost Rs42.59 against the USD. Similarly, the rupee fell by Rs23.62 in CYTD, with the month-to-date (MTD) position showing a decline of 7.22%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 23.38% against the greenback, reached its lowest at 200.14 today and touched its high of 153.22 on May 21, 2021.

Furthermore, the local unit has weakened by 11.77% since its high on July 02, 2021, against EUR while, it has dropped by 13.06% against GBP since its high on May 24, 2021.

In addition, the performance of PKR remained bleak against major currencies during the month to date as it weakened by 8.54%, 7.54%, 7.25%, 7.22%, 7.21%, and 6.58% against JPY, EUR, CHF, AED, SAR, and GBP, respectively.

.jpeg)

Within the open market, PKR was traded at 200/202.50 per USD.

Meanwhile, the currency lost 2.3 rupees to the Pound Sterling as the day's closing quote stood at PKR 249.91 per GBP, while the previous session closed at PKR 247.59 per GBP.

Similarly, PKR's value weakened by 1.8 rupees against EUR which closed at PKR 211.71 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) in which it injected Rs3.4 trillion into the market for 7 days at 12.32 percent.

The overnight repo rate towards the close of the session was 12.25/12.50 percent, whereas the 1-week rate was 12.35/12.45 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,686.66 280.01M |

0.26% 342.63 |

| ALLSHR | 81,305.25 897.01M |

0.35% 281.26 |

| KSE30 | 39,945.45 114.02M |

0.09% 37.19 |

| KMI30 | 190,698.05 148.61M |

0.61% 1163.05 |

| KMIALLSHR | 55,074.15 495.43M |

0.53% 290.50 |

| BKTi | 34,568.40 28.73M |

-1.07% -372.33 |

| OGTi | 28,739.35 22.59M |

1.57% 443.29 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 110,155.00 | 110,525.00 110,155.00 |

-260.00 -0.24% |

| BRENT CRUDE | 68.85 | 69.14 68.32 |

-0.26 -0.38% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 67.14 | 67.18 67.00 |

0.14 0.21% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI