Pakistan's aggressive interest rate hike cycle surpasses three decades

MG News | March 14, 2023 at 11:31 AM GMT+05:00

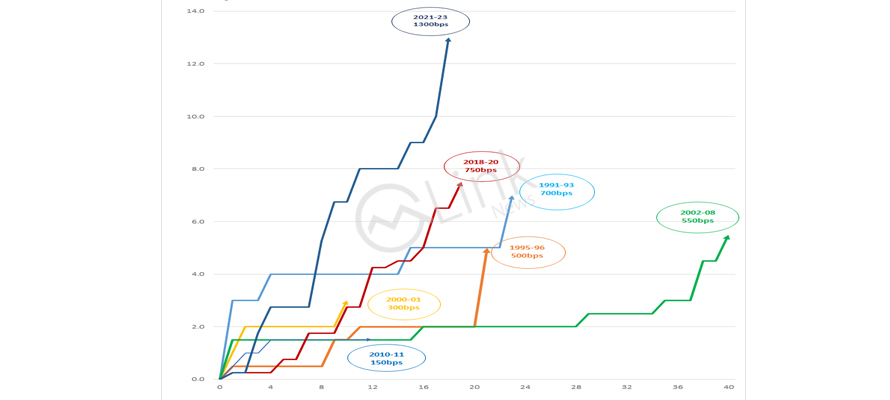

March 14, 2023 (MLN): Pakistan is currently experiencing one of the most intense and aggressive rate hike cycles in over three decades! In just 18 months, the State Bank of Pakistan (SBP) has hiked rates by a whopping 1300 basis points, making it a period of monetary tightening unlike any other in recent history.

Inflation has hit an all-time high, fueled by rising commodity prices, a weakening currency, and depleting foreign exchange reserves. Such runaway inflation along with sharp currency devaluation has raised the risk of is a serious cause for concern, and the authorities must act fast to stabilize the economy.

As we speak, the speed and severity of the current interest rate hikes are being compared to other periods of monetary tightening in the past.

With the policy rate currently standing at a staggering 20%, the highest since the 2008 Global Financial Crisis, it's essential to take a closer look at the interest rate cycles that Pakistan has gone through over the years.

Let's take an exhilarating trip back in time, roughly 35 years ago, and dive into Pakistan's economy's fascinating characteristics of interest rate cycles.

Between 2018-2020, the central bank took strict measures to control the twin deficits, leading to the tightening of monetary policy to guarantee macroeconomic stability. Inflation peaked at a staggering 14.6% YoY by February 2020, making it imperative to keep the economic stability intact.

Similarly, from 2002-2008, the SBP initially responded belatedly to rising inflation. However, as the fiscal deficit and persistent inflation took a toll on macroeconomic stability, the central bank began to accelerate rate hikes to stabilize the economy.

.jpg)

Delving deeper, the country has experienced 15 distinct cycles of rate hikes and cuts since 1992, with each cycle defined as the period between the first change and the last change. Interestingly, each tightening cycle is followed neatly by a loosening cycle, and they alternate perfectly.

Of the 15 cycles, the SBP increased rates in 8 of them, including the current cycle, which is the most aggressive and intense in recent memory.

The most significant increase in interest rates during any cycle was 7.50%, observed between April 2005 and November 2008, while the most significant reduction was 9.00%, between June 1997 and January 2000. On average, there is a 10-month pause between cycles, with the longest pause being 2 years and 5 months, between November 2002 and April 2005, and the shortest being just one month, in July 2001, when rate cuts followed the last hike of the previous cycle.

The length and number of policy decisions show no significant difference between rate hike and rate cut cycles.

However, the time lag between policy changes is notable, with the SBP taking an average of one year and two months to start increasing rates after the last cut, but only seven months to start reducing rates after the last hike.

This suggested a central bank bias toward supporting growth over stabilization at the earliest available opportunity, which has implications for the current cycle.

As the saying goes, history may not repeat itself but it often rhymes.

So, what can we glean from the past as we navigate the present? Currently, the rate hike cycle, which commenced in September 2021, has already lasted for 19 months, exceeding the typical duration of 1 year and 2 months. The rate has jumped by 13%, which is one of the sharpest increases after the 2005-08 and 2018-19 cycles of 7.50% each and surpasses the average increase of 4.4%.

Additionally, the market anticipates another rate hike in April 2023 as SBP hinted in its latest MPC meeting that the inflation to rise further in the range of 27-29% against the November 2022 projection of 21-23%.

In this context, the MPC emphasized that anchoring inflation expectations is critical and warrants a strong policy response.

However, as the country's economic direction is being influenced by external forces, including the IMF, it is difficult to predict when this cycle will come to an end. It's a case of the steering wheel being in the hands of others, so to speak.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction