Pakistan to have less fiscal headroom in the wake of infection spike: Moody's

MG News | January 27, 2022 at 12:04 PM GMT+05:00

January 27, 2022 (MLN): The new waves of infection would expose the relative fragility of Pakistan’s health systems and in the event of further lockdowns or shocks to external demand, the economy would have comparatively less fiscal headroom to support domestic economic activity, said a report issued by Moody's on Wednesday.

Since the outlook for new spikes in infections and economic disruption remains highly uncertain, it would pose serious risks to the informal workforce and the operation of key labour-intensive economic sectors such as textile and garment manufacturing, it added.

In South Asia, pandemic control had improved significantly in recent months. However, economies with relatively weak fiscal profiles, including India, Indonesia, Malaysia and Pakistan, will be compelled to balance fiscal consolidation objectives with rising social demands to ameliorate structural problems such as weak governance, unequal access to healthcare or income inequality.

These governments will face constraints on their ability to stimulate domestic demand or support companies as new pandemic-related disruptions to economic activity emerge, the report noted.

With regard to debt burden of APEC countries rating, the report foresees the region’s outlook across sectors stable for 2022, reflecting generally improved economic conditions for most issuers, although weaker entities remain exposed to downside pressures from higher dollar-borrowing costs.

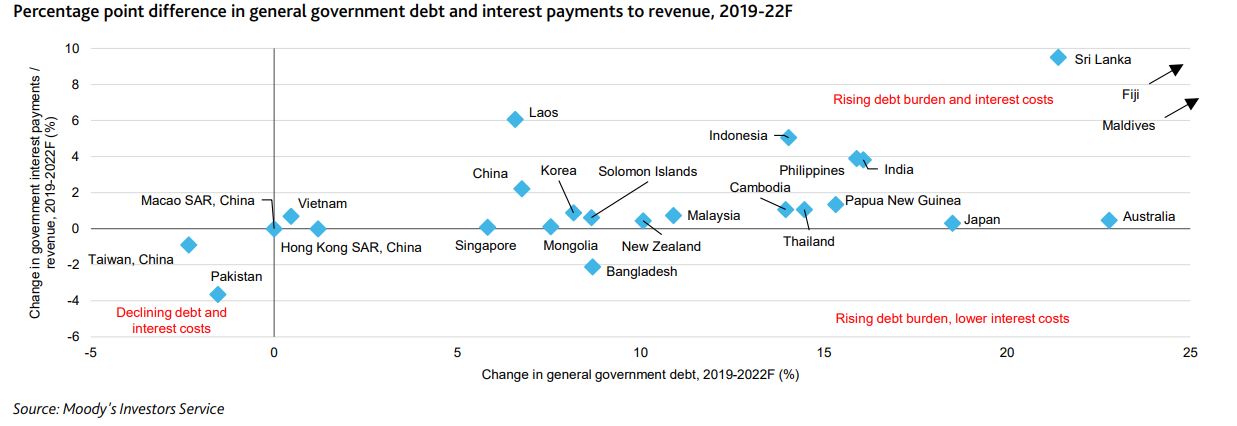

Median debt burdens and growth rates of APAC sovereigns are gradually settling at levels that are weaker than they were before the pandemic, but the region is still better positioned than many others because of comparatively higher growth rates and, in some countries including Pakistan, lower debt burdens.

About half of APAC governments will record a decline in their debt burdens in 2022, as revenue and economic output start to recover and some stimulus measures are gradually unwound. Debt burdens and interest costs will nevertheless remain above pre-pandemic levels for most governments in the region.

The unwinding of pandemic-era policies may prove difficult in economies where rising social pressures will drive government policy, or where the financial and corporate sectors require ongoing forbearance measures as they adjust to uneven growth recoveries across sectors.

Fiscal policy space varies across the region. Fiscal constraints are considerable for a cluster of economies, including India, Indonesia, Malaysia and Sri Lanka.

The report further noted that economies that are growing at a slower rate than the interest rate on their debt will encounter larger fiscal challenges because of less-favourable debt dynamics. The increase in debt levels during the pandemic will further compound this challenge.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,525.00 | 71,645.00 67,860.00 | -3005.00 -4.20% |

| BRENT CRUDE | 91.94 | 94.64 83.16 | 6.53 7.65% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 89.84 | 92.61 78.24 | 8.83 10.90% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes