Pakistan stocks still screamingly cheap despite rally

Abdur Rahman | September 08, 2024 at 03:00 PM GMT+05:00

September 08, 2024 (MLN): Pakistan stocks have been on fire ever since the country narrowly avoided a sovereign debt default. Its benchmark index has more than doubled in a little over a year, yet valuation metrics suggest stocks are still cheap compared to historic levels and its peers.

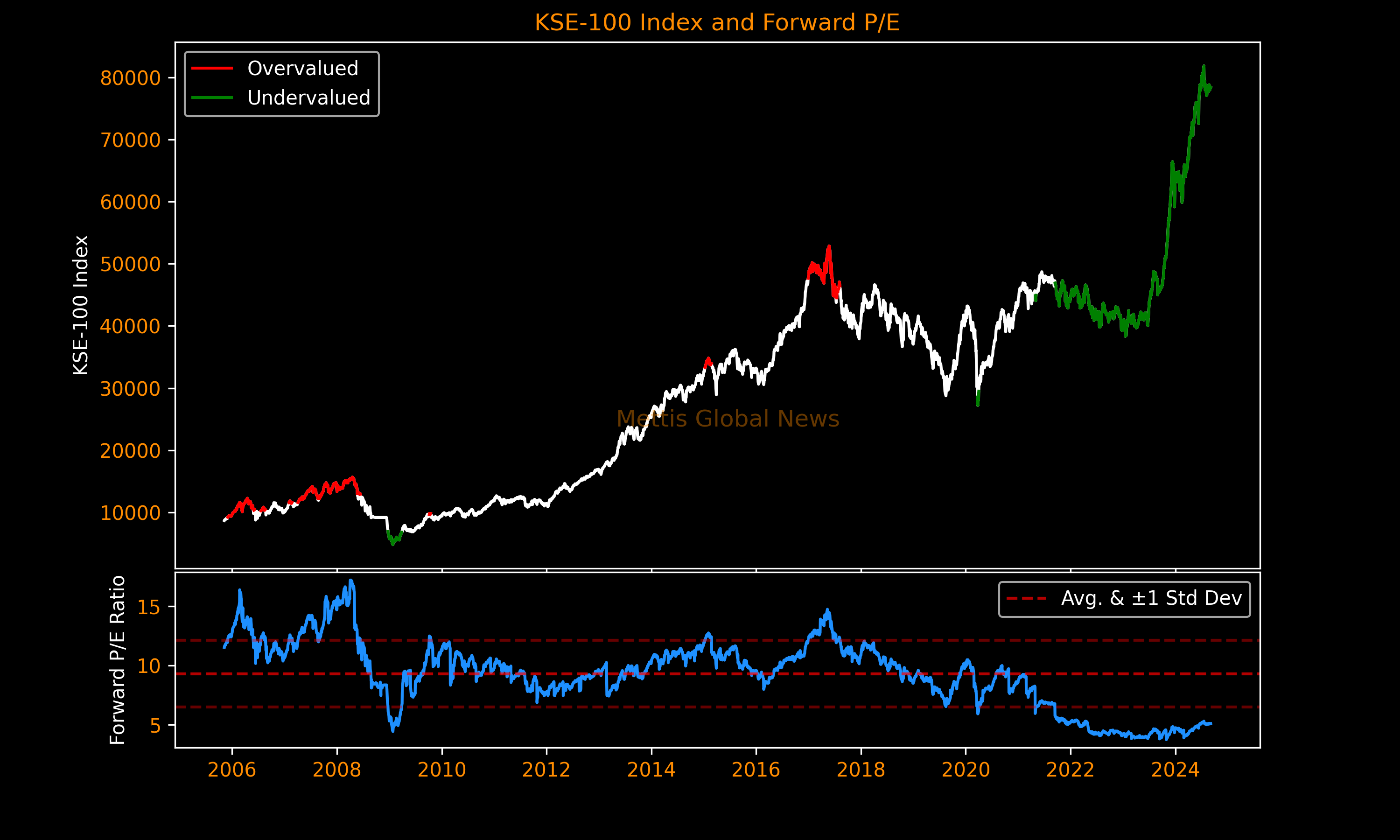

To take one popular metric of valuation, the cash-strapped nation's key gauge's forward price-to-earnings ratio — current stock's price over its predicted earnings per share — is still well below its historical average. This means its earnings growth has far outpaced the recent price rally.

The index currently trades at a 12-months forward price-to-earnings ratio of 5.1, a 45% discount to its average of 9.3 times forward earnings since 2005, according to data compiled by MG Research.

If the KSE-100 were simply to return to its 20-year average valuation, that would be a gain of around 83% from here.

To note, the only other time investors were willing to pay this little for each rupee of future earnings was during the Great Recession, data going back to 2005 shows.

The index has yielded an average gain of 21% in a year for investors who bought shares when the valuation fell one standard deviation below its 20-year average.

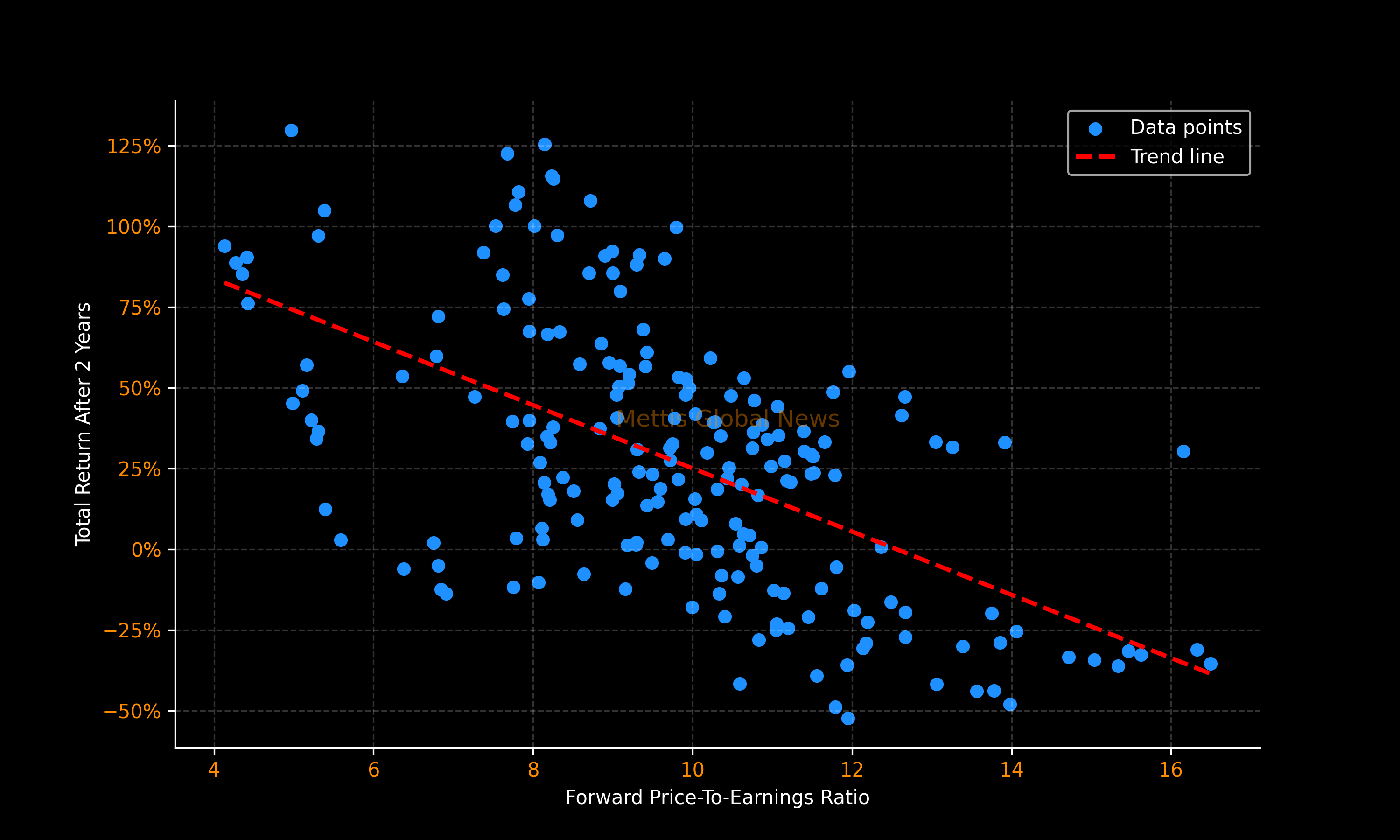

Moreover, investors gained an average return of 28% after 2 years, and a 58% gain over the next 3 years, data with a sample size of 4 compiled by Mettis Global show.

The following graph shows that lower valuations lead to higher future returns and vice versa. Each dot represents a monthly reading of the KSE-100's forward P/E ratio and its total return over the next two years.

Compared to global peers, Pakistan's forward price-to-earnings ratio of 5.1 compares with the MSCI AC Asia Index's ratio of 13.16, MSCI Emerging Markets Index's ratio of 11.75, and the MSCI World index's ratio of 18.77, according to MSCI data as of August 30.

Another valuation metric — the stock market capitalization-to-GDP ratio — is at a 40% discount to its 10-year average.

Pakistan's dividend yield of 8.65% has also far surpassed MSCI Emerging Markets' 2.67%, and the MSCI World's 1.78%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,185.00 | 69,740.00 66,385.00 | -295.00 -0.42% |

| BRENT CRUDE | 83.82 | 85.12 78.38 | 6.08 7.82% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 124.15 | 139.50 124.15 | 5.35 4.50% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 77.01 | 77.98 70.41 | 5.78 8.11% |

| SUGAR #11 WORLD | 13.95 | 14.20 13.91 | 0.04 0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260303092753200_b3e945.webp?width=280&height=140&format=Webp)

Trade Balance

Trade Balance