OPEC+ resumes talks amid divide on February oil output levels

MG News | January 05, 2021 at 04:45 PM GMT+05:00

January 5, 2020: OPEC+ resumes debate on Tuesday after talks stumbled over February policy, with Russia leading calls for higher output and others suggesting holding or even cutting production due to new coronavirus lockdowns.

Debate resumes at 1430 GMT after the group, which combines OPEC and other producers including Russia, failed to find a compromise on Monday.

OPEC+ sources told Reuters that Russia and Kazakhstan backed raising production by 0.5 million bpd while Iraq, Nigeria, and the United Arab Emirates suggested holding output steady.

An internal OPEC document, seen by Reuters on Tuesday and dated Jan. 4, suggested a 0.5 million bpd cut in February as part of several scenarios considered for 2021.

The document also said that the OPEC+ joint ministerial committee highlighted bearish risks and "stressed that the reimplementation of COVID-19 containment measures across continents, including full lockdowns, are dampening the oil demand rebound in 2021".

Two OPEC+ sources said the chances of a cut were slim as very few producers supported it.

"Two clear factions have formed - the Saudi-led proposal for a cautious approach to maintain oil prices and the Russia-led clarion call for a swifter return of supply to the market," said Louise Dickson from Rystad Energy.

On Monday, Saudi Energy Minister Prince Abdulaziz bin Salman said OPEC+ should be cautious, despite a generally optimistic market environment, as demand for fuel remained fragile and variants of the coronavirus were unpredictable.

New variants of the coronavirus first reported in Britain and South Africa have since been found in countries across the world.

With benchmark Brent oil futures holding above $50 per barrel, OPEC+ took the opportunity to raise output by 0.5 million bpd in January as it looks to eventually ease cuts that currently stand at 7.2 million bpd.

OPEC+ producers have been curbing output to support prices and reduce oversupply since January 2017 and cut a record 9.7 million bpd in mid-2020 as COVID-19 hammered demand for gasoline and aviation fuel.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

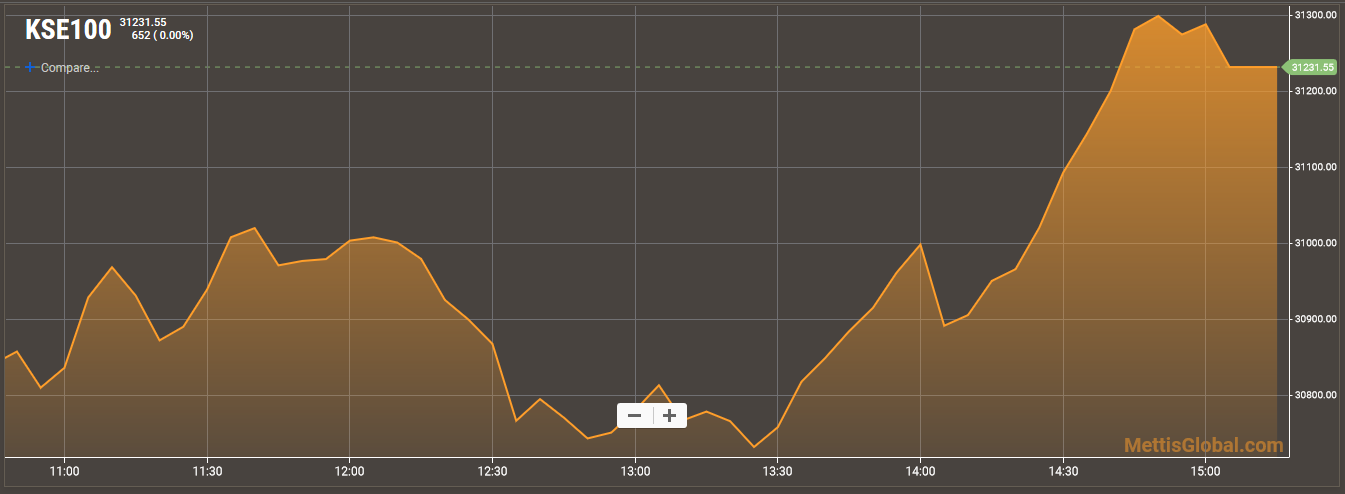

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction