Oil prices unfazed despite Iran-Israel conflict

MG News | April 15, 2024 at 10:02 AM GMT+05:00

April 15, 2024 (MLN): Oil prices remained largely unaffected on Monday following Iran’s assault on Israel that took place over the weekend, with prices easing on speculation that the conflict would not escalate further.

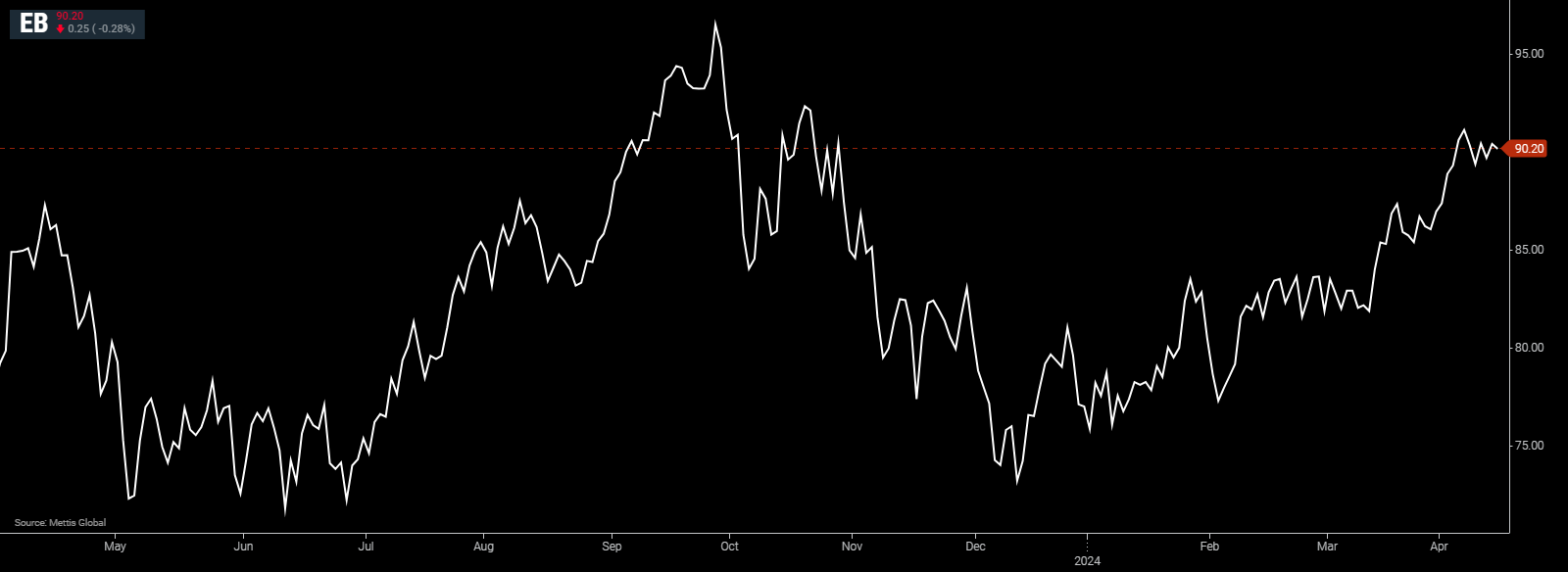

Brent crude initially rose 0.7% to $91.05 a barrel on open, before dropping near $90.2 per barrel, down by 0.28% on the day.

While West Texas Intermediate crude (WTI) was at $85.34 per barrel, down by 0.37% on the day.

More than 300 missiles and drones were fired by Iran at the weekend, the first time it has struck Israel from its soil, though most were intercepted, as Bloomberg reported.

The attack, which had been expected for days, came in retaliation for a strike in Syria that killed Iranian military officers.

“This war may move down the escalation ladder if the Israeli government follows the advice of the White House and forgoes retaliatory action,” RBC Capital Markets LLC analysts including Helima Croft said in a note.

While the Iranian action was “far more expansive than previous reprisals, it was still telegraphed in advance,” they said.

Oil has been one of the strongest performers in commodities this year as OPEC+ keeps a tight rein on supply to drain inventories and support prices.

The latest attack escalates tensions in a region that produces about a third of the world’s crude, and represents the latest twist in a showdown that followed the assault by Tehran-backed Hamas against Israel last October.

Still, the Iranian mission to the United Nations said the issue “can be deemed concluded,” reducing for now the risk of a wider conflict.

“The situation is fluid, and if Israel signals it will not retaliate, market tensions will ease,” said Arne Lohmann Rasmussen, head of research at A/S Global Risk Management.

Shipping risks have also been in focus after Iran seized a vessel, the MSC Aries, near the key Strait of Hormuz shortly before the strikes against Israel.

The ship’s beneficial owner is part of Israel-linked Zodiac Group, according to data compiled by Bloomberg.

The move raises concerns over the safety of vessels in the region, adding to previous logistical disruptions.

“The most feared scenario is the closure of the Strait of Hormuz,” said Global Risk Management’s Rasmussen. “I don’t think Iran will close the strait, but the risks are growing.”

While price moves were restrained, trading was brisk, with nearly 100,000 lots of Brent changing hands by noon in Singapore.

That’s about ten times the volume typically traded by that time in a usual session.

There were also over 5,000 lots of $95 call options for Brent which moved. Bullish call options remain at a premium over opposing puts.

Oil markets have tightened in recent months, lifting energy costs and posing a headache for central bankers as they seek to drive home their push to quell inflation.

Ahead of Tehran’s weekend strike, analysts had been addressing the possibility oil could once again hit $100 a barrel.

OPEC, the producers’ cartel that counts Iran as a member, said last week that oil would need to be closely watched in the coming months to ensure “a sound and sustainable market balance,” according to a monthly report.

There are signs demand is ramping up. US refiners are preparing to boost fuel production for the driving season, while recent macroeconomic prints from China have suggested the economy may be turning the corner.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves