Oil prices steady amid speculation of delay in US rate cuts

MG News | February 28, 2024 at 11:34 AM GMT+05:00

February 28, 2024 (MLN): Global oil prices remained relatively flat on Wednesday as the market was filled with expectations that there might be a delay in the U.S. rate-cutting cycle.

Brent crude is currently trading at $82.19 per barrel, down by 0.03% on the day.

While West Texas Intermediate crude (WTI) is trading at $78.18 per barrel, down by 0.04% compared to the previous close.

On Tuesday, Federal Reserve Governor Michelle Bowman signaled she is in no rush to cut U.S. interest rates, particularly given upside risks to inflation that could stall progress on controlling price pressures or even lead to their resurgence, as Reuters reported.

Kansas City Federal Reserve Bank President Jeffrey Schmid made similar remarks on Monday. Their remarks underlined concern in financial markets that the potential economic benefits of lower rates will be pushed back.

"There is some profit-taking this morning after the past two sessions recouped the $2 per barrel of Mideast risk premium that crude shed on Friday," said Vandana Hari, founder of oil market analysis provider Vanda Insights.

"It's a combined response to the weekly U.S. crude stock surge in the API data this morning and continuing hope that a Gaza ceasefire deal will be reached in the next few days," Hari added.

U.S. crude stocks rose 8.43 million barrels in the week ended Feb. 23, according to market sources citing American Petroleum Institute (API) figures on Tuesday.

Gasoline inventories fell by 3.27m barrels, and distillate stocks fell by 523,000 barrels, the data showed.

Brent and WTO futures rose more than $1 per barrel on Tuesday after Reuters reported the Organization of the Petroleum Exporting Countries and allies led by Russia (OPEC+) will consider extending voluntary oil output cuts into the second quarter.

Extending the output cuts into the second quarter is "likely", one of the OPEC+ sources said. Two said a longer extension to the end of 2024 was possible.

Last November, OPEC+ agreed to voluntary cuts totaling about 2.2 million barrels per day (bpd) for the first quarter this year, led by Saudi Arabia rolling over its own voluntary cut.

Analysts at ANZ Research wrote in a note that such a move by the OPEC+ alliance would likely tighten the market.

Russian authorities announced on Tuesday a six-month ban on gasoline exports from March 01 to compensate for rising demand from consumers and farmers and to allow for planned maintenance of refineries.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

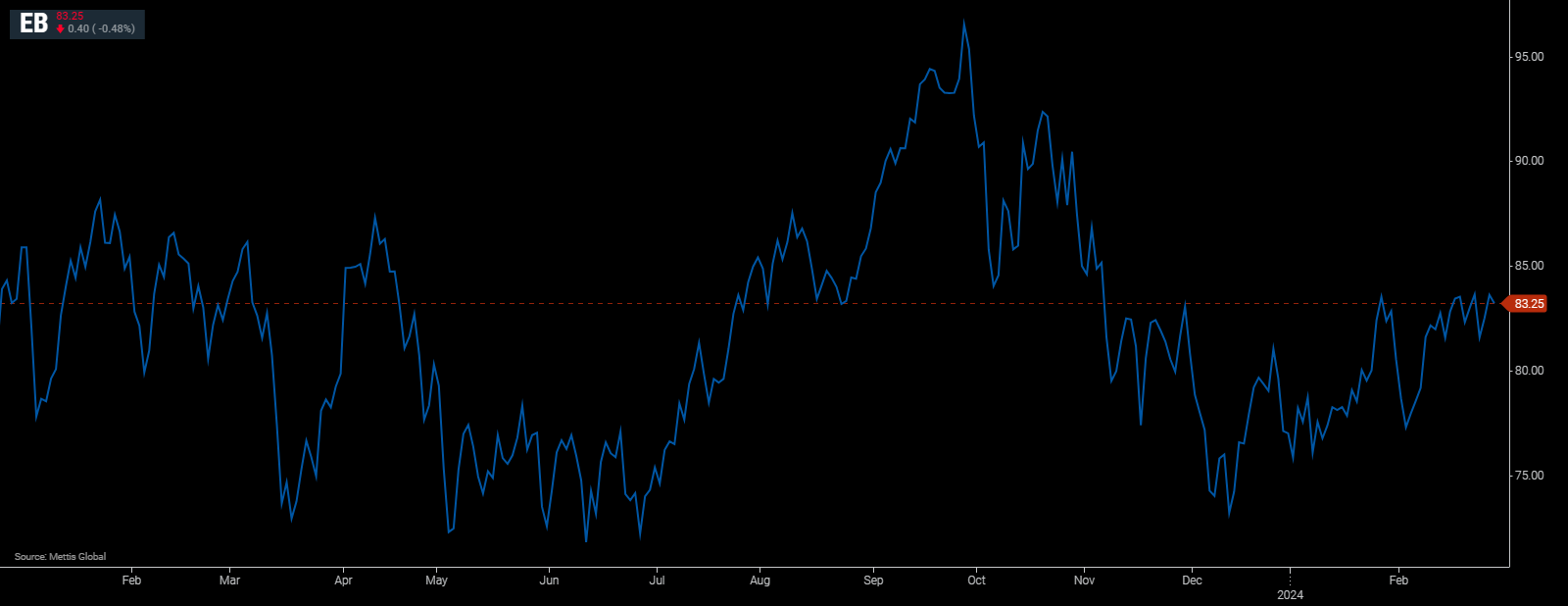

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction