Oil prices stable as market eyes policy support for economic growth

MG News | January 03, 2025 at 02:08 PM GMT+05:00

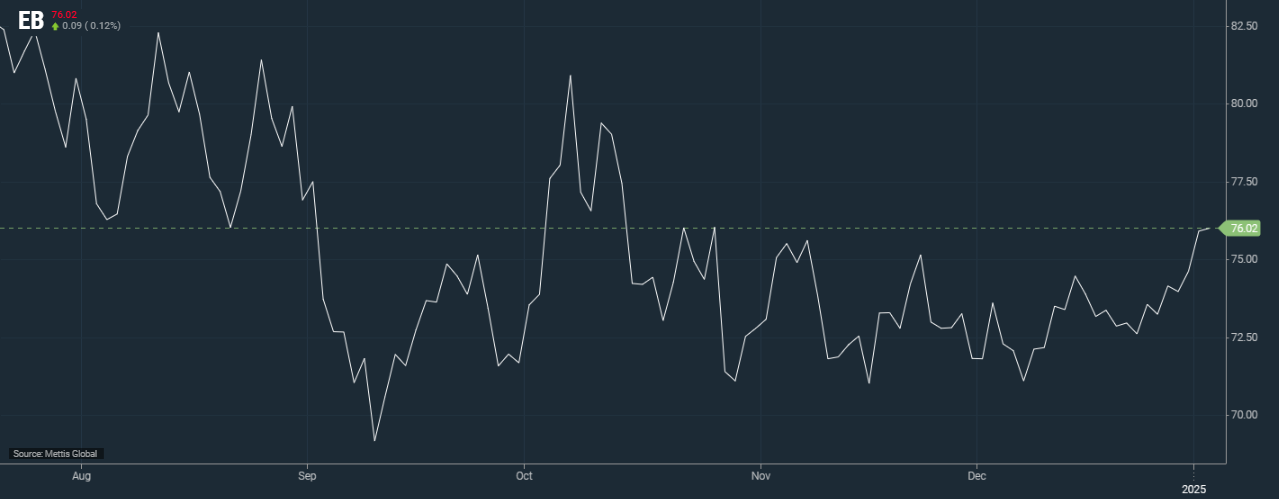

January 03, 2025 (MLN): Oil prices barely budged on Friday after closing at their highest in more than two months in the prior session.

This stability came amid hopes that governments around the world may increase policy support to revive economic growth. Such measures could potentially lift fuel demand.

Brent crude futures increased by $0.09, or 0.12%, to $76.02 per barrel.

West Texas Intermediate (WTI) crude futures increased $0.01, or 0.01%, to $73.12 per barrel by [2:00 pm] PST.

Both contracts are on track for their second weekly increase after investors returned from holidays, improving trade liquidity.

Factory activity in Asia, Europe, and the U.S. ended 2024 on a soft note, as Reuters reported.

Expectations for the New Year soured due to growing trade risks from Donald Trump's impending return to the U.S. presidency and China's fragile economic recovery.

"The December PMIs for Asia were a mixed bag", Capital Economics analysts said in a note, referring to purchasing managers' indexes data published on Thursday.

However, we continue to expect manufacturing activity and GDP growth in the region to remain subdued in the near term", Capital Economics analysts further added.

"With growth set to struggle and inflation below target in most countries, we think central banks in Asia will continue to loosen policy."

Lower interest rates should spur more economic growth and likely lead to higher fuel consumption.

Investors are eyeing further interest rate cuts by the Federal Reserve this year to support the U.S. economy, while China's President Xi Jinping has pledged more proactive policies to promote growth.

"As China's economic trajectory is poised to play a pivotal role in 2025, hopes are pinned on government stimulus measures to drive increased consumption," said StoneX analyst Alex Hodes.

"These measures are expected to bolster oil demand growth in the months ahead," Hodes added.

Reuters further added that the market is also looking to upcoming crude prices from top oil exporter Saudi Arabia.

Saudi Arabia may raise crude prices for Asian buyers in February for the first time in three months, tracking gains in Middle East benchmark prices last month, traders said.

In the U.S., the world's biggest oil consumer, gasoline and distillate inventories jumped last week as refineries ramped up output, though fuel demand hit a two-year low.

Crude stockpiles fell less than expected, down 1.2 million barrels to 415.6 million barrels last week compared with analysts' expectations for a 2.8 million barrel draw.

Traders are paying close attention to recent weather forecasts as expectations of a cold snap in the U.S. and Europe over the coming weeks could boost demand for diesel.

The cold snap is expected to increase the use of diesel as a substitute for natural gas for heating.

Investors are also bracing for Trump's presidency ahead of his Jan. 20 inauguration.

"Trump's tariffs on China and their impact on global demand patterns will be central to oil prices in 2025," said Priyanka Sachdeva, senior market analyst at Phillip Nova.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,570.00 | 123,615.00 118,675.00 |

2040.00 1.72% |

| BRENT CRUDE | 69.03 | 71.53 69.02 |

-1.33 -1.89% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.83 | 69.65 66.80 |

-1.62 -2.37% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|