Oil prices slip despite escalating Middle-East conflict

MG News | April 17, 2024 at 10:28 AM GMT+05:00

April 17, 2024 (MLN): Oil prices edged lower on Wednesday despite the escalating tensions in the Middle-East, with traders speculating that the conflict would not escalate further.

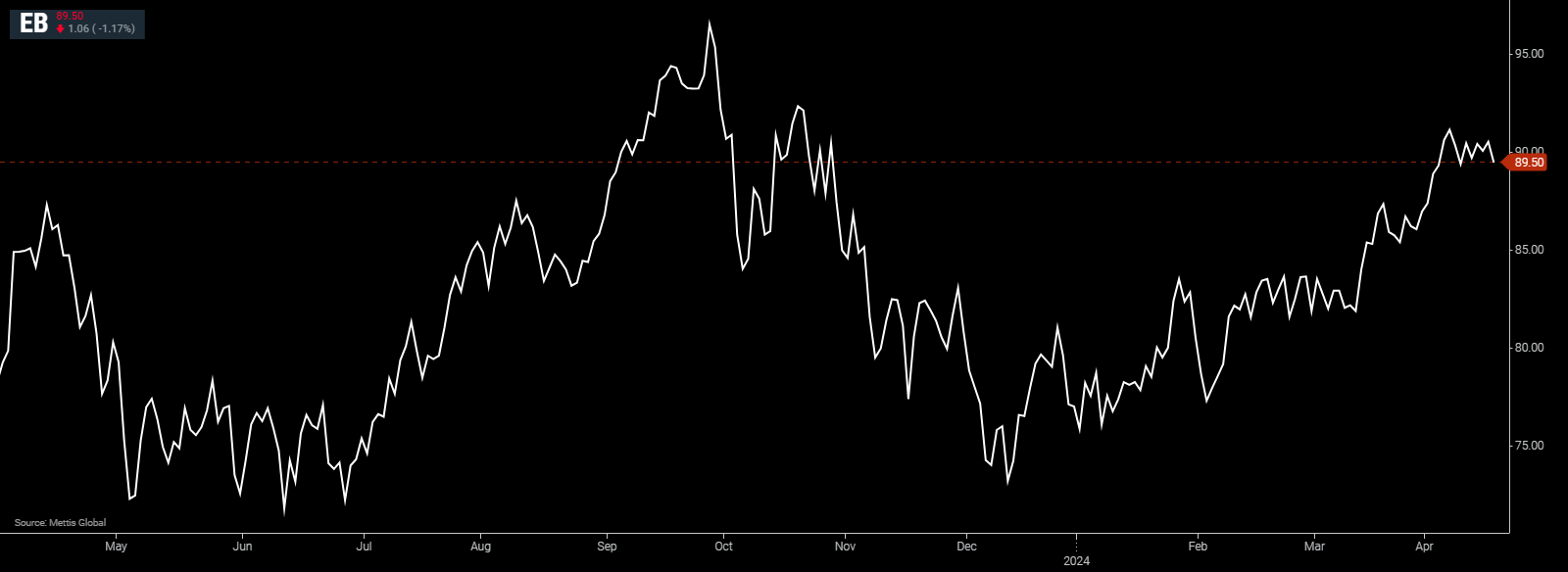

Brent crude traded near $89.5 per barrel, down by 0.58% on the day.

While West Texas Intermediate crude (WTI) was at $84.81 per barrel, down by 0.64% on the day.

Israel has vowed to respond against Tehran for the unprecedented drone and missile attack, although the US and Europe have urged restraint, as Bloomberg reported.

Crude has surged this year as geopolitical risks in the Middle East and Russia, as well as OPEC+ output cuts, combined to push prices higher.

Fresh comments on Tuesday from Federal Reserve Chair Jerome Powell, however, signaled that policymakers will wait longer than previously anticipated to cut US interest rates. That’s likely to be a headwind for wider energy demand.

While headline price movements are muted, oil options markets are flashing warnings.

Bullish call options are trading near the widest premium to opposing puts since October, when the Israel-Hamas war began, as trading volumes of calls soar, said Bloomberg.

Traders piled into over 3 million barrels worth of options contracts in a bet that US oil would spike to $250 a barrel by June.

“Our base case is one where tensions remain contained, avoiding a wider conflict that disrupts oil supply,” said Han Zhong Liang, investment strategist at Standard Chartered Plc.

Iran’s apparent restraint, with its statement that the matter was concluded, as well as diplomatic efforts between Israel and its allies may mean that “any such geopolitical risk premium is likely to be small,” Han added.

Stockpiles were also in focus after the American Petroleum Institute reported a rise of more than 4m barrels in nationwide US inventories last week, although gasoline levels declined, according to people familiar with the figures.

Official data are due later Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves