Oil prices rise amid lower US inflation data

MG News | December 23, 2024 at 11:46 AM GMT+05:00

December 23, 2024 (MLN): Oil prices rose on Monday as lower-than-expected U.S. inflation data revived hopes for further policy easing, although the outlook for a supply surplus next year weighed on the market.

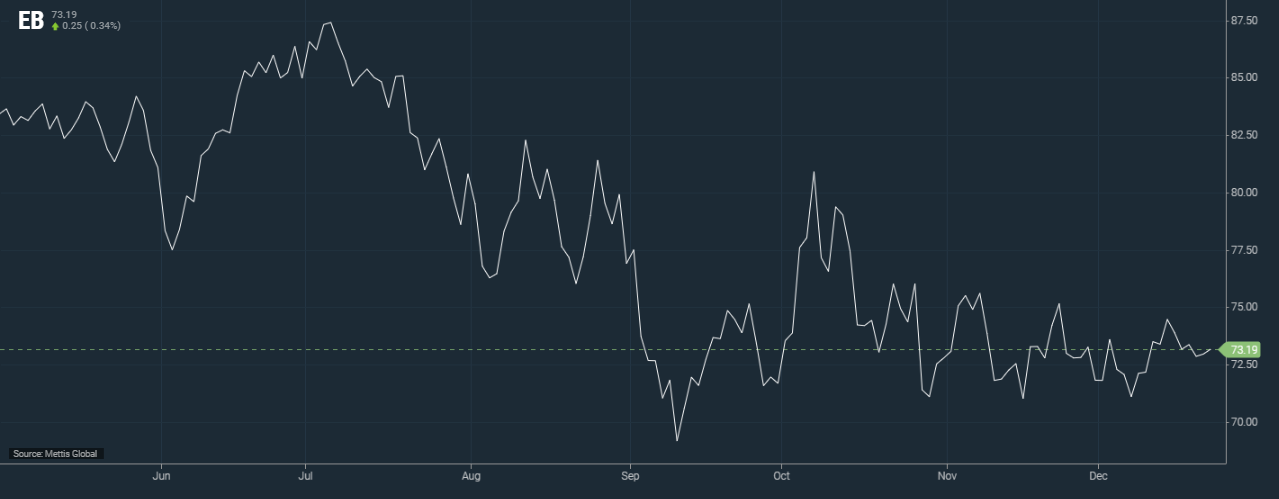

Brent crude futures up by 0.25, or 0.34%, to $73.19 per barrel.

West Texas Intermediate (WTI) crude futures increased $0.33, or 0.48%, to $69.79 per barrel by [11:40am] PST.

"Risk assets, including U.S. equity futures and crude oil, have started the week on a firmer footing," IG Markets analyst Tony Sycamore said.

He added that cooler inflation data helped alleviate concerns following the Federal Reserve's hawkish rate cut, as Reuters reported.

"I think the U.S. Senate passing legislation to end the brief shutdown over the weekend has helped," he said.

Both oil benchmarks fell more than 2% last week on concerns about global economic growth and oil demand after the U.S. central bank signalled caution over further easing of monetary policy.

Research from Asia's top refiner Sinopec pointing to China's oil consumption peaking in 2027 also weighed on prices.

Money managers raised their net-long U.S. crude futures and options positions in the week to Dec. 17, the U.S. Commodity Futures Trading Commission (CFTC) said on Friday.

Concerns about European supply eased on reports that the Druzhba pipeline, which sends Russian and Kazakh oil to Hungary, Slovakia, the Czech Republic, and Germany, has restarted.

The pipeline had halted on Thursday due to technical problems at a Russian pumping station.

Some of Rio Tinto's investors want to unify the miner's corporate structure.

Shipments resumed on Saturday, according to Belarus' BelTa state news agency. On Sunday, Hungarian Foreign Minister Peter Szijjarto said supplies on Druzbha to the country had restarted.

Before the halt, the pipeline was shipping 300,000 barrels per day of crude.

U.S. President Donald Trump on Friday urged the European Union to increase U.S. oil and gas imports or face tariffs on the bloc's exports.

The European Commission said it was ready to discuss with Trump how to strengthen what it described as an already strong relationship, including in the energy sector.

Trump also threatened to reassert U.S. control over the Panama Canal on Sunday, accusing Panama of charging excessive rates to use the Central American passage.

This drew a sharp rebuke from Panamanian President Jose Raul Mulino.

In the U.S., the number of operating oil rigs were up one to 483 last week, the highest since September, Baker Hughes reported on Friday.

Macquarie analysts projected a growing supply surplus for next year, which will weigh down Brent prices.

They expect the average price to be $70.50 a barrel, down from this year's average of $79.64 a barrel, according to a December report.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction