Oil prices rise ahead of OPEC+ decision amid global tensions

MG News | December 04, 2024 at 05:01 PM GMT+05:00

December 04, 2024 (MLN): Global oil prices rose on Wednesday, with traders expecting OPEC+ to announce an extension to supply cuts this week while heightened geopolitical tensions continue to dominate market sentiment.

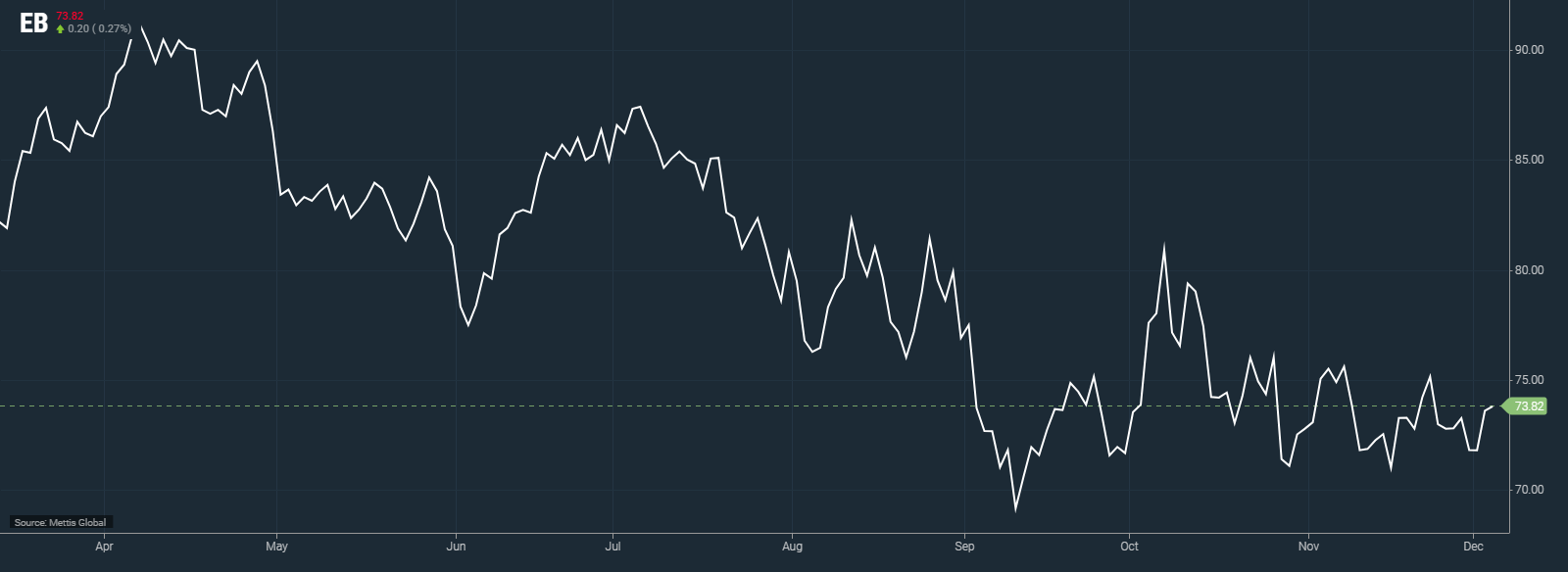

Brent crude traded near $73.82 a barrel, increased 0.27% ($0.20) on the day.

While West Texas Intermediate crude (WTI) was at $70.11 per barrel, up by 0.24% ($0.17)

A shaky ceasefire between Israel and Hezbollah, South Korea's curtailed declaration of martial law, and a rebel offensive in Syria that threatens to involve forces from several oil-producing countries all supported oil prices.

Priyanka Sachdeva, senior market analyst at Phillip Nova, highlighted these factors as key drivers behind the recent rise in oil prices, according to Reuters.

In the Middle East, Israel said on Tuesday that it would return to war with Hezbollah if their truce collapses and that its attacks would go deeper into Lebanon and target the state itself.

In South Korea, lawmakers have submitted a bill to impeach President Yoon Suk Yeol following his declaration of martial law on Tuesday, which was reversed within hours.

The incident has sparked a political crisis in Asia's fourth-largest economy.

However, the bullish momentum hasn't pushed crude past the $75 resistance, indicating market sensitivity to geopolitical and economic developments may be waning, said Dilin Wu, research strategist at Pepperstone.

"With OPEC+ widely expected to extend its 2.2 million barrels per day voluntary production cut into the first quarter of 2025, prices are likely to stay range-bound unless a new catalyst emerges," Wu said.

The Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, are likely extend output cuts until the end of the first quarter next year when members meet on Thursday, Reuters added.

OPEC+ has been looking to phase out supply cuts through next year.

"Neither geopolitics and OPEC+ action nor sanguine financial data will alter the underlying fundamental outlook," said PVM oil analyst Tamas Varga.

"Protracted attempts to push oil towards $80 a barrel will be reined in by supply checks and loose oil balances.", he further added.

US crude oil inventories rose 1.2mn barrels last week, market sources said, citing data from the American Petroleum Institute.

Gasoline stocks also rose, by 4.6mn barrels, even though the week included Thanksgiving, when demand typically rises.

Official data on oil stocks from the U.S. Energy Information Administration is due on Wednesday at 10:30 a.m. ET (1530 GMT).

Analysts polled by Reuters expect crude stocks to decline by 700,000 barrels and gasoline stocks to rise by 639,000 barrels.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction