Oil prices drop amid OPEC+ output increase, U.S. tariff concerns

MG News | March 04, 2025 at 11:27 AM GMT+05:00

March 04, 2025 (MLN): Oil prices extended losses on Tuesday following reports that OPEC+ will proceed with a planned output increase in April while markets braced for U.S. tariffs on Canada, Mexico and China to take effect.

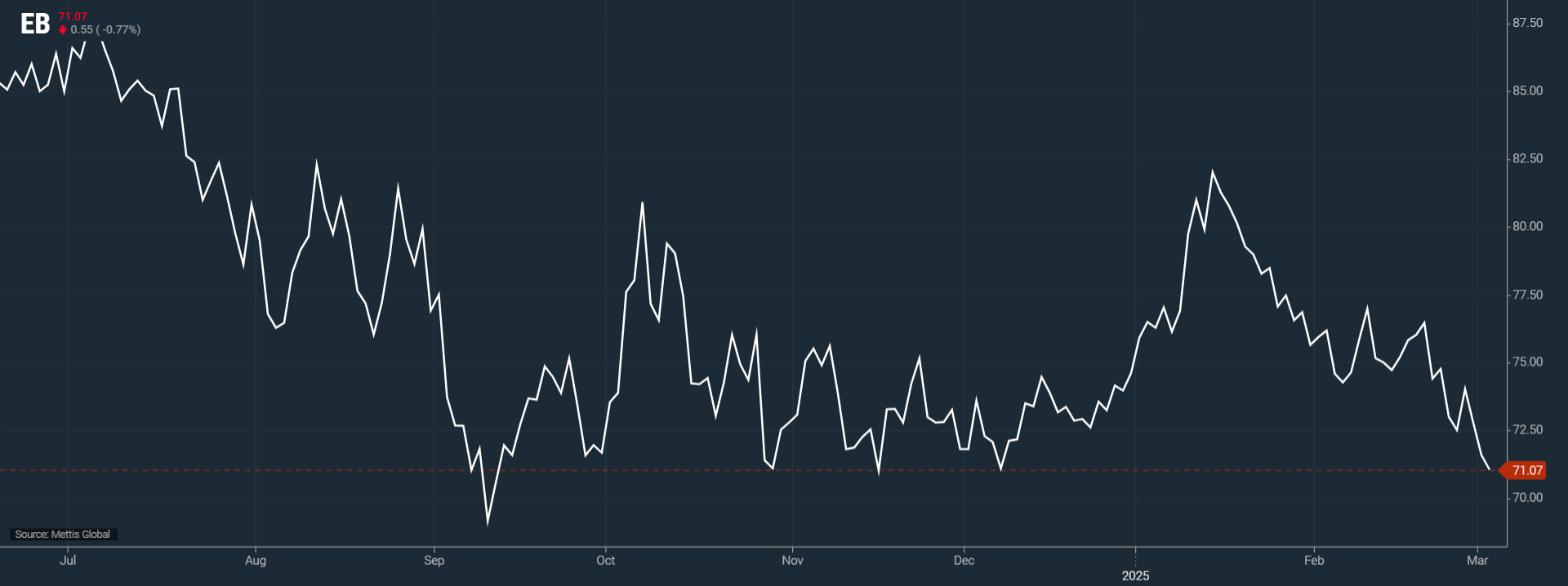

Brent crude futures decreased by $0.55, or 0.77%, to $71.07 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.41, or 0.60%, to $67.96 per barrel by [11:25 am] PST.

"The current downward trend in oil prices is primarily driven by OPEC+'s decision to increase output and the introduction of U.S. tariffs," said Darren Lim, commodities strategist at Phillip Nova.

A further complicating factor was geopolitical developments related to the Russia-Ukraine conflict, he added.

Trump's pause in all U.S. military aid to Ukraine followed his Oval Office clash with President Volodymyr Zelenskiy last week, as Reuters reported.

The Organization of the Petroleum Exporting Countries (OPEC) and allies like Russia, known as OPEC+, decided to proceed with a planned April oil output increase of 138,000 barrels per day, the group's first since 2022.

"While this decision aims to gradually unwind previous output cuts, it has raised concerns about a potential oversupply in the market," said Lim.

U.S. President Donald Trump's 25% tariffs on imports from Canada and Mexico are set to take effect at 12:01 a.m. EST (0501 GMT) on Tuesday with 10% tariffs for Canadian energy, while imports on Chinese goods will increase to 20% from 10%.

Analysts expect the tariffs to weigh on economic activity and fuel demand, putting downward pressure on oil prices.

"Market participants are struggling to gauge the impact of the flood of energy-related policy announcements made by the Trump administration this month," BMI analysts wrote in a note.

"However, those weighing to the downside, notably U.S. tariff measures, are currently winning out."

Further weighing on oil was Trump's halt of military aid to Ukraine, as the market has viewed the growing distance between the White House and Ukraine as a sign of a potential easing of the conflict.

That in turn could lead to sanctions relief for Russia, with more oil supply returning to the market.

The pause followed a Reuters report that the White House has asked the State and Treasury departments to draft a list of sanctions that could be eased for U.S. officials to discuss during talks with Moscow, sources have said.

However, Goldman Sachs analysts say Russia's oil flows are constrained more by its OPEC+ production target than sanctions, warning that an easing might not boost them significantly.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,510.00 | 119,440.00 118,145.00 | 215.00 0.18% |

| BRENT CRUDE | 72.93 | 73.17 71.75 | 0.42 0.58% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.66 | 69.79 68.45 | 0.45 0.65% |

| SUGAR #11 WORLD | 16.43 | 16.58 16.37 | -0.16 -0.96% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|