Oil prices rise on hopes of global trade progress

MG News | July 29, 2025 at 03:28 PM GMT+05:00

July 29, 2025(MLN): Oil prices extended gains on Tuesday, buoyed by optimism

over a U.S.-EU trade agreement, the possibility of a U.S.-China tariff truce,

and President Donald Trump’s shortened deadline for Russia to resolve the

Ukraine conflict.

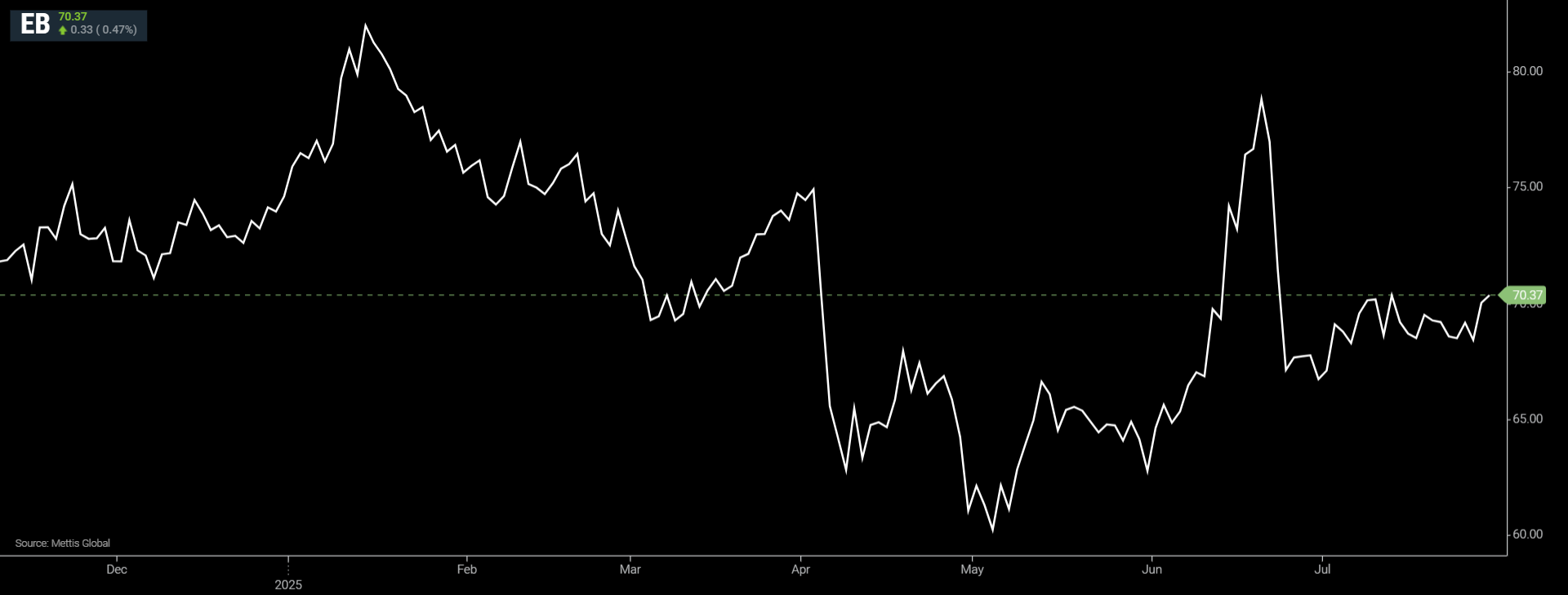

Brent crude futures increased by $0.33, or 0.47%, to $70.37 per

barrel.

West Texas Intermediate (WTI) crude futures

rose by $0.38, or 0.57%, to $67.09 per barrel by [3:25 pm]

PST.

The market was buoyed by easing global trade tensions and

renewed geopolitical concerns.

The recent U.S.-EU trade agreement, which includes a 15%

import tariff on most European goods, helped avert a broader trade war that

could have disrupted nearly one-third of global trade and weakened fuel demand.

Sentiment was further lifted by signs of progress in

U.S.-China trade relations.

Senior economic officials from both nations held over five

hours of talks in Stockholm on Monday, with negotiations expected to continue

on Tuesday—raising hopes of a potential extension to the current tariff truce.

Geopolitical tensions also played a role in supporting oil

prices. On Monday, former President Donald Trump issued a fresh ultimatum,

giving Russia "10 or 12 days" to show progress in ending the war in

Ukraine or face new sanctions.

He also threatened penalties on both Russia and its energy

buyers, as CNBC reported.

These developments added to concerns over disruptions in

Russian oil supply, especially following the EU’s latest sanctions package,

which includes a tighter price cap on Russian crude and restrictions on

importing refined products made with Russian oil.

“Trump’s comments reignited fears that Russia’s oil flows

would be impacted,” noted Daniel Hynes, senior commodity strategist at ANZ.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,365.00 | 69,740.00 66,530.00 | -2115.00 -3.04% |

| BRENT CRUDE | 83.34 | 85.12 78.38 | 5.60 7.20% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 139.05 | 139.50 129.00 | 20.25 17.05% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.26 | 77.58 70.41 | 5.03 7.06% |

| SUGAR #11 WORLD | 14.14 | 14.20 13.94 | 0.23 1.65% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance