Oil prices dip further as Fed signals caution on interest rate cuts

MG News | May 21, 2024 at 11:02 AM GMT+05:00

May 21, 2024 (MLN): Global oil prices fell for the second consecutive session amid fears of higher rates after U.S. Federal Reserve officials stated they were awaiting more signs of slowing inflation before considering interest rate cuts.

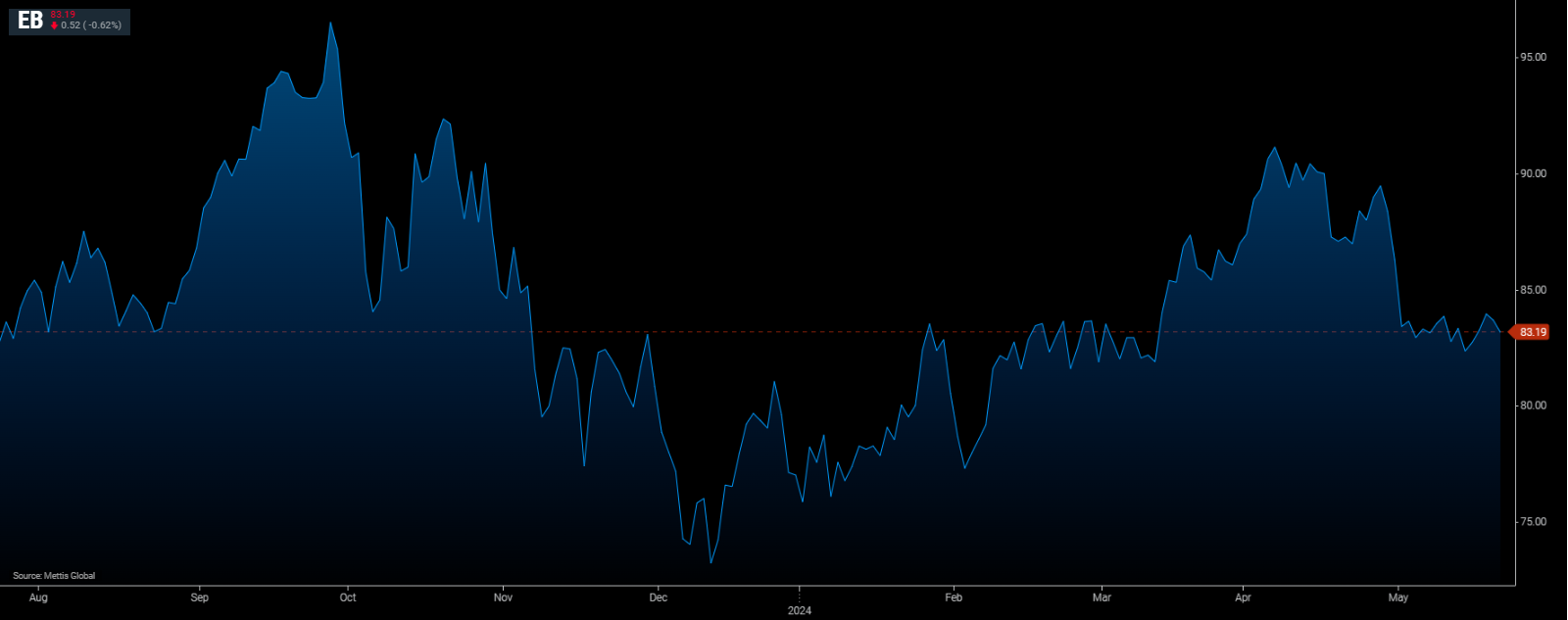

Brent crude traded near $83 per barrel, down by 0.39% on the day. Last week it gained 1.45%.

While West Texas Intermediate crude (WTI) was at $78.73 per barrel, down by 0.38% on the day.

"Fears of weaker demand led to selling as the prospect of Fed rate cut became more distant," said analyst Toshitaka Tazawa at Fujitomi Securities, as Reuters reported.

Fed Vice Chair Philip Jefferson said on Monday it was too early to tell whether the inflation slowdown is "long-lasting," while Vice Chair Michael Barr said the restrictive policy needs more time.

Atlanta Fed President Raphael Bostic said it will "take a while" for the central bank to be confident that a price growth slowdown is sustainable.

Lower interest rates reduce borrowing costs, freeing up funds that could boost economic growth and demand for oil.

On the other hand, the market appeared little affected by political uncertainty in two major oil-producing countries.

"While there has been an up move over some uncertainty in Iran, prices have since pared back some gains, as investors price for the status quo in terms of policies for now and that any wider regional conflict remains off the table," IG market strategist Yeap Jun Rong said in an email to Reuters.

Iranian President Ebrahim Raisi, a hardliner and potential successor to Supreme Leader Ayatollah Ali Khamenei, was killed in a helicopter crash, while Saudi Arabia's Crown Prince Mohammed Bin Salman deferred a trip to Japan because of the health of his father, the king.

"The death of the Iranian President and the Saudi king's health issue don't seem to be affecting the market much, as it is unclear whether they will have an immediate impact on energy policy," Fujitomi's Tazawa said.

Investors are focusing on supply from the Organization of the Petroleum Exporting Countries and its affiliates, together known as OPEC+. They are scheduled to meet on June 1 to set output policy, including whether to extend some members' 2.2 million barrels per day of voluntary cuts.

"Prices remain in wait for a catalyst to drive a breakout of the current range, with eyes still on any geopolitical developments, along with oil inventories data this week," Yeap said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SCRA Balance

SCRA Balance