Oil prices dip after previous session’s surge

MG News | March 13, 2025 at 11:47 AM GMT+05:00

March 13, 2025 (MLN): Oil prices slipped on Thursday after a surge in the previous session on a larger-than-expected draw in U.S. gasoline stocks, as markets weighed macroeconomic concerns against firm near-term demand.

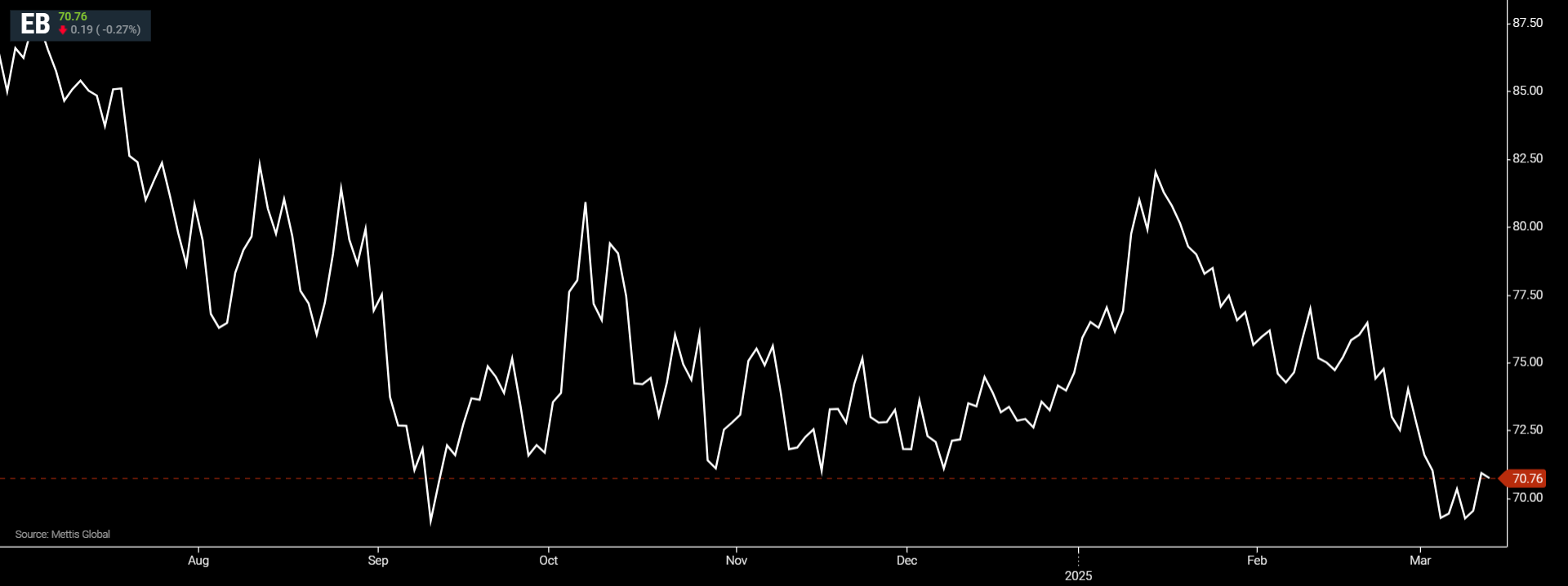

Brent crude futures decreased by $0.19, or 0.27%, to $70.76 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.26, or 0.38%, to $67.42 per barrel by [11:45 am] PST.

U.S. gasoline inventories fell by 5.7 million barrels, more than the 1.9m barrel draw expected by analysts, while distillate stocks also dropped more than anticipated despite gains in crude stocks.

"Declining U.S. gasoline inventories raised expectations for a seasonal demand increase in spring, but concerns about the global economic impact of tariff wars weighed on the market," said Hiroyuki Kikukawa, chief strategist of Nissan Securities Investment.

"With strong and weak factors progressing simultaneously, it has become difficult for the market to lean decisively in one direction or the other," he added.

Donald Trump threatened on Wednesday to escalate a global trade war with further tariffs on European Union goods, as major U.S. trading partners said they would retaliate for trade barriers already erected by the U.S. president.

Trump's hyper-focus on tariffs has rattled investors, consumers and business confidence and raised U.S. recession fears.

Meanwhile, the Organization of the Petroleum Exporting Countries said on Wednesday that Kazakhstan led a sizeable jump in February crude output by the wider OPEC+.

This highlights a challenge for the producer group in enforcing adherence to agreed output targets, as Reuters reported.

Worries about fumbling jet fuel demand weighed further on markets, JP Morgan analysts said.

They added that U.S. Transportation Security Administration data showed passenger volumes for March have decreased by 5% year-over-year, following stagnant traffic in February.

However, firm demand expectations limited overall market weakness.

Signs of robust U.S. demand and Ukraine's deployment of 377 drones targeting Russian energy infrastructure and military installations supported prices, said JP Morgan analysts in a client note.

"As of March 11, global oil demand averaged 102.2m barrels per day, expanding 1.7m barrels per day year-over-year and exceeding our projected increase for the month by 60,000 barrels per day," they added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,585.00 | 119,440.00 118,220.00 | 290.00 0.25% |

| BRENT CRUDE | 72.76 | 73.17 71.75 | 0.25 0.34% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.49 | 69.79 68.45 | 0.28 0.40% |

| SUGAR #11 WORLD | 16.40 | 16.58 16.37 | -0.19 -1.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|