Oil prices climb on U.S. efforts to curb exports

MG News | March 26, 2025 at 12:06 PM GMT+05:00

March 26, 2025 (MLN): Oil prices edged higher on Wednesday on supply concerns with the U.S. stepping up efforts to limit Venezuelan and Iranian oil exports, while a bigger-than-expected drop in U.S. crude inventories also lent support.

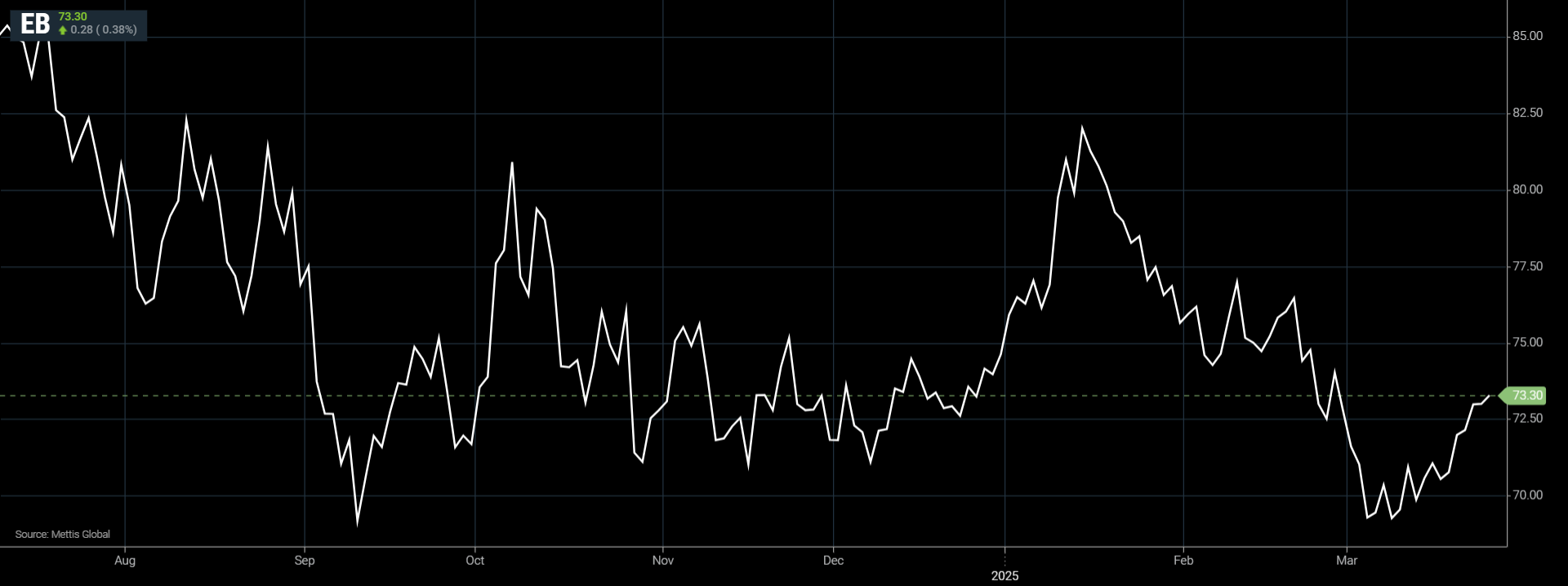

Brent crude futures increased by $0.28, or 0.38%, to $73.3 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.32, or 0.46%, to $69.32 per barrel by [12:00 pm] PST.

Both contracts hit their highest in three weeks in the previous session.

"Crude oil prices maintain their bullish bias after Trump's sanctions on Venezuelan oil, raising supply-side concerns," Priyanka Sachdeva, a senior market analyst at Phillip Nova, wrote in a market commentary on Wednesday.

On Monday Trump signed an executive order authorizing his administration to impose blanket 25% tariffs under the 1977 International Emergency Economic Powers Act on imports from any country that buys Venezuelan crude oil and liquid fuels.

Oil is Venezuela's main export. China, already a target of U.S. import tariffs, is its largest buyer, as Reuters reported.

Trade of Venezuelan oil to top buyer China stalled on Tuesday, as Chinese traders and refiners said they were waiting to see how the order would be implemented and whether Beijing would direct them to stop buying.

Washington last week also imposed a new round of sanctions on Iran's oil sales targeting entities including Shouguang Luqing Petrochemical, a "teapot," or independent refinery in east China's Shandong province, and vessels that supplied oil to such plants in China, the top buyers of Iranian crude.

The market was also buoyed by American Petroleum Institute data that showed U.S. crude inventories fell by 4.6 million barrels last week, a sign of healthy demand for fuel in the world’s largest economy.

Analysts polled by Reuters were expecting a decline of 1m barrels.

Official U.S. government data on crude inventories is due on Wednesday.

The upswing in oil prices is a temporary phenomenon, with the potential economic slowdown due to Trump's tariffs keeping a lid on price gains, Phillip Nova's Sachdeva said.

Further capping oil prices, the U.S. reached deals with Ukraine and Russia to pause attacks at sea and against energy targets, with Washington agreeing to push to lift some sanctions against Moscow.

Kyiv and Moscow both said they would rely on Washington to enforce the deals, while expressing scepticism that the other side would abide by them.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile