Oil plunges 6% as Israeli strikes avoid Iran crude facilities

MG News | October 28, 2024 at 04:04 PM GMT+05:00

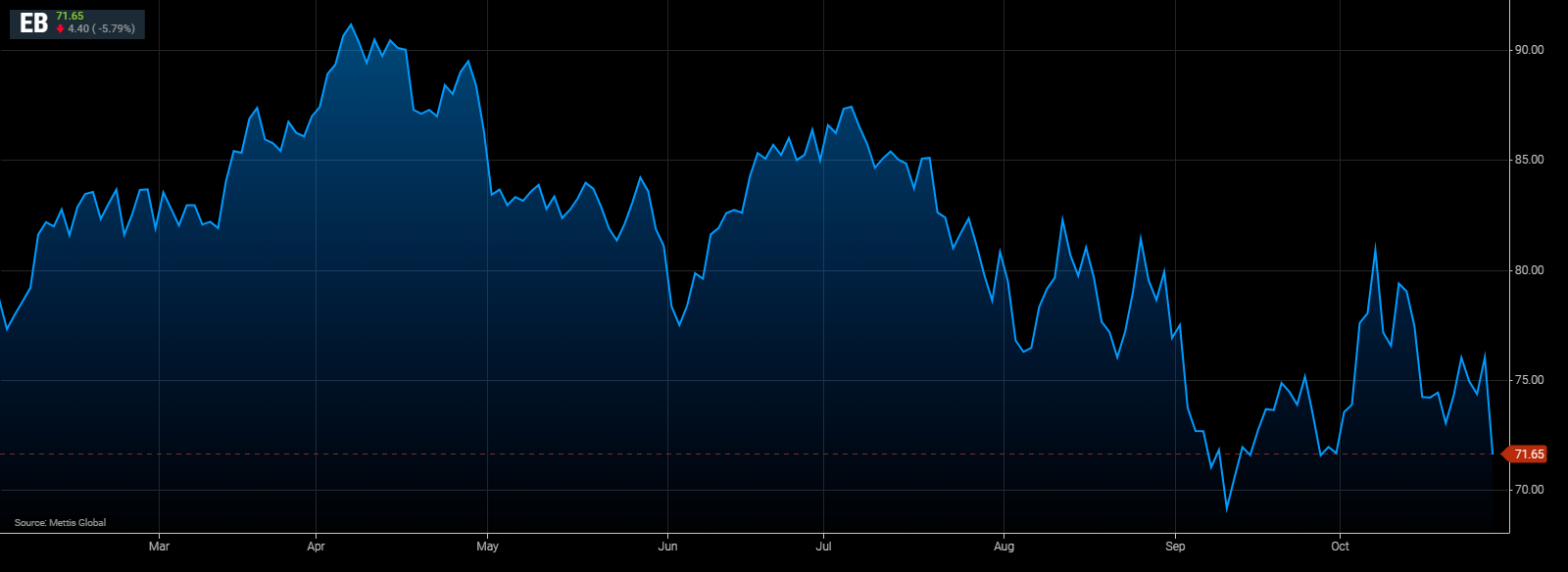

October 28, 2024 (MLN): Oil plunged almost 6% at the start of the week after Israeli strikes against targets in Iran avoided the OPEC member’s crude facilities.

Brent crude traded near $71.65 per barrel, down by 5.79% on the day.

While West Texas Intermediate crude (WTI) was at $67.55 per barrel, down 5.89%.

Israeli jets struck military targets across Iran on Saturday, delivering on a vow to retaliate for a missile barrage at the start of the month, though the attack was more restrained than expected, Bloomberg reported.

The strike avoided oil, nuclear and civilian infrastructure, in line with a request from US President Joe Biden’s administration.

There were signs of the market’s political risk premium fading across the board. In addition to falling prices, bullish options contracts were no longer trading at premiums to bearish ones, as they had done since the aftermath of the Iranian missile attack.

Citigroup Inc. cut its Brent price forecasts, citing lower risks from the conflict in the Middle East.

Iran’s state media said that the country’s oil facilities were working normally, though the country’s foreign ministry said the nature of its response will correspond to the type of attack carried out.

Iran’s missile attack on October 01 restored a war premium to oil that at times pushed the global Brent benchmark above $80 a barrel earlier this month.

Still, prices are almost $20 lower than the first session after the October 07 attack that sparked the conflict last year, as lackluster Chinese demand and expectations of oversupply early next year has pressured prices in recent months.

“We may see further short-term downward pressure as the geopolitical premium is priced out,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “However, we see strong support around $70 and, with last night’s price drop, most of the geopolitical premium is likely already priced out.”

Monday’s slump comes ahead of a crucial few weeks for prices, with a host of influential events looming, including the US election.

OPEC+ plans to start gradually reviving oil production in December, and the market is watching for any change to that timeline.

Though the planned output increase in the near-term is small, it will add supplies to a market that the International Energy Agency forecasts won’t be in need of them.

Key gauges of market strength have also been softening in recent days, though they remain in a bullish backwardation structure, where the nearest contracts trade at a premium relative to later-dated ones.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,935.00 | 119,440.00 118,260.00 | 640.00 0.54% |

| BRENT CRUDE | 71.82 | 73.17 71.75 | -0.69 -0.95% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 68.53 | 69.79 68.45 | -0.68 -0.98% |

| SUGAR #11 WORLD | 16.43 | 16.58 16.42 | -0.16 -0.96% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|