Oil markets react to U.S. tariffs, global demand uncertainty

MG News | March 25, 2025 at 01:13 PM GMT+05:00

March 25, 2025 (MLN): Oil prices were little changed on Tuesday as markets weighed the impact of newly announced U.S. tariffs on countries that buy Venezuelan oil and the uncertain outlook for global demand.

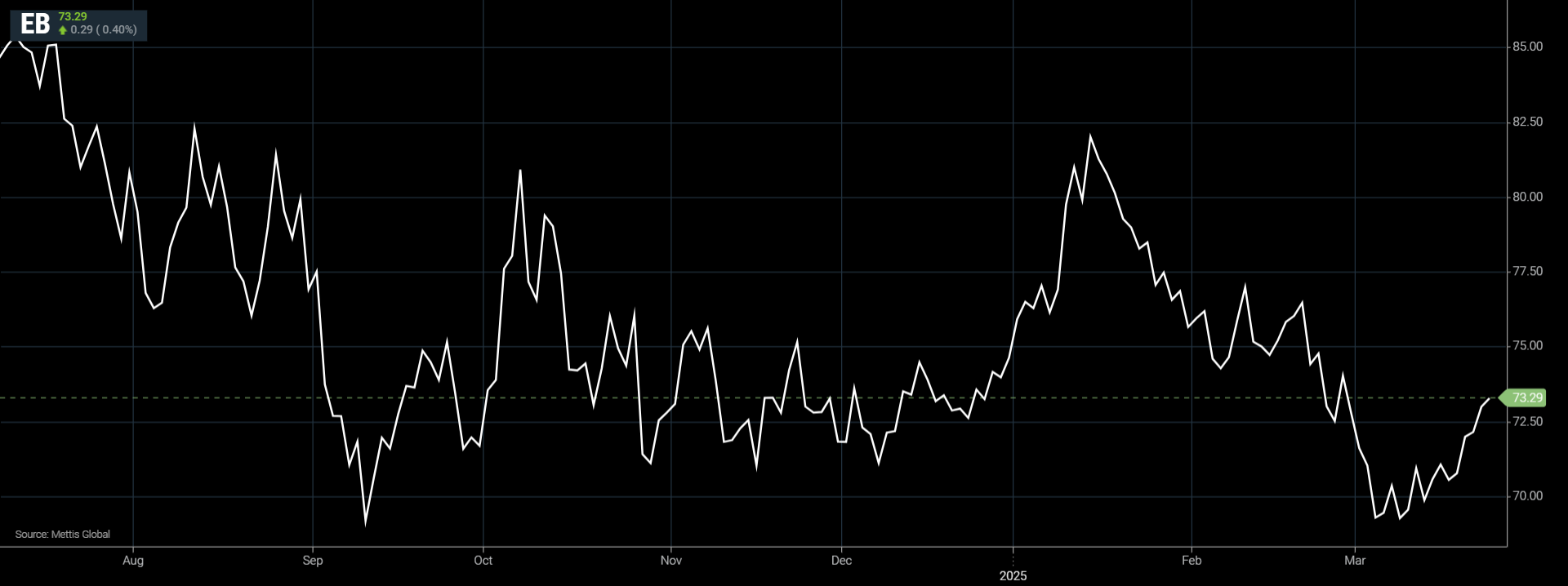

Brent crude futures increased by $0.29, or 0.4%, to $73.29 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.29, or 0.42%, to $69.4 per barrel by [1:05 pm] PST.

Both benchmarks gained more than 1% on Monday after U.S. President Donald Trump announced a 25% tariff on countries importing oil and gas from Venezuela.

Oil is Venezuela's main export and China, which is already the subject of U.S. tariffs, is its largest buyer, as Reuters reported.

"Investors fear Trump's various tariffs could slow the economy and curb oil demand," said Tsuyoshi Ueno, senior economist at NLI Research Institute.

However, the prospect of tighter U.S. sanctions on Venezuelan and Iranian oil constraining supply, along with his swift policy shifts, makes it difficult to take large positions.

"We expect WTI to stay around $70 for the rest of the year, with potential seasonal gains as the U.S. and other countries enter the driving season," he added.

Last week, the U.S. issued new sanctions intended to hit Iranian oil exports.

However, crude eased back from its session highs after the Trump administration also on Monday extended a deadline to May 27 for U.S. producer Chevron to wind down operations in Venezuela.

The withdrawal of Chevron's licence to operate could reduce production in the country by about 200,000 barrels per day, ANZ analysts wrote in a note.

Oil prices were also pressured by economic concerns amid mounting global trade tensions.

Trump also said automobile tariffs are coming soon even as he indicated that not all of his threatened levies would be imposed on April 2 and some countries may get breaks, a move Wall Street took as a sign of flexibility on a matter that has roiled markets for weeks.

Meanwhile, OPEC+, the Organization of the Petroleum Exporting Countries and allies including Russia, will likely stick to its plan to raise oil output for a second consecutive month in May, four sources told Reuters.

This comes amid steady oil prices and plans to force some members to reduce pumping to compensate for past overproduction.

Investors were also monitoring talks to end the war in Ukraine, which could increase supply of Russian crude to global markets.

U.S. and Russian officials wrapped up day-long talks on Monday focused on a narrow proposal for a ceasefire at sea between Kyiv and Moscow, part of a diplomatic effort that Washington hopes will help pave the way for broader peace negotiations.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,585.00 | 119,440.00 118,225.00 | 290.00 0.25% |

| BRENT CRUDE | 72.59 | 73.17 71.75 | 0.08 0.11% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.31 | 69.79 68.45 | 0.10 0.14% |

| SUGAR #11 WORLD | 16.37 | 16.58 16.37 | -0.22 -1.33% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|