Oil gains on rising demand, trade war delay

MG News | February 14, 2025 at 03:19 PM GMT+05:00

February 14, 2025 (MLN): Oil prices rose on Friday, poised to end three weeks of decline, buoyed by rising fuel demand and expectations that U.S. plans for global reciprocal tariffs would not come into effect until April, giving more time to avoid a trade war.

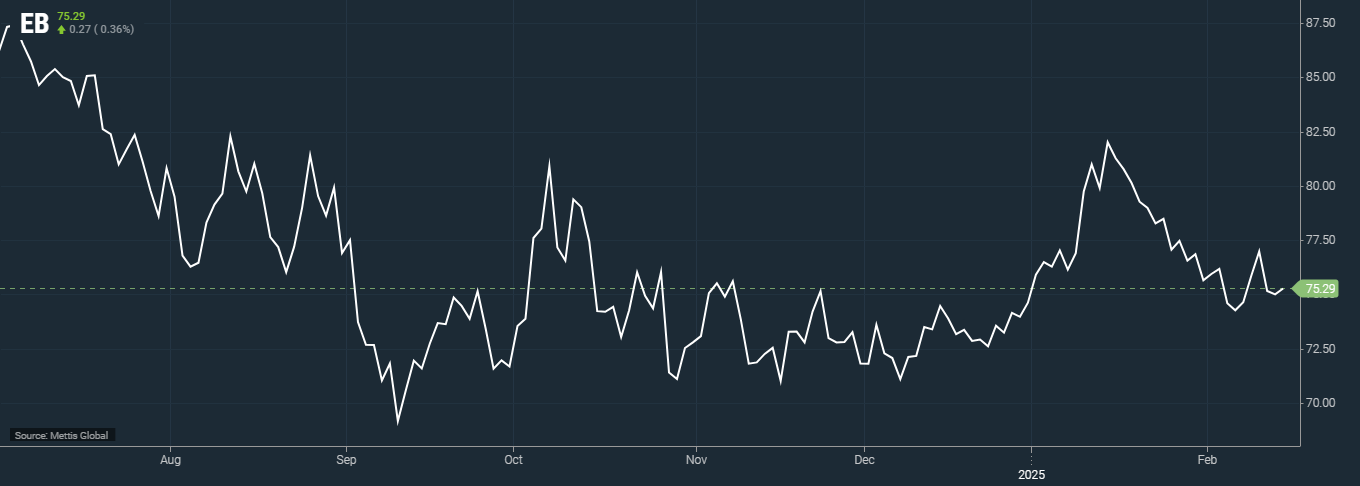

Brent crude futures increased by $0.27, or 0.36%, to $75.29 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.14, or 0.20%, to $71.43 per barrel by [3:15 pm] PST.

U.S. President Donald Trump on Thursday ordered commerce and economics officials to study reciprocal tariffs against countries that place tariffs on U.S. goods and to return their recommendations by April 1.

Positive development on the trade front in light of U.S. tariff delays paves the way for some recovery in oil prices this morning.

The risk environment warms up to the prospects of further trade consensus being reached, said Yeap Jun Rong, a market strategist at IG.

"However, gains in oil prices may seem limited as market participants have to digest the prospects of Russian supplies being brought back on the market amid potential Ukraine-Russia peace talks," Yeap said.

A potential peace deal between Russia and Ukraine kept traders concerned that an end of sanctions on Moscow could boost global energy supplies, as Reuters reported.

Trump ordered U.S. officials this week to begin talks on ending the war in Ukraine after Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskiy expressed a desire for peace in separate phone calls with him.

Russian oil exports could be sustained if workarounds to the latest U.S. sanctions package are found after Russian crude production rose slightly last month, the International Energy Agency (IEA) said in its latest oil market report.

Meanwhile, global oil demand has surged to 103.4 million barrels per day, a 1.4mn bpd increase year-over-year, analysts at JPMorgan said in a report on Friday.

"Initially sluggish, demand for mobility and heating fuels picked up in the second week of February, suggesting the gap between actual and projected demand will soon narrow," JPMorgan said.

"Heating fuel use is expected to rise again. Additionally, soaring gas prices in Europe could prompt a shift from gas to oil, boosting demand."

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,810.00 | 72,235.00 67,615.00 | 3345.00 4.89% |

| BRENT CRUDE | 83.91 | 84.48 81.28 | 2.51 3.08% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 124.00 | 124.00 124.00 | -4.00 -3.13% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.66 | 77.23 74.37 | 2.10 2.82% |

| SUGAR #11 WORLD | 13.99 | 14.04 13.93 | 0.06 0.43% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance