NRL: Strong margins lift profits

By MG News | April 21, 2022 at 12:29 PM GMT+05:00

April 21, 2022 (MLN): National Refinery Limited (NRL) has announced its financial results for 9MFY22 ended March 31, 2022, whereby it has witnessed a fourfold increase in its net profits worth Rs3.67 billion (EPS: Rs45.93) against a net profit of Rs891 million (EPS: Rs11.15) recorded in the same period of last fiscal year.

This bumper profitability is due to improved gross margins amid an increase in economic activities around the world. International oil prices also showed a steady upward trend owing to the rising demand for petroleum products.

According to the financial statement sent to PSX, the company witnessed a jump in net revenue from contracts with customers by 57%YoY to Rs154bn, which resulted from a decrease in trade discounts offered to the customers, and taxes, duties, and levies.

Consequently, the gross profit margin of the refinery expanded by 3ppt to 6% during 9MFY22.

On the cost side, the major expense side i.e., distribution costs soared by 80% to Rs1.07bn while administrative expenses saw a 5% increase to Rs692mn during the said period.

Meanwhile, the financial cost of the company observed a 30x YoY upsurge to Rs4.68bn during the review period, affecting the financial health of the company. An increase in the policy rate by the central bank might be one of the reasons behind this increase in financial costs whereas non-core expenses ballooned by 74% to Rs215mn.

Notably, the company saw a significant uplift to the bottom line in the form of a tax credit worth Rs1.28bn received during 9MFY22 against Rs892mn tax paid in the same period last fiscal year.

|

Profit and Loss Account for the nine months ended March 31, 2022 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Mar-22 |

Mar-21 |

% Change |

|

Revenue from contracts with customers |

178,001,765 |

145,283,529 |

22.52% |

|

Trade discounts, taxes, duties, levies and price differentials |

(23,747,293) |

(47,178,076) |

-49.66% |

|

Net revenue from contracts with customers |

154,254,472 |

98,105,453 |

57.23% |

|

Cost of sales |

(145,404,512) |

(95,445,576) |

52.34% |

|

Gross Profit |

8,849,960 |

2,659,877 |

232.72% |

|

Distribution cost |

(1,065,429) |

(591,051) |

80.26% |

|

Administrative expenses |

(691,803) |

(658,861) |

5.00% |

|

Other income |

193,583 |

279,263 |

-30.68% |

|

Other operating expenses |

(215,452) |

(123,807) |

74.02% |

|

Operating profit |

7,070,859 |

1,565,421 |

351.69% |

|

Finance cost-net |

(4,680,514) |

(155,467) |

2910.62% |

|

Profit before taxation |

2,390,345 |

1,409,954 |

69.53% |

|

Taxation |

1,282,398 |

(518,338) |

- |

|

Profit after taxation |

3,672,743 |

891,616 |

311.92% |

|

Earnings per share - basic and diluted (rupees) |

45.93 |

11.15 |

311.93% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

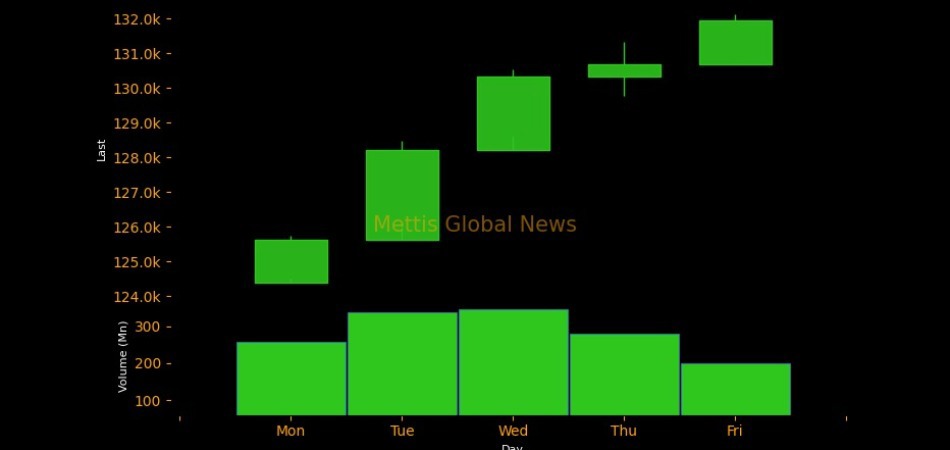

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI