Miserable PKR nosedives by 5.4 rupees against greenback

MG News | May 10, 2023 at 04:18 PM GMT+05:00

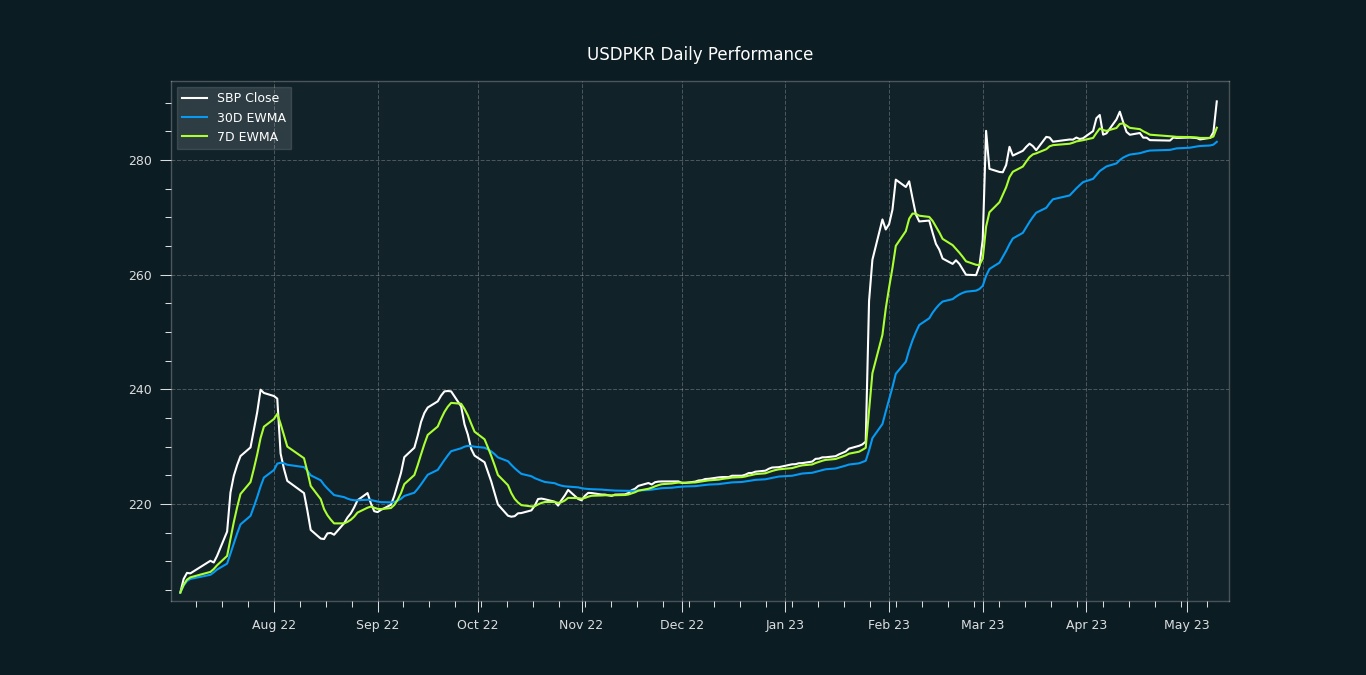

May 10, 2023 (MLN): The political chaos has pushed the Pakistani rupee (PKR) towards the bottomless pit as the currency nosedived by 5.4 rupees against the US dollar in today's interbank session.

Accordingly, the local unit touched a historic low and settled the trade at PKR 290.22 per USD compared to yesterday's closing of PKR 284.84 per USD.

Throughout today’s session, the local unit traded in a band of 5.25 rupees, showing an intraday high bid of 290 and a low offer of 284.9 while in the open market, PKR was traded at 296/298 per USD.

Following the arrest of PTI Chairman Imran Khan, the political landscape o Pakistan has turned into a mess which shattered the confidence of the market in local currency, surging demand for the dollar in the interbank and open markets.

The currency has already been in the doldrums due to weak macros and delay in IMF's tranche. Now, the arrest of Imran Khan has added more fuel to the fire.

With regards to the outlook of PKR, the analyst fraternity is of the view that political stability is the major requirement to restore economic stability which ultimately supports the local unity to get stabilized.

On the economic front, Moody’s Investor Service has warned that Pakistan could default without an International Monetary Fund bailout as its financing options beyond June are uncertain.

Meanwhile, the currency lost 7.3 rupees to the Pound Sterling as the day's closing quote stood at PKR 366.26 per GBP, while the previous session closed at PKR 358.99 per GBP.

Similarly, PKR's value weakened by 5.3 rupees against EUR which closed at PKR 317.97 at the interbank today.

In FYTD, PKR lost 85.37 rupees or 29.42%, while it plummeted by 63.79 rupees or 21.98% against the USD in CYTD. Within the last seven sessions, the local unit moved down by 2.19%, as per data compiled by Mettis Global.

On another note, within the money market, the overnight repo rate towards the close of the session was 20.1%/20.2%, whereas the 1-week rate was 20.6%/20.7%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,000.00 | 119,275.00 117,905.00 | 1380.00 1.17% |

| BRENT CRUDE | 72.41 | 72.82 72.34 | -0.83 -1.13% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.03 | 70.41 69.97 | 0.03 0.04% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|