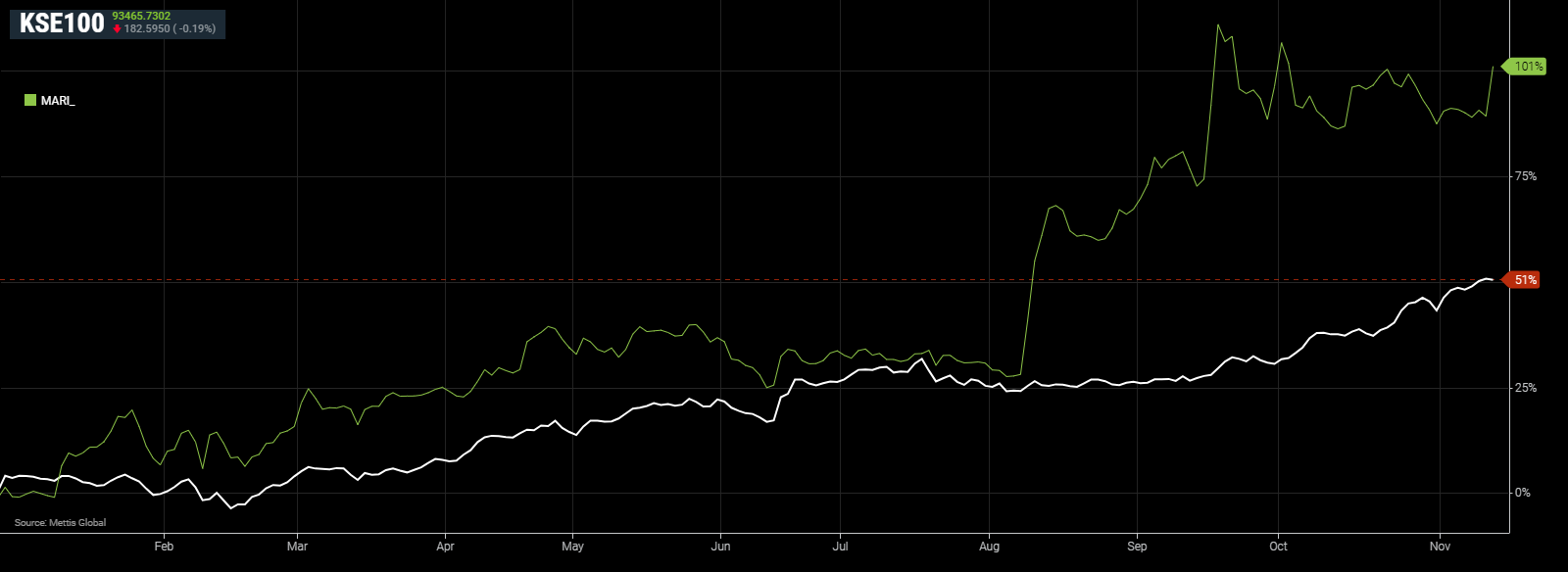

Mari Petroleum expected to rally further: Report

By MG News | November 12, 2024 at 10:59 AM GMT+05:00

November 12, 2024 (MLN): Mari Petroleum Company Limited (MARI) is expected to rally further based on a discounted cash flow (DCF) model that incorporates both the company’s base reserves and implicit exploration option to reflect the company’s future work program, brokerage house KTrade noted in a report.

KTrade Research expects MARI to hit Rs534 per share. That would be again of over 22% from here.

Reserve Replacement Ratio (RRR) of 432% in 2024 has extended reserve life to 17 years – the highest within KTrade Research’s coverage cluster, it said.

RRR over the last five years has averaged over 100% supporting strong cash generation underpinning a focused exploration program over the next 5 years across a high impact license portfolio.

Mari’s gas allocations outside of the network have shielded the company from circular debt exposure and measures to enhance revenue through sustainability initiatives such as carbon offsets and diversification into data centers can provide upside risk to earnings outlook.

“We forecast a 5-year earnings CAGR of about 9% across our forecast range FY25-FY29,” the brokerage house stated.

"Over the past 12 months, MARI has outperformed the broader market by 17% and we believe outperformance is likely to continue as earnings reflect development monetization and reserve additions," it noted.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI