KSE100 in CY21: Full of ups and downs

MG News | January 04, 2022 at 02:41 PM GMT+05:00

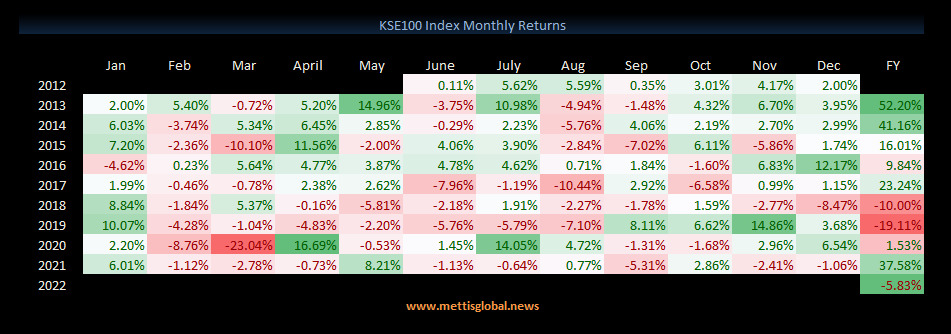

January 4, 2022 (MLN): CY21 has been a very wild and unpredictable year for Pakistan’s stock market due to an uncertain political environment along with the destructive economic situation. As a result, the market ended CY21 with a meagre gain of 2% YoY (down 7.7% in USD terms) to settle at 44,596 points compared to 43,755 points in CY20. In USD terms, the KSE100 return suffered a hit declining by 7.7% YoY as local currency depreciated by 11% during the year.

For Dec’21 alone, the market posted a negative return of 1.1%MoM (1.5% in USD terms), bringing a disappointing end to CY21 as investor’s sentiments were dented by the announcement of a mini-budget where the government levied new taxes of PKR350bn in order to strike a deal with IMF over the revival of $6bn EFF support package.

The year’s performance of the market which clearly fell short of expectations can be divided into two halves. The 1H of CY21 was exceptional for the market as the index rose sharply, posting an 8% return, mainly on the back of reopening of global economies and sooner-than-expected recovery on the macroeconomic front, which translated to the all-time high profitability of listed companies together with a slowdown in COVID-19 infection ratio. Massive Covid-19 vaccination drive played a key role in rejuvenating investors’ sentiments.

On the macroeconomic front, the Current Account remained in surplus in the early part of the year, marked by strengthening of PKR (PKR 153 against USD), robust growth in LSM, rising GDP growth rate, lower CPI reading amid low international commodity prices, unchanged interest rate at 7%, surge in exports and lower imports all contributed to the positive momentum.

However, the jubilation was short-lived as the 2H of CY21 was proven to be weak, corroding all the gains of 1H. The phenomenal increase in international commodities’ prices in 2HCY21 exerted pressure on the country’s import bill which resulted in an increase in the current account and a decline in forex reserves and thus devaluation occurred in PKR against USD which created massive inflation in the country and negatively impacted the stock market. Higher commodity prices posed some serious risks and challenges for the companies as their costs started to elevate substantially thus creating an environment of uncertainty and unpredictability, causing the investors to steer away from equities. Likewise, exits from MSCI also kept the market under pressure as foreigner selling continued till Nov '21.

During the year, the SBP increased the interest rates by 275bps to counter the overheated economy consequently, the rise in government bond yields diverted equity market liquidity towards fixed income. However, the only bright side was that the average volume traded reached 474mn shares a day — the highest in the last 10 years. The average volume traded jumped by 44% in 2021 compared to an average of 330m shares in 2021. While the average daily value traded stood at PKR16,926mn compared to PKR12,262mn average daily value traded during 2020.

In terms of index contribution, the top 3 sectors throughout the year were Technology & Communication, Banks and Fertilizers. These sectors collectively added 1,836 points to the index. On the flipside Cement, Refineries and OMCs took away 1,088 points from the KSE100 Index.

On the basis of sector indices, Technology emerged as the best performing and the only sector that posted a positive return of 47.96% during CY21, attributable to rapid digitalization supported by the Govt. Fertilizer and Commercial banks posted the lowest negative returns of 0.37% and 0.48% respectively. While the worst performing sectors were Pharmaceutical and Auto Assemblers, generating a negative return of 15.59% and 15.51% respectively.

Scrip-wise, SYS, MEBL and EFERT were the best-performing stocks during the year as they added 1,603 points to the index, whereas NRL, OGDC and DGKC took home the unwanted title of worst-performing scrips.

Flow wise, foreigners were the net sellers during CY21, offloading their position by $359mn compared to $571.5mn in CY20. The major sectors which endured the heaviest foreign selling included E&Ps and Banks. Meanwhile, it is important to note that as a result of persistent sell-off from foreign investors, the total ownership of PSX by foreigners contracted to just 15% as opposed to 20% during CY18, a report by AKD Securities cited.

On the local side, the majority of this selling was absorbed by Individuals and Companies amounting to $236mn and $108mn, respectively. However, Brokers and Insurance sectors stood on the other side with net selling of $33mn and $20mn, respectively.

Compared to regional markets, the index underperformed, posting a negative return of 8% in USD terms compared to its regional players like Sri Lanka, India, China etc. The index also undeformed MSCI frontier Market (MSCI FM), which gained 16%. On other hand, MSCI Emerging (MSCI EM) fund was down 5%, a report by Topline Securities underlined.

Outlook:

Raza Jafri, Head of equities at Intermarket Securities, said that IMF programme resumption can trigger the January effect. Since its inception, the KSE-100 has risen 20 out of 30 times in the first month of the year and gained 4% MoM on average, pushing forth the case for the January effect being in play.

“The expected resumption of the IMF programme can trigger better performance at the start of 2022, by extending comfort over the macroeconomic outlook,” he stated.

Flows should also be supportive, as foreign institutional selling is now seemingly behind us (foreign investors ownership is now near trough 2009 levels), while locals have ample room to rotate into equities, he added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves