Int’l scrap reaches 7-year high; rebar prices to rise further in local markets

By MG News | July 06, 2021 at 04:54 PM GMT+05:00

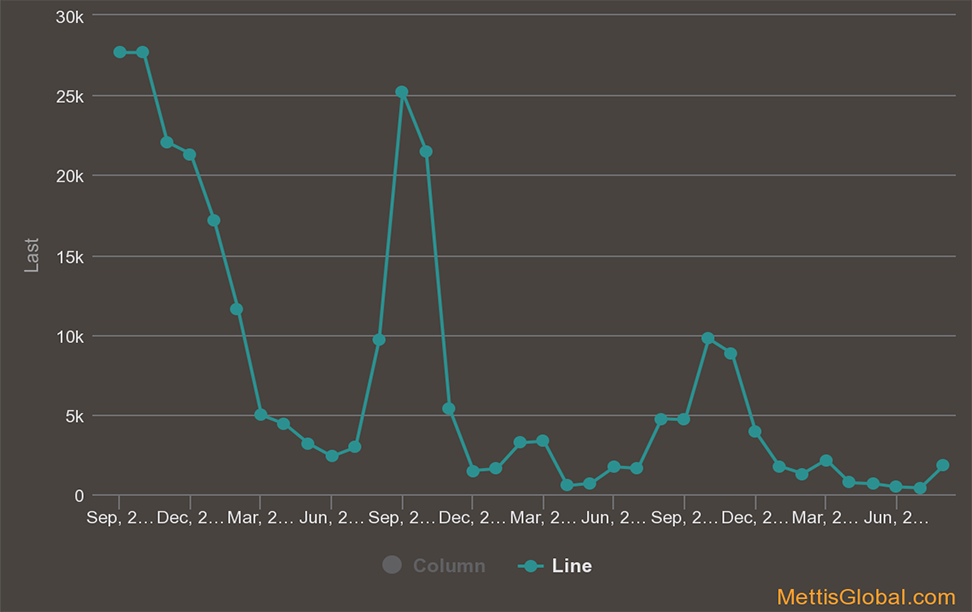

July 06, 2021 (MLN): International scrap prices surged by 22.2% CYTD to stand at $517/mt compared to CY20 avg. of $287/mt in response to demand recovery with economic activity picking up while supply remains restricted. This is the level seen at a 7-year high.

An additional stimulus to scrap prices has been provided by strong rebar demand in China leading the country to lift restrictions on scrap imports after local Chinese scrap prices made multi-year highs, a research report by AKD securities highlighted.

To note, China’s import of scrap for Apr’21 totaled 76.3k tons, 2x of total CY20 scrap imports. Furthermore, the removal of 13% value-added tax (VAT) rebate on 146 steel exports, including rebar and hot-rolled coil while its finance ministry also cut the import duties on raw materials of steel, indicating China’s plan to continue its massive development.

Moving forward, it is expected that demand for scrap will remain upbeat as Chinese EAF players look to enhance capacities due to the decarbonization campaign in China while players in Europe also move towards decreasing carbon footprint, Mohsin Ali, Analyst at AKD said.

On the local front, long steelmakers have enjoyed a surge in demand on the back of various incentives provided in the construction sector package, where the Rs900bn federal PSDP allocation for FY22 will further strengthen the already buoyant demand.

It is prudent to mention that the derived steel demand increased by 18%YoY in FY21 and is slated to grow by 8% in FY22. Consequently, local players were able to manage an increase in input costs (scrap prices up by 90.5% in FY21) through swift pass on as local rebar prices surged by Rs36-40K per ton or up by 36.4% in FY21.

The research estimates suggest current rebar prices of Rs150-151K/ton reflect scrap prices of $450-460/ton —assuming margins to sustain at 1HFY21 levels. Hence, it is expected that rebar prices would go up by at least Rs2-3K/ton (currently standing at Rs150-151K/tons) given scrap prices remain at $500/ton as manufacturers will look to sustain margins. However, if the price increase is delayed, local players might be in for margin attrition in the near term.

The steel companies, particularly Amreli Steel Limited (ASTL), are likely to remain in limelight on the back of the government's continued support towards the construction sector where the commencement of announced PSDP-funded projects is going to contribute towards strong demand to strengthen the cashflows of the company in near future, stimulating investors' interest in the stock.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI