Indus Home Ltd plans backward integration through setting up spinning facility: PACRA

MG News | May 08, 2019 at 12:29 PM GMT+05:00

May 8, 2019 (MLN): VIS Credit Rating Company Limited (VIS) has assigned initial long-term entity rating of ‘A-’ (Single A Minus) and short-term rating of ‘A-2’ (A-Two) to Indus Home Limited (IHL).

Long Term Rating of ‘A-’ signifies good credit quality and adequate protection factors while risk factors may vary with possible changes in the economy.

Short Term Rating of ‘A-2’ indicates good certainty of timely payment; sound liquidity while risk factors are small. Outlook on the assigned ratings is ‘Stable’.

The assigned ratings incorporate strong financial profile of the parent entity and extensive experience of the sponsor in the textile sector.

Ratings also incorporate conservative financial profile of IHL as evident from low leveraged capital structure and strong liquidity profile.

Business risk profile draws support from favourable government policies and increased opportunities for growth. Ratings remain dependent on maintaining low gearing levels and sound debt coverage ratios given sizeable Capex plans over the rating horizon.

Moreover, further strengthening of sales channels and access to end-clients while improving capacity utilization, as planned, are considered important.

Sales have depicted growth in FY18 and in the ongoing year on the back of higher average selling prices.

USA and Europe remain core markets with clients comprising a mix of institutional brokers and direct clients.

Profitability has witnessed improvement in the ongoing year on the back of higher gross margins due to rupee depreciation.

Going forward, management has rolled out a three-year capex plan to enhance operational efficiency and expand business operations. Moreover, the company also plans backward integration of operations through setting up of spinning facility.

The project is expected to come online in 2021. Entire expansion cost is to be financed through concessionary rate long-term financing facility (LTFF).

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

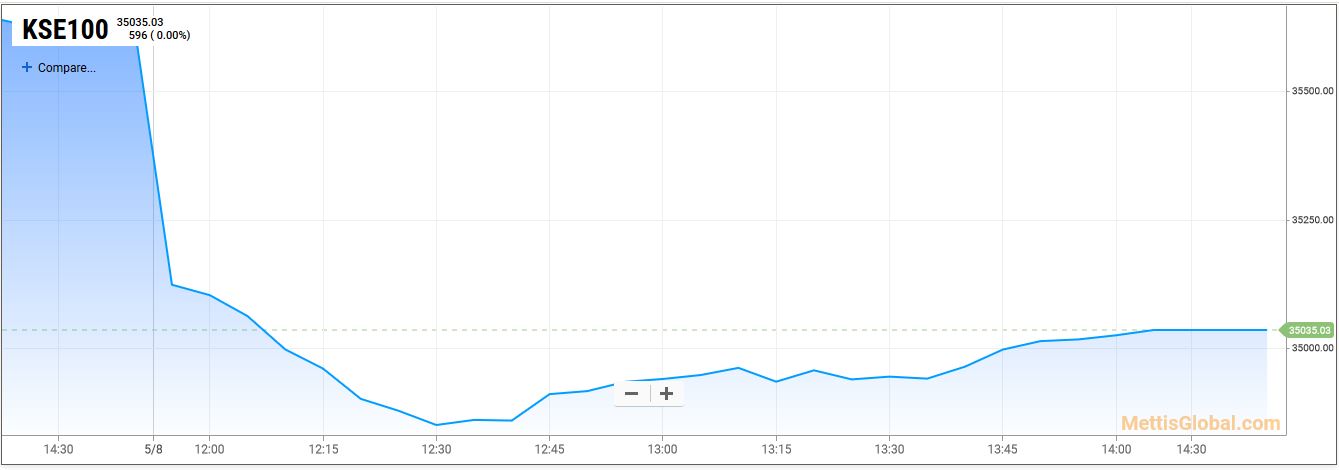

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves