Haroon Akhtar assures to resolve tax issues of business community

By MG News | November 02, 2017 at 04:43 PM GMT+05:00

Prime Minister's Special Assistant on Revenue Haroon Akhtar said that business community was making useful contribution to the development of the economy and assured that he would play role for resolving its tax related issues.

He was talking to a delegation of Islamabad Chamber of Commerce and Industry that called on him led by its President Sheikh Amir Waheed.

Haroon Akhtar said ICCI should send issues of business community in writing and assured that he would look into them for redress. He said all chambers and associations of the country should develop consensus on major issues of private sector and raise a united voice that was the best approach to get the issues addressed. He said government was taking measures to create an investment and business friendly environment so that private sector could play more effective role in the economic development of the country.

He said FBR's role was to improve revenue collection of the country, but he has asked the tax collecting agency to avoid taking any measures that may create harassment in the business community. He said that business community should bring any coercive measures of FBR into his notice and assured that he would address them. Commenting on RD, he said that government would try to remove anomalies in the hike of regulatory duty.

Haroon Akhtar said that government was working to streamline the process of audit selection so that taxpayers could be facilitated on this account. He assured that government would consider revising taxes on computers parts and accessories to facilitate the computer industry.

Speaking at the occasion, Sheikh Amir Waheed, President, Islamabad Chamber of Commerce and Industry said that business community realized the importance of tax payment and friendly approach of FBR was needed for tax collection that would yield win-win results for tax collector and taxpayers. He said that repeated selection of same taxpayers for audit was creating problems for them and urged that audited cases should be given 5-year exemption for next audit.

He stressed that government should revise RD on those imported items that would being used as raw material for industry as hike in RD on such items would affect manufacturing activities and hurt the indigenous industry. Muhammad Naveed Senior Vice President and Nisar Mirza Vice President ICCI said that government had exempted computers and laptops from GST which was a laudable decision and urged that government should also exempt parts and accessories of computers from GST that would facilitate the growth of computer and IT industry. He said government should also address key issues of pharmaceutical industry so that it could grow fast.

Khalid Javed, Tariq Sadiq, Mian Akram Farid, Zubair Ahmed Malik, Mian Shaukat Masud, Ch. Waheed ud Din, Zafar Bakhtawari, Khalid Iqbal Malik, Muzzamil Sabri, M. Ejaz Abbasi and Nasir Qureshi were in the ICCI delegation.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,475.00 | 110,105.00 109,405.00 |

-810.00 -0.73% |

| BRENT CRUDE | 68.52 | 69.00 68.49 |

-0.59 -0.85% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.88 | 67.50 66.85 |

-0.57 -0.85% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

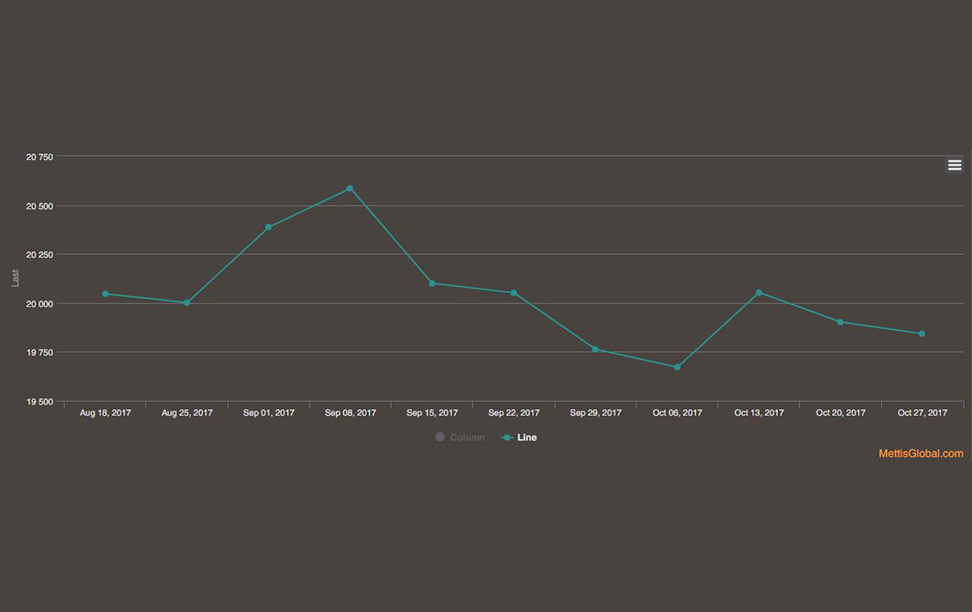

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI