Govt domestic debt, liabilities see sharpest drop in 2 years

MG News | November 12, 2024 at 11:32 AM GMT+05:00

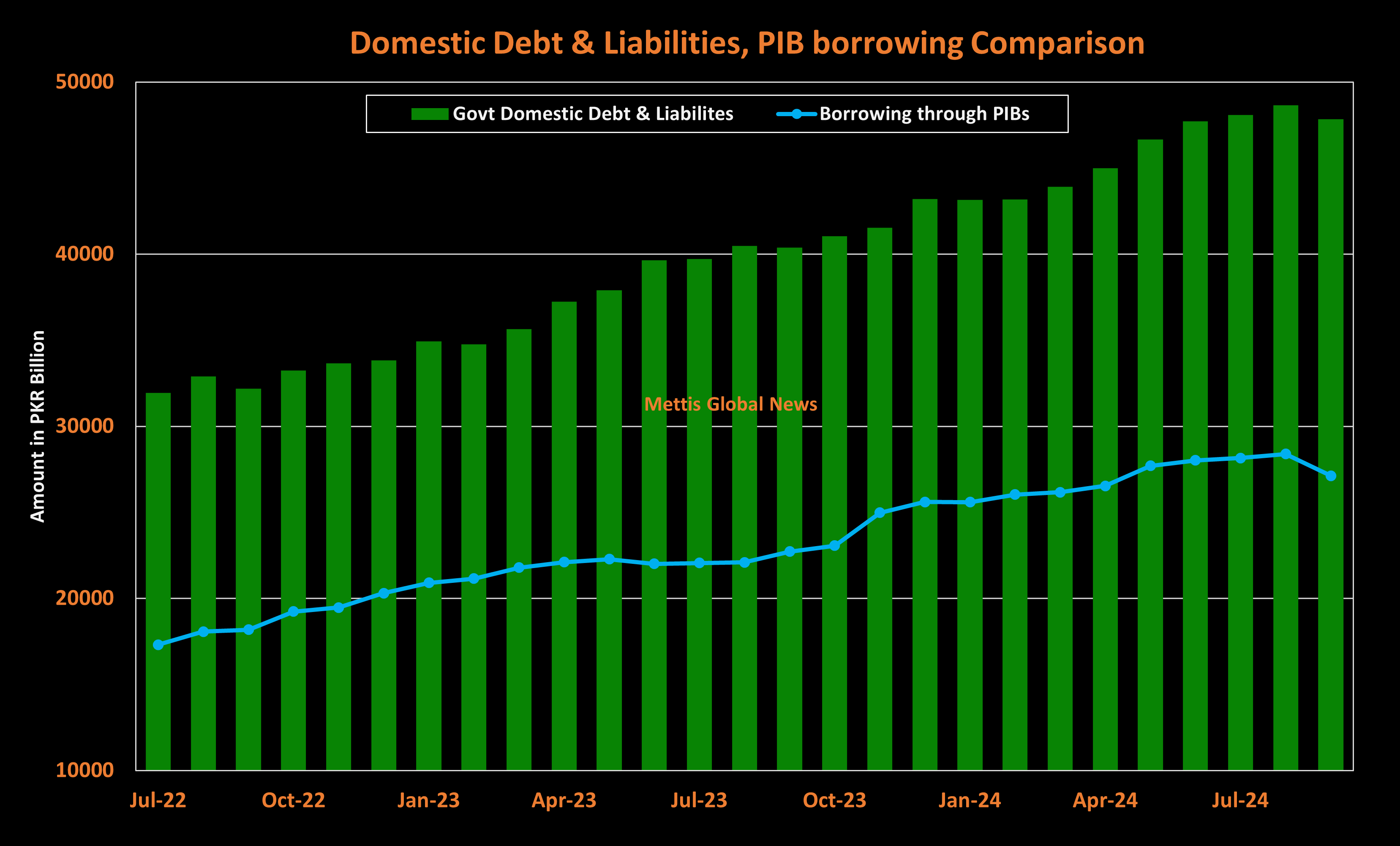

November 11, 2024 (MLN): The total government domestic debt and liabilities dropped by 1.65% to Rs47.85 trillion in September 2024 compared to Rs48.65tr in the previous month, the latest data released by the State Bank of Pakistan (SBP) showed.

This marks the sharpest drop since September 2022 and the first decline in eight months.

The government’s efforts in debt reprofiling aided this drop, as reduced borrowing through Pakistan Investment Bonds emerged as the primary contributing factor.

However, the debt burden has increased by 18.51% in comparison to Rs40.37tr in September 2023.

According to details provided by the State Bank of Pakistan (SBP), the larger portion of the debt was permanent debt, which totaled Rs33.03tr, signifying a growth of 20.58% YoY.

This comprised Rs32.16tr in federal government bonds, Rs474.94bn in SBP's on-lending to the government of Pakistan against SDRs allocation, Rs389.6bn worth of prize bonds, and the remaining Rs2.84bn in market loans.

A notable factor to add here is that permanent debt dropped 3.16% MoM due to the retirement of PIBs by the government.

The floating debt rose by 26.33% in September to Rs11.22tr compared to Rs8.88tr in the same period last year.

Market Treasury Bills comprised the major proportion of the total floating debt and stood at Rs11.14tr in September 2024, up 2.69% MoM and 26.48% YoY.

On the other hand, the government's unfunded debt fell by 3% to Rs2.83tr in September 2024, primarily due to a significant drop of 2.56% in saving schemes, which amounted to Rs2.74tr compared to Rs2.81tr in the SPLY.

Foreign currency loans fell significantly as they clocked in at Rs372.71bn in September 2024, compared to Rs386.16bn in September 2023.

Borrowing through Naya Pakistan Certificates also reduced by 29.85% YoY to Rs84.7bn in September 2024.

Conversely, on a sequential basis, it increased by 5.87% in September compared to Rs80bn in August.

Moving forward, domestic liabilities of the government dropped by 54.09% YoY and were reported at Rs309.68bn in the review month.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction