Government issues first Pakistan Energy Sukuk to resolve Circular debt

By MG News | March 02, 2019 at 05:40 PM GMT+05:00

Karachi, March 02: In order to resolve the Circular Debt faced by Pakistan economy, today Ministry of Energy, through Power Holding Private Limited, a company hundred percent owned by the Government of Pakistan, issued the first Pakistan Energy Sukuk of Rs 200 bn - Meezan Bank was appointed as the Shariah Advisor of the Sukuk and structured the transaction to ensure its Shariah Compliance with the approval of its Shariah Board.

A consortium of Islamic banks has been led by Meezan Bank Limited (MBL) which helped the government to structure the historic Sukuk. The other members of the consortium comprises BankIslami Pakistan Limited (BIPL), Faysal Bank Limited (FBL), MCB Islamic Bank Limited (MIB), Dubai Islamic Bank Pakistan Limited (DIBPL), Al Baraka Bank Pakistan Limited (ABPL), United Bank Limited Ameen Islamic Banking (UBL) and National Bank of Pakistan Aitemaad Islamic Banking (NBP).

MBL was also the largest investor in the Sukuk with a participation of Rs88 billion, while other banks which invested in the Sukuk includes FBL Rs35 billion, BIPL also Rs35 billion, DIBPL Rs14.15 billion, MIB Rs10 billion, ABPL Rs8.85 billion, UBL Ameen Rs5 billion and NBP Aitemaad Islamic Rs4 billion.

To facilitate the issuance of Sukuk, Meezan Bank Limited is also acting as the Investment Agent and Trustee of the Sukuk. The Sukuk has been declared SLR eligible by the State Bank of Pakistan for all banks in the country. The Sukuk is asset based and comprises the assets of power generation and distribution companies. The instrument is based on Islamic mode of Ijarah and has a 10-year maturity with semi-annual rental payments.

The Ministry is also planning to get the Sukuk listed in the Pakistan Stock Exchange and a large category of investors shall be eligible for investing in the instrument and will help in the growth of Islamic capital market. The government has highly appreciated the support provided by the Islamic banking industry and the Sukuk will provide the much-needed liquidity to the energy sector and help the government to ease the circular debt crisis.

The present government has shown keen interest to shift the government borrowing to Islamic modes and Ministry of Finance & Ministry of Energy are also planning another Sukuk issuance in the coming months of around Rs 200-300 billion

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,025.00 | 108,105.00 107,505.00 |

-210.00 -0.19% |

| BRENT CRUDE | 66.54 | 66.63 66.48 |

-0.20 -0.30% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.88 | 65.02 64.82 |

-0.23 -0.35% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

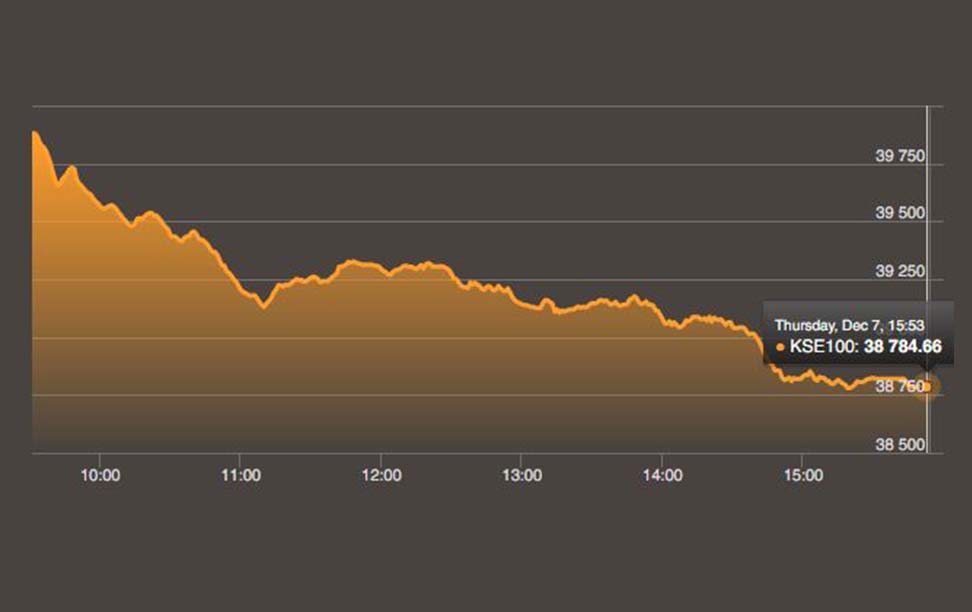

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|