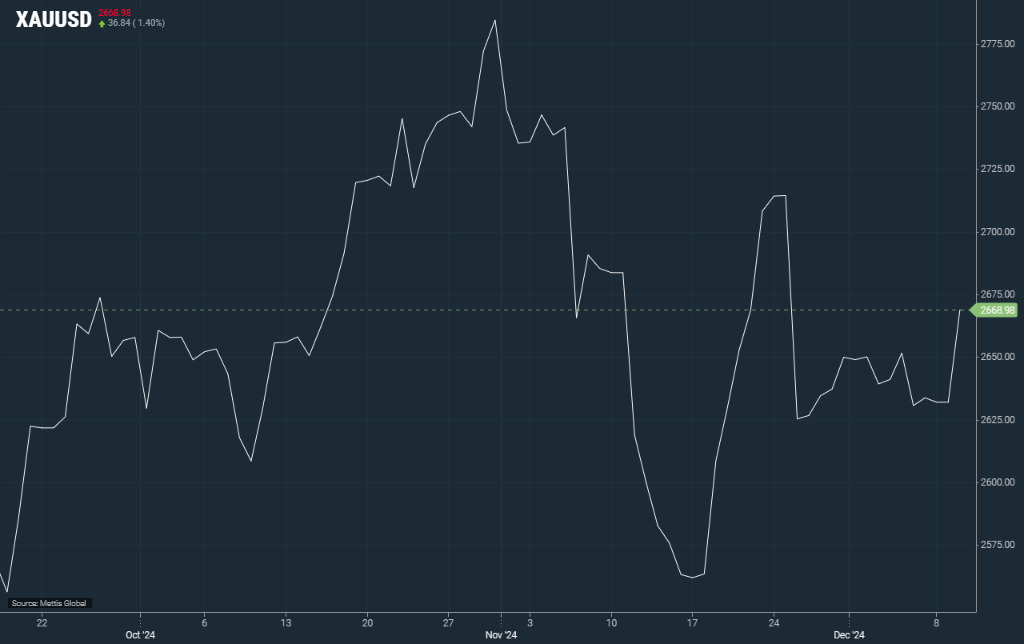

Gold gains 1.40% on geopolitical worries, inflation data

MG News | December 10, 2024 at 03:55 PM GMT+05:00

December 10, 2024 (MLN): Gold spot prices gained 1.40% ($36.84) at $2,668.98 per ounce, as of [3:37 pm PST] from the prior day's close of $2,660.32 per ounce, Gold futures also decreased 0.27% to $2,674.8.

Gold prices gained on Tuesday, helped by escalating geopolitical tensions in the Middle East and expectations of a U.S. rate cut this month, with key U.S. inflation data later this week grabbing investors' attention.

Spot gold was up 0.2% to $2,665.04 per ounce, as of 0912 GMT. Bullion hit a 2-week high in the previous session. U.S. gold futures rose 0.1% to $2,687.40, as Reuters reported.

Friday’s jobs report has boosted bets around a December Fed rate hike, said FXTM senior research analyst Lukman Otunuga.

He further added that geopolitical tensions in the Middle East and reports of China’s central bank resuming gold purchases after a six-month break are supporting gold prices.

Traders now see about a 90% probability of a 25-basis-point rate cut next week, according to the CME FedWatch tool up significantly from 73% last week.

Investors are eyeing the U.S. Consumer Price Index (CPI) release on Wednesday and the Producer Price Index (PPI) on Thursday, both expected to have an influence on the Federal Reserve's rate-cut decision.

"Gold bulls could face obstacles if a hotter-than-expected U.S. CPI report reduces bets around Fed cuts beyond December 2024," Otunuga added.

The non-yielding bullion tends to shine in a lower-interest-rate environment and during periods of economic or geopolitical instability.

Israeli forces advanced 25 km southwest of Damascus after seizing a buffer zone in southern Syria and conducting overnight airstrikes on Syrian military targets, Syrian sources reported Tuesday.

Elsewhere, China will adopt an "appropriately loose" monetary policy and a more proactive fiscal approach next year, as per the Politburo.

This is "a shift from a 'prudent' stance that has been held for nearly 14 years.

Hence, a further reduction of interest rates in China may spur higher demand for gold purchases," said Kelvin Wong, OANDA's senior market analyst for Asia Pacific.

Spot silver added 0.1% to $31.85 per ounce, platinum was steady at $939.55 and, palladium was trading 0.1% lower at $973.00.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account