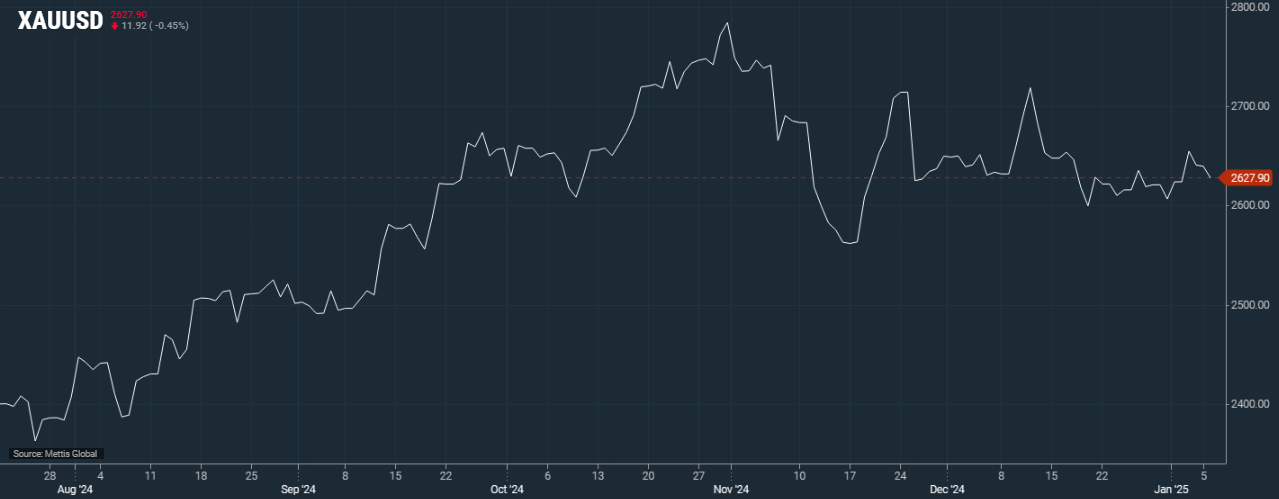

Gold drops as investors await U.S. economic Data

By MG News | January 06, 2025 at 01:47 PM GMT+05:00

January 06, 2024 (MLN): Gold spot prices decreased by 0.45% ($11.92) at $2,627.9 per ounce, as of [1:40 pm PST] from the prior day's close of $2,639.7 per ounce.

U.S. gold futures dropped 0.6% to $2,639.40.

Gold prices dipped on Monday on profit-booking after gaining last week.

Investors awaited a slew of U.S. economic data, including the December nonfarm payrolls report, for further guidance on the Federal Reserve's stance on interest rates.

Bullion hit a three-week high and registered a weekly gain on Friday.

"The pressure on gold is mostly due to profit taking after the recent rally last week," said Ajay Kedia, director at Kedia Commodities in Mumbai.

"All eyes are now on Donald Trump returning to the office, which could be a game changer", he added.

The U.S. jobs report, due on Friday, is expected to provide more clues to the Fed's rate outlook, as Reuters reported.

ADP hiring and job openings data, as well as minutes of the Fed's last policy meeting, are also on investors' radar.

"How the U.S. jobs data fares this week could hold the key to whether gold breaks out of its recent range", said Tim Waterer, chief market analyst at KCM Trade.

Gold flourishes in a low-interest-rate environment and serves as a hedge against geopolitical uncertainties and inflation.

U.S. President-elect Donald Trump is set to return to office on January 20 and his proposed tariffs and protectionist policies are expected to fuel inflation.

This could prompt the Fed to go slow on rate cuts, limiting gold's upside, Reuters further added.

After three rate cuts in 2024, the Fed has projected only two reductions for 2025 due to persistent inflation.

Goldman Sachs pushed back its gold price forecast of $3,000 per troy ounce from December 2025 to the second quarter of 2026, citing expectations of fewer U.S. rate cuts in 2025.

Spot silver was steady at $29.64 per ounce, platinum dipped 0.6% to $932.59 and palladium fell 1% to $912.75.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)

Central Government Debt

Central Government Debt

CPI

CPI