Forced stabilization of oil prices to badly hit industry: OCAC

MG News | November 17, 2022 at 10:20 AM GMT+05:00

November 17, 2022 (MLN): While expressing disappointment over the forced stabilization of oil prices for the second fortnight, Oil Companies Advisory Council (OCAC) claimed that this forced stabilization is at the cost of the industry which will severely impact the already crippled oil Industry.

In a letter to the Ministry of Energy, Waqar Siddiqui, Chairman OCAC highlighted, “Prices of Motor Fuels have been kept unchanged for the second fortnight of November 2022 by the Government of Pakistan (GOP) despite the fact that the prices were increasing based on GOP approved pricing formula.”

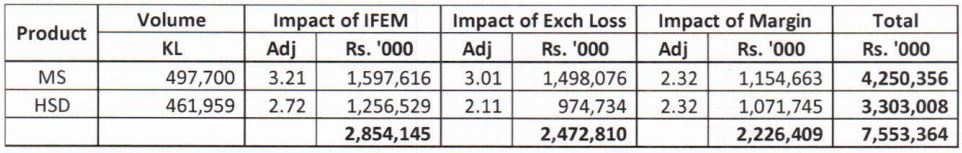

The letter also underlined the items that were adjusted such as Inland Freight Equalization Margin (IFEM) was reduced by Rs3.21 & Rs2.72 per liter on MS & HSD, respectively.

Exchange Loss Adjustment was reduced by Rs3.01 & Rs2.11 per liter on MS & HSD respectively.

Margins — long-pending revision of OMCs' Margin on Motor Fuels was approved by ECC on October 31, 2022, however, the revised margin of Rs6 per liter (an increase of Rs. 2.32 per liter) for both products has not been incorporated in prices to date.

Based on expected sales volumes for the second fortnight of November, as confirmed in the Product Review meeting chaired by Oil and Gas Regulatory Authority (OGRA), the impact of the above-unjustified adjustments is as under:

Instead of passing on the increase or absorbing the impact of this increase by reducing the Petroleum Levy, the price components were very forcefully and unjustly reduced, he added.

Calling attention to the severity of the matter, he said that the industry is already facing a severe financial crunch due to high global prices, depreciation of the Rupee, increased LC Confirmation charges, high premiums on imports, etc., and will not be able to survive if these unfair adjustments are not removed immediately.

He also requested Minister an urgent meeting with Industry members so as to ensure the survival of the industry and avoid any supply chain challenges.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,400.73 346.40M | 0.92% 1570.51 |

| ALLSHR | 103,483.96 796.97M | 0.55% 561.58 |

| KSE30 | 52,734.06 184.56M | 1.08% 564.57 |

| KMI30 | 245,565.33 110.97M | 1.07% 2605.02 |

| KMIALLSHR | 67,233.70 319.67M | 0.68% 453.28 |

| BKTi | 47,898.10 95.85M | 0.98% 462.51 |

| OGTi | 33,838.49 13.78M | 1.39% 464.88 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,825.00 | 90,115.00 86,915.00 | 75.00 0.09% |

| BRENT CRUDE | 60.80 | 62.67 60.56 | -1.44 -2.31% |

| RICHARDS BAY COAL MONTHLY | 87.50 | 0.00 0.00 | 1.05 1.21% |

| ROTTERDAM COAL MONTHLY | 94.50 | 0.00 0.00 | -0.70 -0.74% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.93 | 58.88 56.65 | -1.42 -2.43% |

| SUGAR #11 WORLD | 15.17 | 15.28 15.08 | -0.12 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

MTB Auction

MTB Auction