Weekly Market Roundup

_20251227202758441_135692.jpeg?width=950&height=450&format=Webp)

MG News | December 28, 2025 at 01:30 AM GMT+05:00

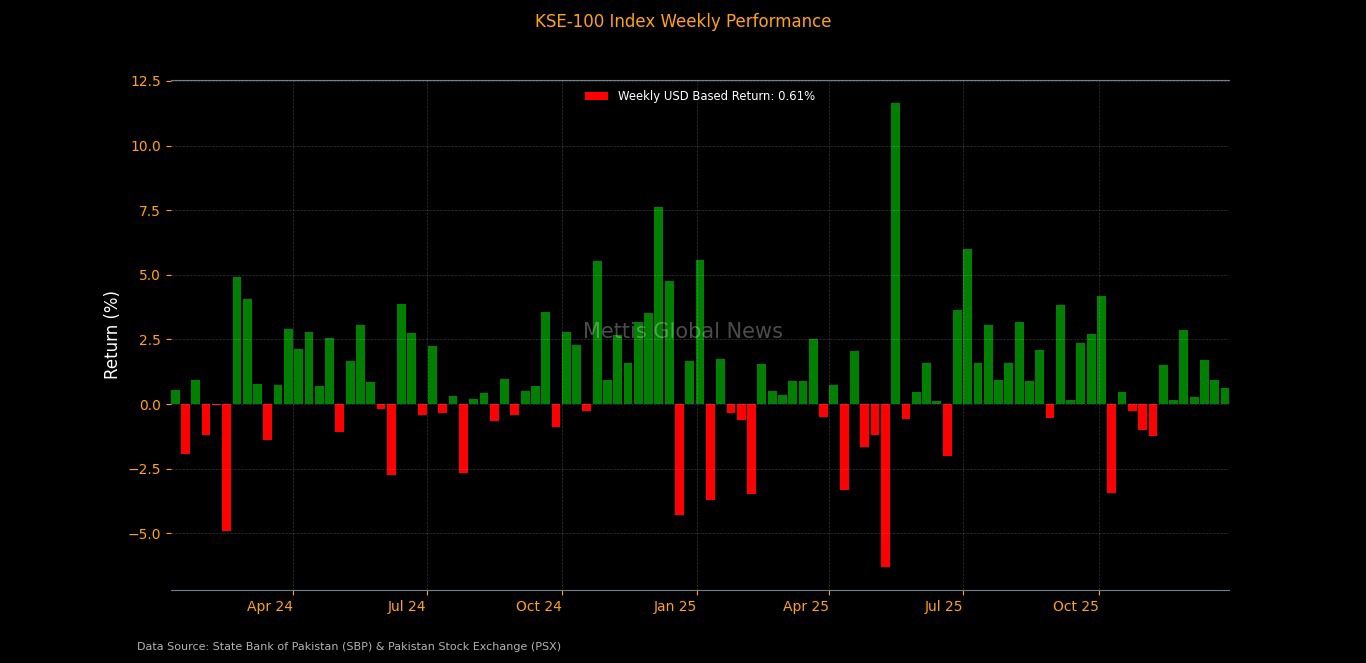

December 28, 2025 (MLN): The Pakistan Stock

Exchange closed the week on a positive note, with the benchmark KSE-100 Index

advancing by 996 points, or 0.58% WoW, to settle at 172,400.73, compared to

171,404.49 at the end of last week.

Market sentiment remained constructive, supported by

selective buying in heavyweight sectors, particularly commercial banks and oil

& gas exploration companies.

The KSE-100 Index rose due to investor optimism around the PIA auction, which likely boosted confidence in market liquidity and structural reforms, driving buying activity in the stock market.

_20251227202104221_be0fc6.jpeg)

Market Capitalization

In rupee terms, total market capitalization increased to

Rs5.06tr this week from Rs5.03tr last week, marking a rise of approximately

Rs28.9bn, in line with the weekly index gain.

In dollar terms, market capitalization rose to $18.07bn from $17.96bn, translating into an increase of around $108.3m WoW.

As a result, USD returns for the week stood at 0.61%, easing from 0.93% recorded last week, indicating relatively modest foreign-adjusted gains.

On the macroeconomic front, liquidity improved as the State

Bank of Pakistan raised Rs1.02tr

through PIB and MTB auctions, with strong MTB participation and a 78bps drop in

12-month yields, showing easing rate expectations.

External financing increased by 8.6% MoM to $511.49m

in November 2025, though still down YoY, with multilateral lenders leading

inflows.

Foreign portfolio inflows showed cautious optimism, as SCRA

balance rose by Rs194.19m

WoW to Rs30.7bn, with net security purchases of Rs8.53bn.

The Pakistani rupee posted a slight appreciation,

strengthening from Rs280.25 to Rs280.17 per USD, representing a 0.03% WoW gain,

which provided marginal support to foreign investor returns.

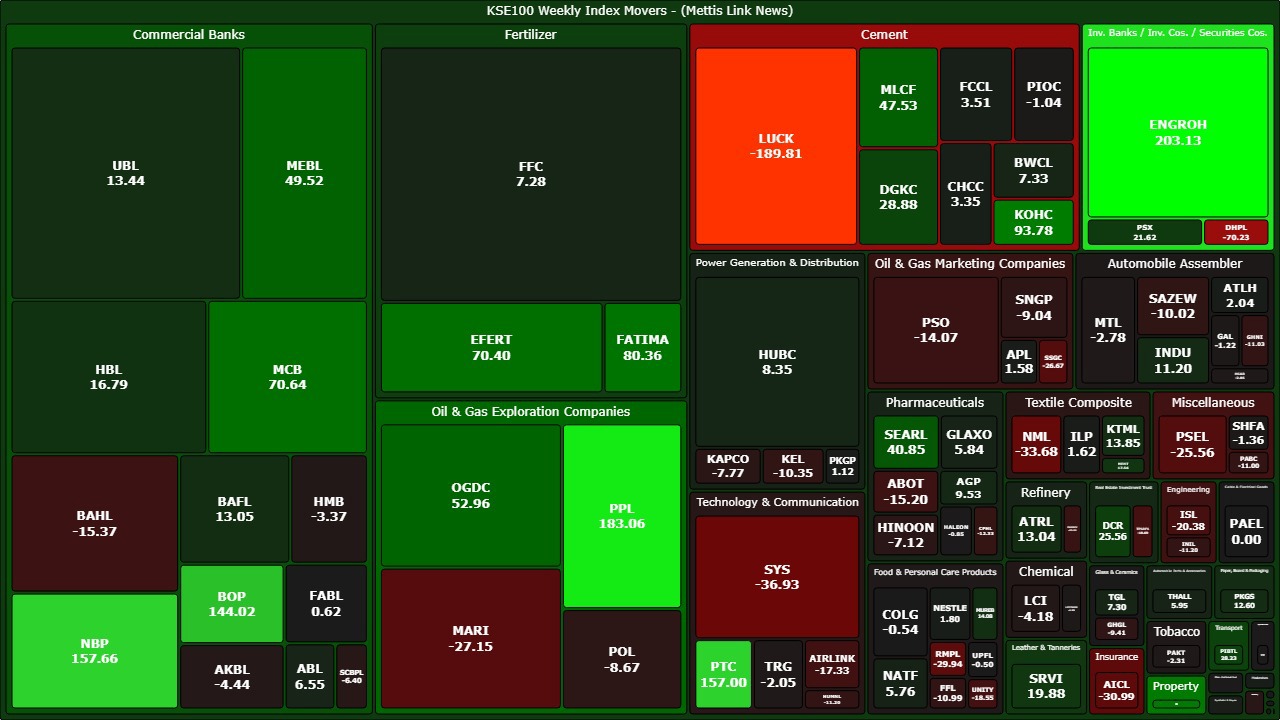

Index Movers

On a sectoral basis, Commercial Banks dominated performance,

contributing a substantial 443 points to the KSE-100 Index, emerging as the

single largest driver of weekly gains.

This was followed by Oil & Gas Exploration Companies

(+200 points), Fertilizer (+158 points), and Investment Banks / Investment

Companies / Securities Companies (+155 points), reflecting renewed interest in

value and rate-sensitive sectors.

Property (+92 points) and Technology & Communication

(+89 points) also provided notable upside support, while Transport,

Pharmaceuticals, and Paper & Board sectors added incremental gains.

On the downside, Oil & Gas Marketing Companies led the

decliners, subtracting 48 points, followed by Food & Personal Care Products

(-39 points), Miscellaneous (-38 points), Engineering (-32 points), and

Insurance (-31 points).

Weakness was also observed in Cement, Chemicals, and Power Generation & Distribution, which collectively capped broader market upside.

_20251227202027421_05e732.jpeg)

Scrip-wise, Engro Holdings (ENGROH) emerged as the top

contributor, adding 203 points to the index. Pakistan Petroleum Limited (PPL)

followed closely with a 183-point contribution, while National Bank of Pakistan

(NBP) added 158 points.

Other notable gainers included Pakistan Telecommunication

Company (PTC) (+157 points), Bank of Punjab (BOP) (+144 points), Kohat Cement

(KOHC) (+94 points), and JDW Sugar-linked Property exposure (JVDC) (+92

points).

Fertilizer plays FATIMA and EFERT, along with major banks

MCB, MEBL, and HBL, further supported the benchmark.

On the negative side, Lucky Cement (LUCK) emerged as the

largest drag, shaving off 190 points. This was followed by DHPL (-70 points),

Systems Limited (SYS) (-37 points), Nishat Mills (NML) (-34 points), and Askari

Insurance (AICL) (-31 points).

Additional pressure came from Mari Petroleum (MARI), SSGC, PSEL, and ISL, reflecting continued weakness across energy-linked and industrial names.

FIPI / LIPI

From an investor flow perspective, Foreign Institutional

Portfolio Investors (FIPI) remained net sellers, posting net outflows of $0.07m

during the week.

Foreign selling was primarily driven by foreign corporates,

which recorded net selling of $1.59m, while foreign individuals posted marginal

net buying of $0.03m.

Overseas Pakistanis provided meaningful support with net

inflows of $1.49m, though this was insufficient to offset overall foreign

selling.

In contrast, Local Institutional Portfolio Investors (LIPI)

absorbed the foreign outflows almost entirely, registering net buying of

$0.07m.

Buying interest was led by mutual funds, which recorded net

purchases of $4.41m, followed by companies ($1.60m) and broker proprietary

trading ($1.38m).

However, this was partially offset by profit-taking from

insurance companies, which booked net selling of $5.02m, while individual

investors also remained net sellers with outflows of $1.25m during the week.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,400.73 346.40M | 0.92% 1570.51 |

| ALLSHR | 103,483.96 796.97M | 0.55% 561.58 |

| KSE30 | 52,734.06 184.56M | 1.08% 564.57 |

| KMI30 | 245,565.33 110.97M | 1.07% 2605.02 |

| KMIALLSHR | 67,233.70 319.67M | 0.68% 453.28 |

| BKTi | 47,898.10 95.85M | 0.98% 462.51 |

| OGTi | 33,838.49 13.78M | 1.39% 464.88 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,825.00 | 90,115.00 86,915.00 | 75.00 0.09% |

| BRENT CRUDE | 60.80 | 62.67 60.56 | -1.44 -2.31% |

| RICHARDS BAY COAL MONTHLY | 87.50 | 0.00 0.00 | 1.05 1.21% |

| ROTTERDAM COAL MONTHLY | 94.50 | 0.00 0.00 | -0.70 -0.74% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.93 | 58.88 56.65 | -1.42 -2.43% |

| SUGAR #11 WORLD | 15.17 | 15.28 15.08 | -0.12 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction