Fauji Cement posts Rs2.61bn profit in 1QFY24, capacity utilization at 64%

.png?width=950&height=450&format=Webp)

MG News | October 25, 2023 at 09:51 AM GMT+05:00

October 25, 2023 (MLN): Fauji Cement Company Limited (PSX: FCCL) recorded an increase of 12.92% YoY in its profits in 1QFY24, with the company's after-tax profits rising to Rs2.61 billion [EPS: Rs1.07], compared to a profit of Rs2.31bn [EPS: Rs0.94] in the same period last year (SPLY).

Going by the results, the company's top line increased by 38.18% YoY to Rs20.31bn as compared to Rs14.7bn in SPLY.

The first quarter of FY24 saw a considerable increase of 14% YoY in the industry domestic demand along with a 48% increase in exports to Afghanistan and an overall increase of 16%.

The company's overall dispatches increased by 25% with capacity utilization of 64%.

The cost of sales rose by 38.31% YoY but was lesser than proportionate to sales increase, which improved the gross profit by 37.89% YoY to Rs6.32bn in 1QFY24.

The management continued its focus on implementing cost optimization initiatives including an increase in the use of local coal, higher usage of alternative fuel, and increasing captive solar generation capacity to 40MW, which along with the use of a Waste Heat Recovery Power Plant fulfills almost 60% of Company's requirement during the daytime operations.

All Cement Plants of FCCL now have solar captive power capacity.

In addition, fixed cost rationalization also contributed to the achievement of these impressive results.

Moreover, during the review period, other income surged by 3.82x YoY to stand at Rs97.17m in 1QFY24 as compared to Rs25.4m in SPLY.

On the expense side, the company observed an increase in selling and distribution expenses by 40.82% YoY and other expenses by 18.83% YoY to clock in at Rs703.67m and Rs280.5m respectively during the review period.

The company’s finance costs surged by 4.46x YoY and stood at Rs1.07bn as compared to Rs240.04m in 1QFY23, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs1.39bn against the Rs1bn paid in the corresponding period of last year, depicting a rise of 39.33% YoY.

To note, the company stated that the Greenfield expansion at D.G. Khan is expected to be completed in the second quarter of FY24, which will increase the company's production capacity and thereby its market share.

| Unconsolidated (un-audited) Financial Results for Quarter ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 20,313,087 | 14,700,385 | 38.18% |

| Cost of sales | (13,991,877) | (10,116,118) | 38.31% |

| Gross Profit | 6,321,210 | 4,584,267 | 37.89% |

| Selling and distribution expenses | (703,673) | (499,684) | 40.82% |

| Administrative expenses | (356,836) | (318,748) | 11.95% |

| Other Income | 97,167 | 25,396 | 282.61% |

| Other expenses | (280,499) | (236,045) | 18.83% |

| Finance cost | (1,069,638) | (240,035) | 345.62% |

| Profit before taxation | 4,007,731 | 3,315,151 | 20.89% |

| Taxation | (1,393,729) | (1,000,321) | 39.33% |

| Net profit for the period | 2,614,002 | 2,314,830 | 12.92% |

| Basic earnings/ (loss) per share | 1.07 | 0.94 | - |

Amount in thousand except for EPS

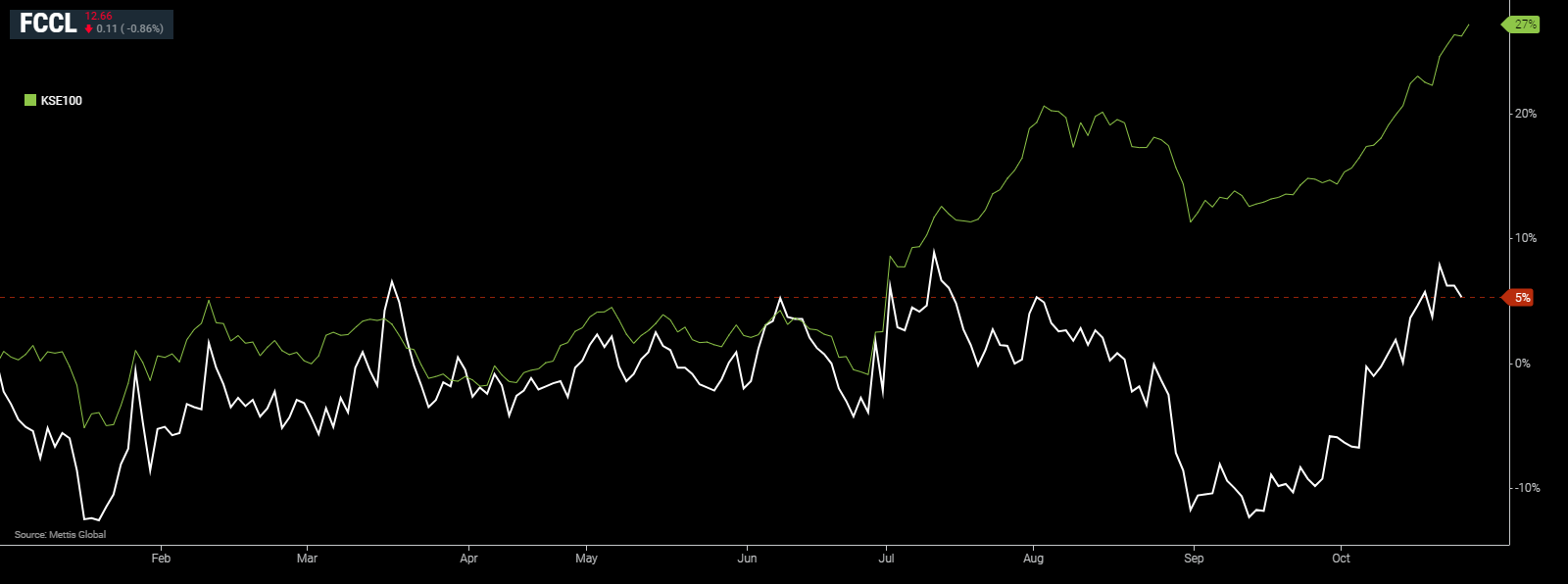

FCCL and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,691.08 204.73M | -3.16% -5478.63 |

| ALLSHR | 100,605.79 452.28M | -3.22% -3347.16 |

| KSE30 | 51,327.62 101.29M | -3.23% -1715.27 |

| KMI30 | 234,255.58 78.63M | -3.57% -8675.81 |

| KMIALLSHR | 64,318.37 208.70M | -3.29% -2188.72 |

| BKTi | 49,641.17 44.27M | -2.78% -1417.38 |

| OGTi | 33,066.33 11.03M | -3.20% -1093.65 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260223094701042_aaf3ab.png?width=280&height=140&format=Webp)