Does PIA trading halt hint money-making maneuver?

.jpg?width=950&height=450&format=Webp)

Nilam Bano | May 21, 2024 at 10:25 AM GMT+05:00

May 21, 2024 (MLN): It seems that a chance to manipulate situations to make big bucks is never missed as evidenced by the recent announcement concerning Pakistan International Airlines Corporation Limited (PIA) and PIA Holding Company Limited (PIAHCL).

According to their new arrangement, May 21, 2024, will be the last trading day for PIA shares (for Future contracts) before a break, with trading resuming on June 3, 2024.

This means that for 12 calendar days and 8 trading sessions, no future contracts will be available for PIA shares.

During this break, 33,558,500 shares currently in May-June futures will need to be settled on Monday and Tuesday with short notice, creating a stressful situation for traders.

The ready market will have to absorb this large volume of shares in just two days.

Only deliveries will be processed during this period. It is important to note that PIA’s book closure does not involve any dividend entitlement, changes to holding quantities, or share splits.

The only change will be the alteration of the trading symbol. The Central Depository Company (CDC) has records of who owns these shares.

There are concerns that this situation might be manipulated, especially since the contract will be suspended suddenly, forcing buyers to sell their shares quickly and possibly at low prices.

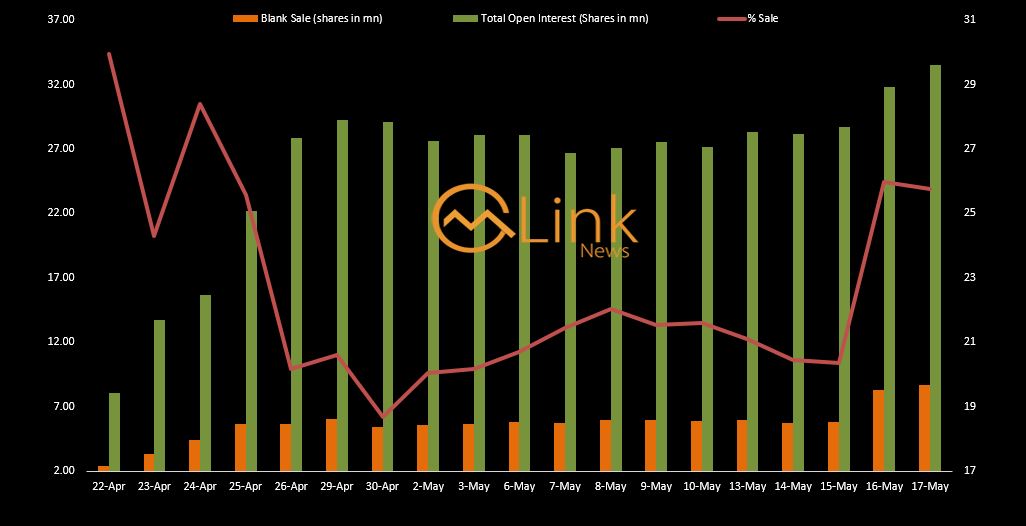

The following data shows a noticeable increase in blank sales over the period. For instance, on April 22, the blank sale was 2.42 million shares which increased to 8.64m by May 17.

This consistent rise reveals a growing trend in selling shares without having the actual stock, which signals an upsurge in speculative trading.

The total open interest has also increased, starting from 8.07m on April 22 and rising to 33.59 million by May 17.

However, the total open interest does not increase linearly. There are fluctuations, with notable peaks and troughs throughout the period.

The percentage sale (blank sale as a percentage of total open interest) varies across the period, with a high of 29.95% on April 22 and a low of 18.69% on April 30.

By May 17, this percentage had climbed back up to 25.75%, indicating a substantial portion of the total open interest is made up of blank sales.

This situation is potentially concerning and requires close monitoring by regulatory authorities to ensure market integrity.

Thus, the Security Exchange Commission of Pakistan (SECP) should inquire who is the seller in PIAA in the bullish market which must know the fact the contract will be suspended in between and the buyer has no option but to dump the shares at any price today as today is the last date of PIA Future Contracts.

What could have been done?

Since the SECP sanctioned the SOA on May 3, 2024, the concerned authorities knew that trading of this particular scrip was going to be halted. They should have taken proactive measures to discourage Future Contracts for this scrip.

Additionally, smaller counters should have been established to manage the situation more effectively.

Moreover, there is a need to enforce the implementation of cash settlement for Future Contracts to minimize exchange risk, rather than using T+30 settlement.

The best practice worldwide is to settle Future Contracts in cash rather than through physical delivery. This approach reduces the risk and complexity associated with the actual transfer of assets, ensuring smoother and more efficient market operations.

The reason cash settlement is not widely adopted in the PSX, despite its availability, is the active use of T+30 settlement. This practice appears quite disruptive and can create panic in the market during volatile times.

While authorities are introducing T+1 settlement, T+30 is still actively used, which should be discouraged.

Mettis Link News contacted PSX authorities for their comments on this matter; however, we have not yet received a response.

Details of SOA:

The sanctioned SOA between both companies is for the following:

- Effecting re-organization of PIA through the cancellation of its current paid-up capital

- Allowing PIAHCL to own 100% of the paid-up capital of PIA

- Division of PIA by separating the Non-Core Undertaking from PIA and vesting the whole of the Non-Core Undertaking in PIAHCL

- Simultaneous issuance and allotment of fully paid ordinary shares by PIAHCL to the erstwhile shareholders of PIA

- The aviation business and the business ancillary to aviation are retained in PIA and the other businesses are transferred to PIAHCL.

???????Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,696.08 225.42M | -2.49% -4684.31 |

| ALLSHR | 110,409.60 562.44M | -1.97% -2222.98 |

| KSE30 | 56,421.48 92.24M | -2.78% -1610.72 |

| KMI30 | 259,376.51 95.19M | -2.93% -7821.37 |

| KMIALLSHR | 70,799.62 290.97M | -2.31% -1676.50 |

| BKTi | 53,251.17 19.31M | -0.94% -506.14 |

| OGTi | 38,624.98 9.94M | -1.71% -670.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,890.00 | 89,385.00 87,585.00 | -1190.00 -1.34% |

| BRENT CRUDE | 69.27 | 69.73 68.61 | 0.87 1.27% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.35 -2.64% |

| ROTTERDAM COAL MONTHLY | 98.50 | 98.50 98.50 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.14 | 64.48 63.28 | 0.93 1.47% |

| SUGAR #11 WORLD | 14.72 | 14.87 14.67 | -0.11 -0.74% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks