CPI review: Policy rate in the spotlight

By MG News | October 04, 2019 at 05:37 PM GMT+05:00

October 04, 2019 (MLN): Pakistan Bureau of Statistics (PBS) released the annual national headline inflation numbers for Sept’19. Based on new consumer basket, the CPI surged to 11.37% in Sept from 10.49% in August, whereas, it clocked in at 12.6% on 2007-08 base. The primarily cause of this acceleration was the food index which went up to 15.8% YoY, from 12.6% in August on the back of increase in prices of perishable food items.

During the period under review, monthly headline inflation numbers showed slow normalization as it increased only by 0.8% MoM against 1.6% in August, even though food index increased by 2.12% MoM.

This drop in monthly inflation was due to the economic adjustment faced by the country, which included the decisions to cut fuel prices for Sept’19 which to some extent offset the impact of rising food prices, reported AKD research.

Keeping in view latest developments, this CPI included Urban and Rural Price Index, where urban inflation (UCPI) stood at 11.6% YoY versus a lower 11.1% YoY rural inflation (RPI).

Going forward, September‘s reading of inflation show that fiscal measures have been implemented and it is expected that stability in exchange rate and oil prices at current level are likely to remain. However, hike in power tariffs may add some points to the CPI starting October, revealed EFG HERMES.

This month’s inflation figures are important in terms of next monetary announcement as the SBP governor, Dr Raza Baqir in his recent speech, said that any decision regarding monetary policy will be taken after the announcement of inflation rates. To recall, the SBP kept key policy rate unchanged at 13.25% in the last monetary policy committee meeting.

With regards to inflation expectations and current interest rate, several brokerage houses have put forth their expectations for the policy rate. It is noted that inflation remained within the expected range of State Bank of Pakistan during 1QFY20. In view of BMA research house, the SBP will likely to cut policy rate by 50bps and will set the tone of further cuts in coming quarters.

As per AKD research, higher than expected inflation may discount the possibility of an early rate cut. High inflationary pressures coming from FOOD an Energy groups and fiscal challenges will likely keep policy rates on hold.

Similarly, in view point of EFG HERMES, SBP will likely maintain Status Quo on the monetary front as they expect that inflation will come down in coming few months on the back of increasing foreign reserves, stability of PKR against USD and low oil prices. Meanwhile, it is least expected over potential rate cuts in near future.

In addition, Intermarket Securities is anticipating that SBP will not consider monetary easing before 2020. Instead, it will continue to take a cautious approach to avoid any premature impetus to the economy.

However, it is too early to say that whether the SBP will cut the policy rate or maintain as recent developments such as decrease in foreign reserves (USD 768.90 Million or 4.87%) on Sept 27, 2019 and depreciation of 36 paisa against USD in first week of October’19 tell a different story.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,440.00 | 110,105.00 109,380.00 |

-845.00 -0.77% |

| BRENT CRUDE | 68.50 | 69.00 68.48 |

-0.61 -0.88% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.88 | 67.50 66.83 |

-0.57 -0.85% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)

Trade Balance

Trade Balance

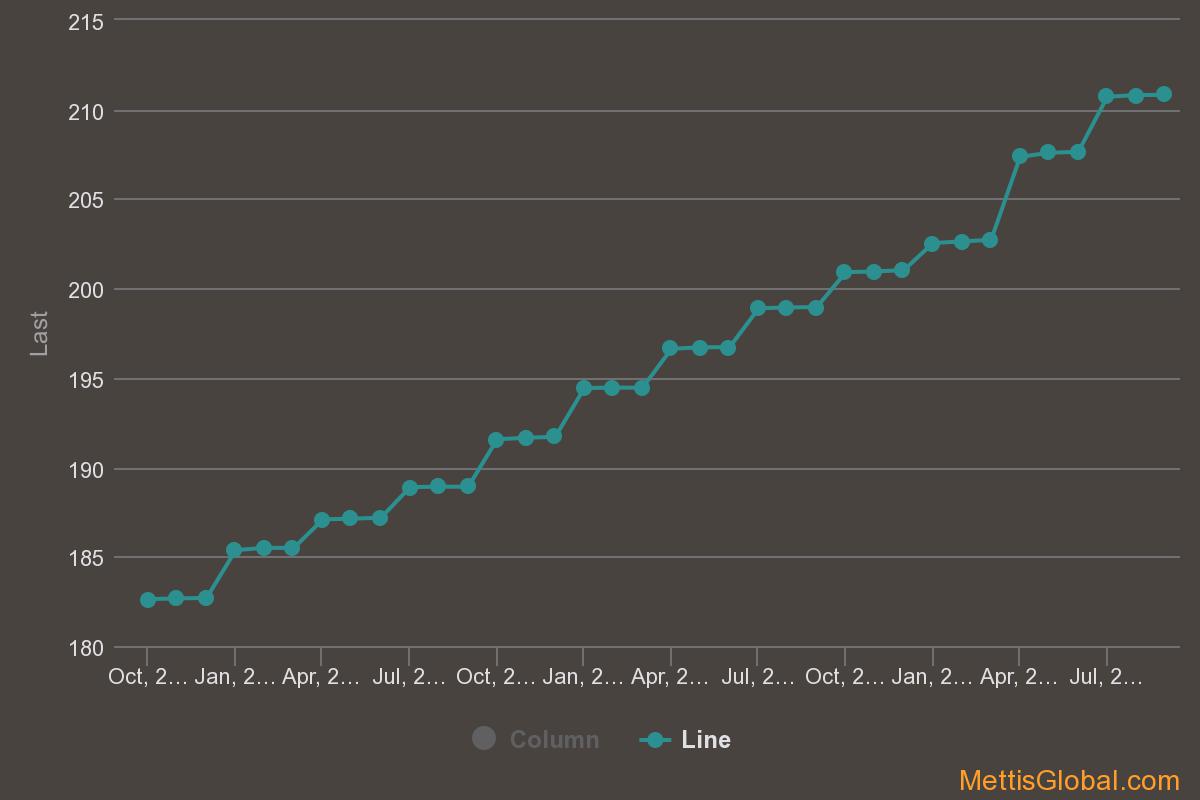

CPI

CPI