Closing Bell: Dance till the music stops…

MG News | April 17, 2020 at 04:07 PM GMT+05:00

April 17, 2020 (MLN): The capital markets ended with significant gains of 1502 points on Friday fuelled by positive events on the both domestic and international front as investors temporarily set aside all worries over COVID-19 spread and took full opportunity to buy stocks.

The KSE-100 index was locked in a 5% lower circuit in early trade, triggering the market halt for an hour; first time-ever halted for a positive reason. However, when markets resumed, the index ended at 32,831 points i.e. 4.80% higher than the previous closing.

The sentiments were bolstered by Central bank which surprisingly cut the policy rate with a further 200 bps to 9%. While IMF disbursement of $1.386 billion under RFI along with the suspension of debt payments by G20 contributed to the improvement in investors’ sentiment.

Further, the benchmark index gained 2.49% or 798.62 points during the week.

The Index remained positive throughout the session touching an intraday high of 33,256.82

Of the 95 traded companies in the KSE100 Index 85 closed up 9 closed down, while 1 remained unchanged. Total volume traded for the index was 201.43 million shares.

Sectors propping up the index were Fertilizer with 322 points, Cement with 187 points, Oil & Gas Exploration Companies with 171 points, Power Generation & Distribution with 149 points and Oil & Gas Marketing Companies with 98 points.

The most points added to the index was by ENGRO which contributed 144 points followed by HUBC with 116 points, FFC with 112 points, LUCK with 88 points and DAWH with 66 points.

Sector wise, the index was let down by Miscellaneous with 5 points, Tobacco with 3 points and Textile Spinning with 1 points.

The most points taken off the index was by BAHL which stripped the index of 24 points followed by ABL with 18 points, BAFL with 6 points, MEBL with 5 points and SHFA with 5 points.

All Share Volume increased by 183.30 Million to 302.40 Million Shares. Market Cap increased by Rs.229.71 Billion.

Total companies traded were 362 compared to 341 from the previous session. Of the scrips traded 319 closed up, 31 closed down while 12 remained unchanged.

Total trades increased by 21,737 to 86,557.

Value Traded increased by 3.84 Billion to Rs.8.60 Billion

| Company | Volume |

|---|---|

| K-Electric | 23,239,000 |

| Hascol Petroleum | 21,340,500 |

| The Bank of Punjab | 19,618,500 |

| Unity Foods | 17,957,500 |

| Fauji Cement Company | 15,370,000 |

| Power Cement | 12,283,000 |

| Worldcall Telecom | 11,753,000 |

| Lotte Chemical Pakistan | 10,685,000 |

| Fauji Foods | 7,077,000 |

| Engro Fertilizers | 7,005,790 |

| Sector | Volume |

|---|---|

| Commercial Banks | 53,236,135 |

| Cement | 41,948,563 |

| Power Generation & Distribution | 29,257,145 |

| Oil & Gas Marketing Companies | 27,779,140 |

| Technology & Communication | 22,628,000 |

| Chemical | 21,929,950 |

| Vanaspati & Allied Industries | 17,958,700 |

| Oil & Gas Exploration Companies | 15,072,587 |

| Food & Personal Care Products | 11,219,000 |

| Fertilizer | 9,998,179 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

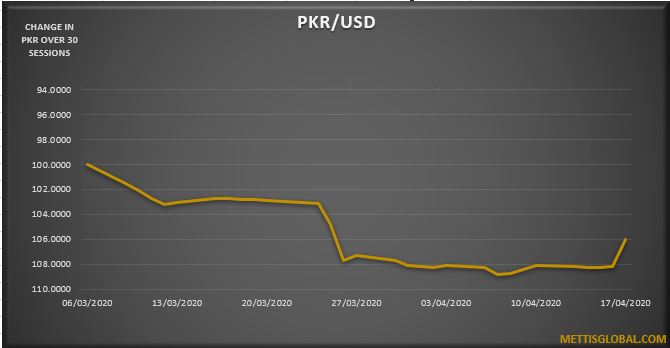

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves