Closing Bell: Bears growl

MG News | August 07, 2019 at 05:41 PM GMT+05:00

Aug 07, 2019 (MLN): Pakistan stock market witnessed another round of selling spree today as Benchmark KSE-100 Index closed at its lowest since March 31, 2015.

Escalating tensions between Pakistan and India over Kashmir issue and lack of positive triggers pushed the index to a four-year low after shedding 723 points or 2.33 percent decline to close at 30,277 level.

In addition to this, redemption at mutual funds kept the flow of selling pressure across the board. Apparently better Financial results of MCB & UBL couldn’t keep stock prices of both the Banks in place and just prior to result announcement UBL touched the lower circuit, revealed in the closing note by Arif Habib Limited.

The Index remained negative throughout the session touching an intraday low of 30,229.39

Of the 91 traded companies in the KSE100 Index 11 closed up 77 closed down, while 3 remained unchanged. Total volume traded for the index was 53.55 million shares.

Sector wise, the index was let down by Commercial Banks with 200 points, Oil & Gas Exploration Companies with 176 points, Fertilizer with 98 points, Power Generation & Distribution with 68 points and Oil & Gas Marketing Companies with 50 points.

The most points taken off the index was by OGDC which stripped the index of 70 points followed by UBL with 55 points, HUBC with 51 points, PPL with 51 points and ENGRO with 45 points.

Sectors propping up the index were Inv. Banks / Inv. Cos. / Securities Cos. with 7 points, Miscellaneous with 5 points, Leather & Tanneries with 2 points and Real Estate Investment Trust with 1 points.

The most points added to the index was by DAWH which contributed 9 points followed by SHFA with 5 points, KTML with 3 points, FFBL with 3 points and SRVI with 2 points.

All Share Volume increased by 10.97 Million to 65.29 Million Shares. Market Cap decreased by Rs.119.04 Billion.

Total companies traded were 326 compared to 320 from the previous session. Of the scrips traded 58 closed up, 249 closed down while 19 remained unchanged.

Total trades increased by 7,364 to 33,138.

Value Traded increased by 0.08 Billion to Rs.2.75 Billion

| Company | Volume |

|---|---|

| K-Electric | 4,598,000 |

| Maple Leaf Cement Factory | 4,396,500 |

| Lotte Chemical Pakistan | 2,857,000 |

| TRG Pakistan | 2,763,500 |

| Cherat Cement Company | 2,572,500 |

| Hascol Petroleum | 2,567,500 |

| Unity Foods | 2,494,000 |

| Fauji Cement Company | 2,358,500 |

| Oil & Gas Development Company | 1,960,700 |

| United Bank | 1,918,500 |

| Sector | Volume |

|---|---|

| Cement | 11,937,500 |

| Commercial Banks | 8,464,300 |

| Power Generation & Distribution | 7,319,500 |

| Engineering | 5,566,500 |

| Technology & Communication | 4,688,500 |

| Oil & Gas Marketing Companies | 4,664,900 |

| Oil & Gas Exploration Companies | 4,263,100 |

| Chemical | 3,765,900 |

| Vanaspati & Allied Industries | 2,494,000 |

| Fertilizer | 2,174,200 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

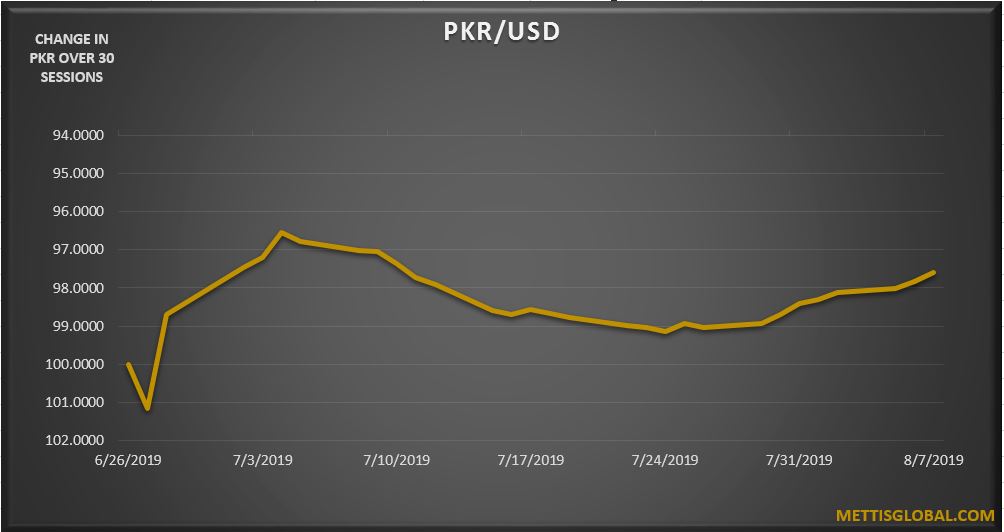

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves