Buffet’s Safety of Margin – A Winning Bait For Successful Stock Investing

Abu Ahmed | May 22, 2024 at 03:30 PM GMT+05:00

May 22, 2024 (MLN): For stock investors, savoring unpleasant movements in stock price is unavoidable, no matter how thoroughly understood the business before investing in the stock. That is why, stock investors are left with no choice but to bait at stocks despite the cognizance of risk of losing capital, Mr. Larry Hite, one of the American Hedge Fund Managers, rightly quoted that:

“If you don’t bait, you can’t win. If you lose all your chips, you can’t bet.”

Losing a portion of capital is usual in stock investing, but losing the whole is certainly unusual and unacceptable. How could one suffer losses and remain resilient to bait for the next investment proposition is what shape the destiny of an investor. Warrant Buffet exemplified it by floating the concept of “Margin of Safety”.

Margin of Safety is an investing principle that involves only purchasing stocks when their market price is significantly below their intrinsic value. An investing style simple to mimic. The only thing one needs for successful practicing of the concept is to keep the difference between the market price and intrinsic value as wide as possible. As, the wider the difference the thicker the cushion against price risk would be. To many investors, buying a stock at a 50% discount to its intrinsic value is what needed to replicate the strategy for preserving capital and yet reaping benefits of investing.

value. An investing style simple to mimic. The only thing one needs for successful practicing of the concept is to keep the difference between the market price and intrinsic value as wide as possible. As, the wider the difference the thicker the cushion against price risk would be. To many investors, buying a stock at a 50% discount to its intrinsic value is what needed to replicate the strategy for preserving capital and yet reaping benefits of investing.

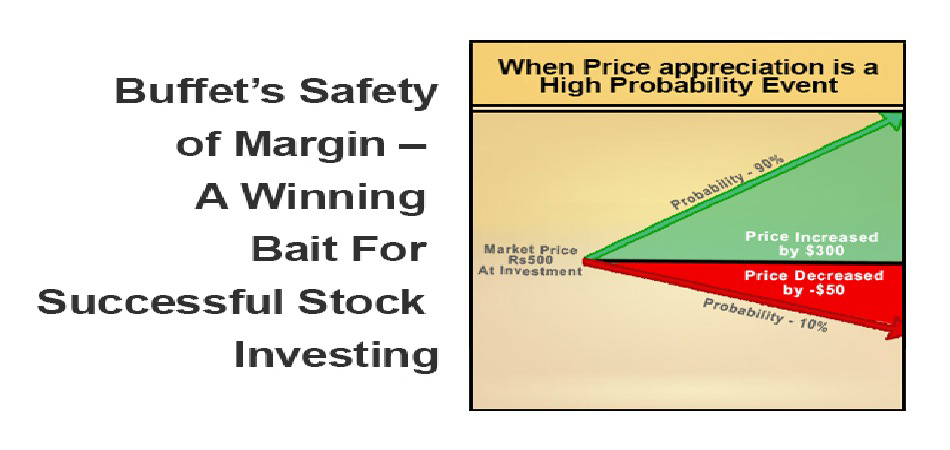

In fact, it is more than a gap between the two. When Buffet had floated the concept of Margin of Safety, he was not actually referring to the gap, rather he was suggesting to invest in a stock whereby appreciation in stock price is a high probability event. Thus, ensuring a higher Expected Value of the investment at some point in the future alongside the risk involved.

The Formula to Calculate the Expected Value of an Investment:

The formula to calculate the expected value of an investment is:

EV = ∑ P(Xi) * Xi

where:

- X is an increase/decrease in stock price

- Xi is increase/decrease in price of the stock

- P(Xi) is the probability of an increase/decrease in price

How to Estimate the Expected Value of an Investment:

Expected Value is a function of change in price and probabilities concerning to price change

Expected Value = f (∆Price, Probability)

(a)- Estimation of Price Delta:

Can be done by involving Fundamental and Technical Analysts in estimating likely gap between the current market price and future stock prices

(b)- Assign probability to Price deltas:

Collective deliberations could be a great help in assigning more rational probabilities to events, events of increase/decrease in stock prices as estimated, can be assigned.

| Increased by | Decreased by | |

| Price | Rs.300/share | Rs.(200)/share |

| Probability | 50% | 50% |

Then expected value of the investment comes to:

Expected {(Probable increase in price)*(Probability)}

Gains/(Loss) = +

On investment {(Probable decrease in price)*(Probability)}

Expected Gains/(Loss) = {(300)*(0.50)} + {(-200)*(0.50)} = Rs.50/Share

Assuring of Capital Preservation for the Next Bait:

For capital preservation, the Expected Profit needs to be larger. Investing in a setting whereby both, significant price appreciation and the probability of price appreciation, are high probabilistic events, increases the expected profit needed for capital preservation.

So, Invest in a High Probability Event:

The following example exemplifies how investing in a high probability protects capital from absolute loss.

| Increased by | Decreased by | |

| Price | Rs.300/share | -Rs.50/share |

| Probability | 90% | 10% |

Expected {(Probable increase in price)*(Probability)}

Gains/(Loss) = +

On investment {(Probable decrease in price)*(Probability)}

Expected Gains/(Loss) = {(300)*(0.90)} + {(-50)*(0.10)}

Expected Gains/(Loss)= Rs.265/Share

So, when you invest next in a stock, invest in a high-probability event stock.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,220.00 | 123,615.00 118,675.00 |

1690.00 1.43% |

| BRENT CRUDE | 69.13 | 71.53 69.08 |

-1.23 -1.75% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.89 | 69.65 66.84 |

-1.56 -2.28% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|