BlackRock, Fidelity lead the way for crypto adoption, BTC surges 16%

MG News | June 21, 2023 at 12:48 PM GMT+05:00

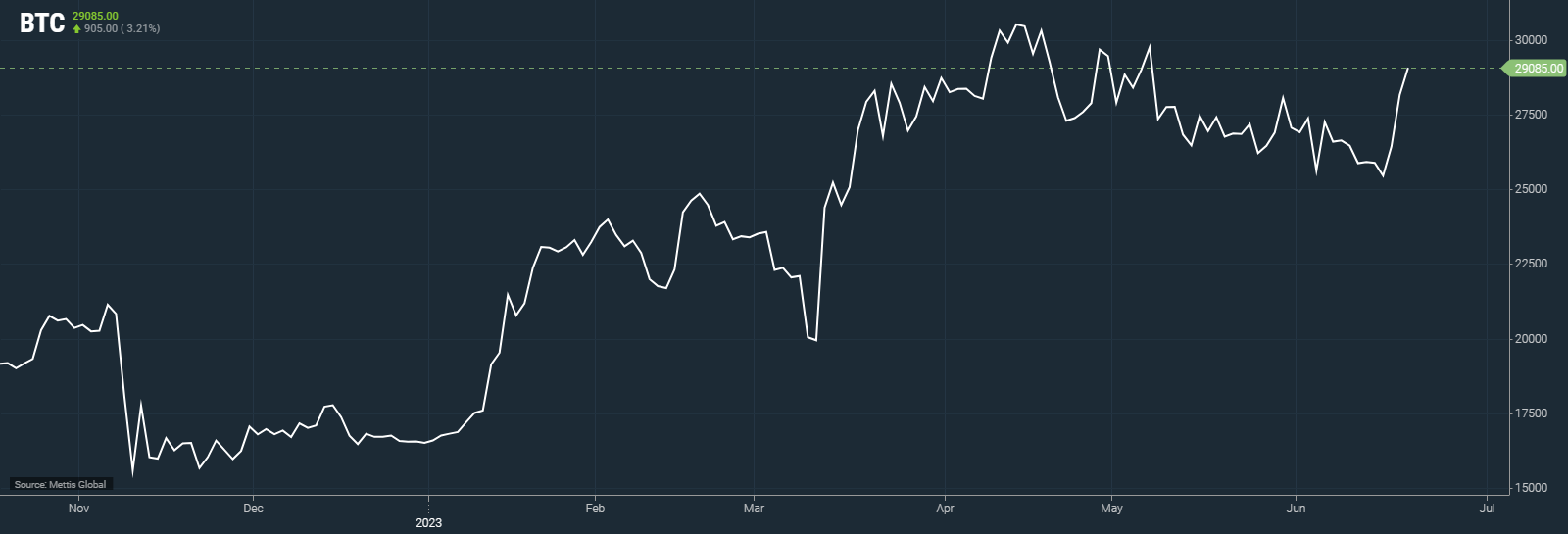

June 21, 2023 (MLN): Bitcoin (BTC), the largest cryptocurrency, has surged by 16% since June 15, after BlackRock Inc (NYSE: BLK), the world's biggest asset manager, filed for a bitcoin exchange-traded fund (ETF) on June 15, followed by Citadel Securities and Fidelity Digital Assets backed new crypto exchange going live on June 20.

Bitcoin is up 9.59% this week, 6.1% in the month, and 74.5% year-to-date

BTC/USD Daily time-frame chart

The ETF would allow investors to get exposure to the cryptocurrency, as the asset class comes under intense regulatory scrutiny.

A new crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets, and Charles Schwab Corp could reshape the digital-asset landscape amid heightened US scrutiny of the sector.

Notably, these two major moves come at a time when the global cryptocurrency industry has been caught in the crosshairs of the U.S. securities regulator on alleged violations of securities laws.

The US Securities and Exchange Commission has recently widened its crackdown on the crypto industry through lawsuits against two of the biggest firms, Binance and Coinbase, alleging that they acted as unregistered securities exchanges, broker-dealers and clearinghouses.

SEC Chair Gary Gensler has long criticized existing crypto platforms for failing to separate different parts of their businesses, such as custody, market-making and trading, which could result in conflicts of interests.

Institutional interest in crypto investing has waned after the industry went through a market crash and high-profile firms including FTX collapsed last year.

Still, some traditional financial institutions have been laying the groundwork to participate in the crypto markets. BlackRock Inc., the world’s largest asset manager, filed last week to launch a spot Bitcoin exchange-traded fund.

Joshua Chu, group chief risk officer at blockchain technology group XBE, Coinllectibles and Marvion said that "the fact that BlackRock, a well-respected and established asset management company, has filed for a Bitcoin ETF could be seen as a positive development in the quest for regulatory approval," as Reuters reported.

"It also shows resilience of the public's interest in crypto."

The SEC rejected Grayscale Investment LLC’s application last year to convert its flagship spot Grayscale Bitcoin Trust (GBTC.PK) into an ETF.

Grayscale sued the SEC, claiming that the regulator was acting arbitrarily in rejecting applications for spot bitcoin ETFs when it had previously approved bitcoin futures ETFs.

The SEC has also rejected proposals for spot bitcoin ETFs from firms including Fidelity, Cboe Global Markets and NYDIG.

BTC/USD Weekly time-frame chart

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves