Auto Sector to endure losses of Rs50 billion given current ban on non-filers

By MG News | October 03, 2018 at 11:03 AM GMT+05:00

October 02, 2018 (MLN): The Pakistan Automotive Manufacturers Association (PAMA) has claimed that the government is bound to suffer revenue losses amounting to Rs. 50 billion lest sales drop, owing to a ban on non-filers of tax returns from purchasing new vehicles.

PAMA urged the government to lift the restrictions on non-filers for purchase of cars, and offered its cooperation for documentation purposes by sharing the data on non-filers with the Federal Board of Revenue (FBR) on a regular basis.

The former PML-N government had previously enforced a limitation on non-filers of tax returns in the Finance Act 2018-19, which prevented them from purchasing new cars.

However, the ban can be lifted if the changes in the Finance Act introduced by the Finance Minister Asad Umar are passed.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,720.00 | 106,200.00 105,625.00 |

-30.00 -0.03% |

| BRENT CRUDE | 67.16 | 67.29 67.06 |

0.05 0.07% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.43 | 65.65 65.34 |

-0.02 -0.03% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

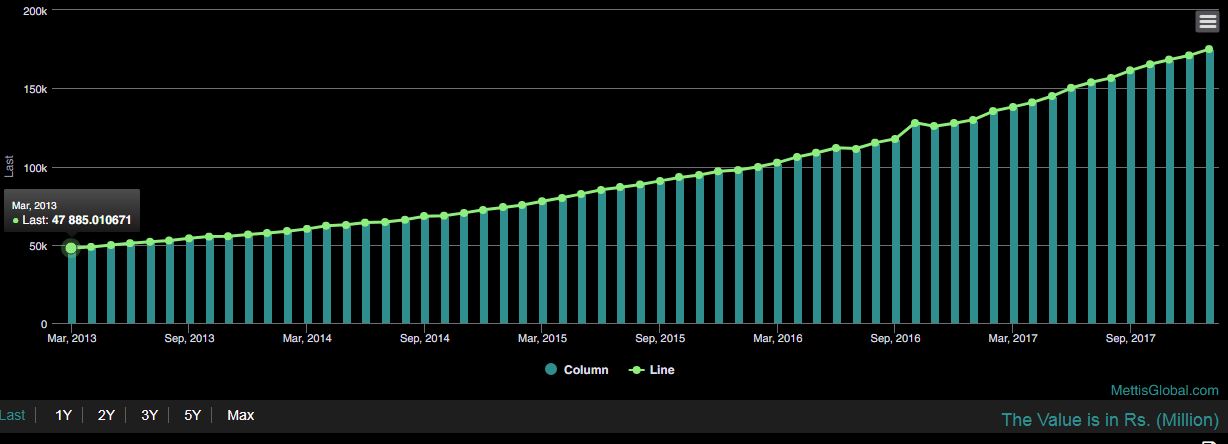

CPI

CPI