August's $2.1bn trade data - all eyes on export performance!

A A H Soomro | September 03, 2023 at 10:24 AM GMT+05:00

September 03, 2023 (MLN): Amid the gloomy petrol and electricity bomb, it's time to focus on how exactly we are faring in terms of global trade.

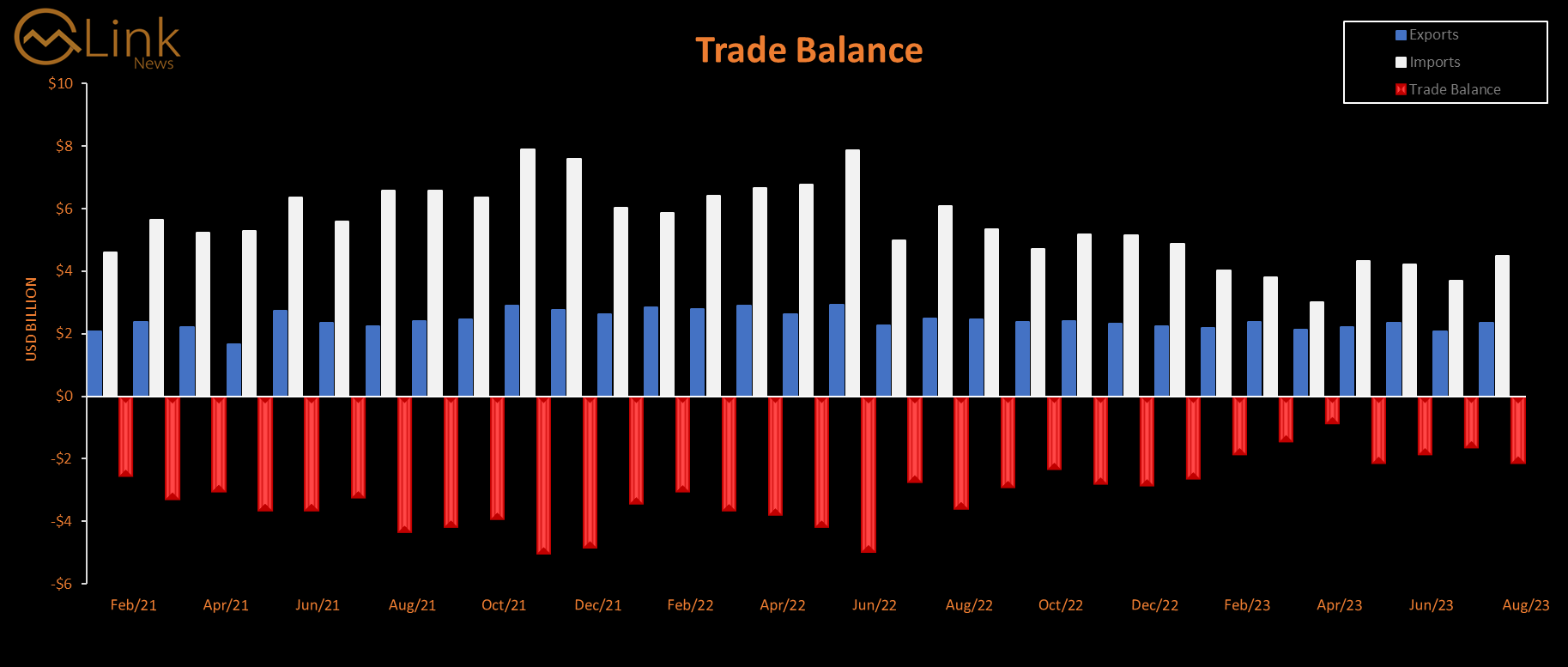

The monthly trade deficit has increased from $1.6 billion to $2.1bn in a month, primarily driven by $800 million growth in imports as compared to nominal $300m growth in exports. Imports were unsustainably low In July regardless.

The important number to remember is our target $2.5bn monthly remittances. As long as a Trade Deficit of $2.5-3bn is being plugged in handsomely by overseas Pakistanis - with radical efforts to grow exports - Pakistan is in a safe position.

Let's recall that in the last 12 months, the currency has dropped 40% from Rs218 to 305/USD in interbank and interest rates have shot up from 15% to 22%.

The results of such contraction have not produced desirable results; the trade deficit has decreased from $3.6bn to $2.1bn - thanks to $1.5bn compression in imports primarily.

Policymakers need to re write their economic textbooks that exports have and will not increase by depreciating the currency only.

Once the pent-up import demand decelerates, all eyes should be on export growth. This must be the number 1 task for the new and current government. Refunds, gas, electricity, policies, market access etc whatsoever is needed should be provided given financial space.

One positive takeaway is that the government isn't defending the currency despite plummeting remittances and yet met a sharp increase in our imports by letting market forces dictate the prices.

The next stop is to forecast weekly inflows of remittances, exports and investments. A free-falling currency is not the answer to fix the trade mess.

In September, authorities should work towards increasing remittances, reducing bottlenecks for exports and letting imports add taxes and exports. Currency stability will be of paramount importance for the next few months.

Another inflationary wave is already on its way in the form of gas and electricity prices. Let's not compound the misery by depreciating further.

The author is an independent economic analyst and writes on Twitter and Linkedin.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SCRA Balance

SCRA Balance